CME: Turkey Prices Remain Strong Despite Bird Flu

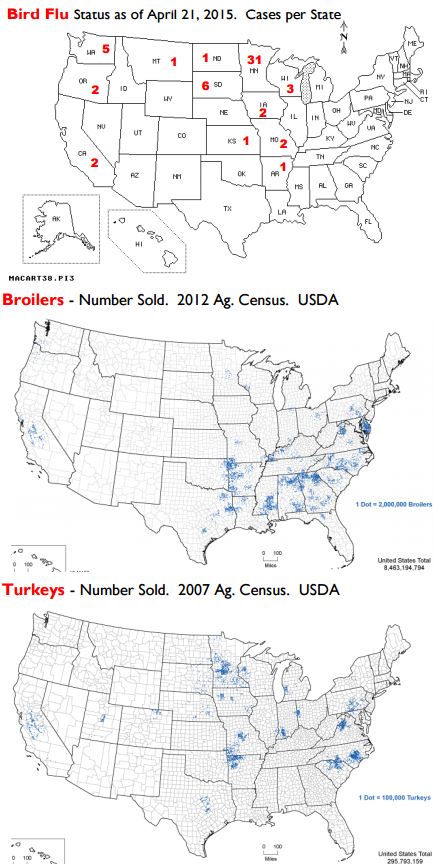

US - With more cases of HPAI (Highly Pathogenic Avian Influenza) cropping up, there is growing concern about the impact that it may have on livestock markets going into the spring and summer, write Steve Meyer and Len Steiner.According to APHIS, there were five cases of HPAI on 20 April alone, four of them in commercial turkey operations and one in an egg laying operation in Iowa. The latter was particularly significant given the size of the operation.

We have seen news reports that put the size of the operation at 5.3 million chickens although APHIS reported the flock size at 3.8 million chickens.

Please note that this was not a broiler operation and thus the destruction of the birds will have no impact on the chicken supply, rather it directly affects the egg market.

The number of turkeys in the commercial operations affected by HPAI currently stands at 2.55 MM head, representing about 4.5 per cent of quarterly slaughter in Q1. At this point the supply impact has been much more significant for the turkey market than any demand effects.

It is important to recognize the outsize impact that trade with Mexico has on the turkey market. Last year, Mexico accounted for 63 per cent of US turkey exports.

Exports to Mexico in January were up 15.9 per cent but were 2.3 per cent lower in February as Mexico banned imports from some states affected by HPAI. At this point, Mexico does not appear to have much appetite for cuttng off access to the US turkey or chicken supply.

Meat price inflation in Mexico remains high and Mexican industry is reliant on the US for a significant part of its supply. In March, Mexico announced that it would allow turkey from states affected by HPAI if product went into further processing.

So the reason why turkey prices remain very strong at this point is quite simple.

We have had some significant supply reductions while at the same time export demand impact has been relatively small. But for livestock producers, the effect of HPAI on the broiler industry remains the true risk.

So far, and despite all the talk in the press, we think the effect of HPAI on broiler production has been non existent. Most cases of HPAI have been in states that account for a very small part of US chicken output.

Chicken exports in January were down 12.4 per cent and they were down 17 per cent in February and some of this was likely attributable to HPAI induced bans, especially the loss of business with China. Largely, however, we think that the lower exports are a result of the strong dollar and expanding chicken production in other parts of the world.

Mexico is the largest buyer of US chicken meat but exports in January and February were modestly higher than a year ago. Going forward, market participants will continue to pay close attention to any cases of HPAI in large broiler production states.

There was one case of HPAI in a turkey flock in Arkansas on 11 March 2015 but it appears that was an isolated case and no cases have been reported affecting large commercial broiler operations in the Southeast.

Chicken production is expanding in the US, both as a result of a larger laying flock but also heavier weights. Export demand has been negatively affected by trade issues (Russia), the strong dollar, lower feed costs in other parts of the world and HPAI.

Spread of HPAI in broiler producing areas would certainly be negative for livestock markets as it would further limit exports but, for now, that has not been the case. Let’s all hope that does not change.