What's Been the Bird Flu Impact in the US So Far?

US - Loss of exports, rather than supply, will be the most marked effect from the bird flu outbreak to hit the Mississippi flyway.According to Len Steiner and Steve Meyer in their daily livestock report, poultry exports have been shutdown to China, although they played down the impact to domestic demand.

They also said the supply impact, at this point, was negligible.

They wrote that, since April 1, there have been 18 cases of Highly Pathogenic Avian Influenza (HPAI) identified in the US.

In most cases HPAI has affected turkey farm but the latest case was in a commercial broiler layer flock in Jefferson County, Wisconsin. This is the second such case in a commercial chicken operation and the first case in a chicken operation location in the Mississippi flyway.

Given the spread of HPAI along the Mississippi flyway, one could argue that it was just a matter of time before cases of HPAI would be found in some commercial chicken operations.

The main vector for the spread of the disease appears to be migratory wild birds although we have not seen a comprehensive review of the situation. USDA/APHIS at this point is working closely with local government and industry to quarantine affected operations and eliminate the disease before it get a chance to spread.

The US poultry industry unfortunately has a long experience with HPAI, although it had been several years since we have seen such an outbreak. There are three concerns for market participants at this time.

Will the Spread of HPAI Impact Poultry Supplies?

At this point we think the supply impact is negligible. In the case of chickens we are looking at one layer operation with 200,000 birds. This is a tragedy for the operation in question and will cause significant economic harm to it.

However, US broiler slaughter in 2014 was 8.5 billion head and in the larger context the depopulation of one or even several bird houses will have a very limited supply impact. At this point, HPAI is not comparable to the PEDv in hogs last year, which reduced slaughter numbers by several percentage points. -

Will HPAI Cases Impact US Consumer Demand?

In the past this has not been an issue. In previous cases US consumers have not overreacted to cases of bird flu and we have no reason to think this year this will be any different. The US consumer response to HPAI is different than in Asia, largely because of how poultry is consumed here. In Asia, consumers purchase a significant amount of poultry in live markets and some variants of HPAI, such as H5N1 and H7N9 have caused infections in people. Those infections came from direct contact between people and poultry. The variant of HPAI currently in the US has not been shown to infect people. In addition, we think the US consumer is confident in the control systems put in place by both government and industry. This is different than purchasing a live chicken from the back of a truck in some Asian market.

Will the Cases of HPAI Limit US Exports and What Does this Mean for Chicken Prices in the Domestic Market?

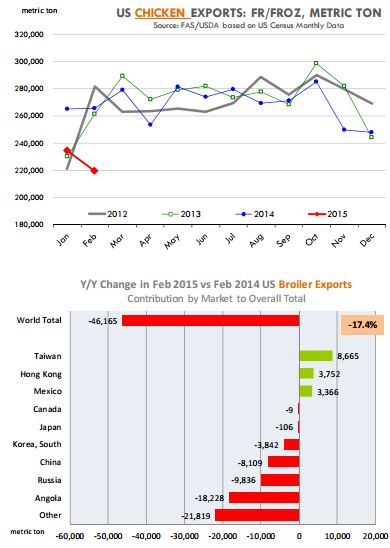

February broiler exports were down 17.4 per cent and we think some of this was due to bans put in place following cases of HPAI in a number of states.

The most prominent case is China, which banned all US chicken imports but exports to a number of smaller markets also were down significantly. Exports accounted for 19 per cent of US chicken production last year so the loss of exports is a much more significant factor than any loss in supply due to HPAI. USDA currently projects chicken exports to drop 8.5 per cent compared to a year ago. Half of that, however, is due to the lack of access to the Russian market.

If China remains closed at least until June, it would explain another 2 per cent of the annual reduction. But exports to other markets are down sharply as well.

A strong US dollar and poultry expansion in other large exporting countries also will present significant headwinds for US chicken in 2015. The number to remember is 6 per cent - this is the increase in per capita consumption forecast for 2015. Any downward revisions to export forecast will further increase product availability in the domestic market. We are asking the US consumer to eat more chicken and pork (the extra supply needs to be used up) and lower prices are needed to clear the market.