CME: Rising Bird Flu Cases Do Not Change Price Outlook

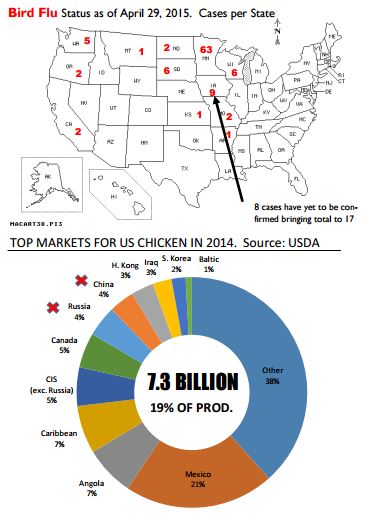

US - The bird flu situation continues to worsen, with more cases announced daily in Iowa and Minnesota, write Steve Meyer and Len Steiner.Since most of the poultry operations in these states are turkey and egg producing farms, so far the impact of the disease has been confined to these sectors.

Iowa recently announced that it suspected 5 additional outbreaks in three counties and those numbers are not included in the list of outbreaks as they have yet to be confirmed.

Two of the operations in question in Sioux County have a combined flock size of 5.5 million birds in egg laying operations.

Prior to this latest announcement from Iowa, we heard of another four operations with probable HPAI. One of those operations is listed in the Animal and Public Health Information System (APHIS) database and the other three will likely be confirmed today.

Among them, there was a chicken breeder farm with about 19,000 head. As far as we can tell, this is the first case of Highly Pathogenic Avian Influenza (HPAI) in a broiler operation and analysts noted that it is significant the virus was able to penetrate such operations which are assumed to be better protected.

Does the recent escalation in the number of HPAI cases change the outlook for poultry supplies and prices in the short term? We do not think so, at least through the summer.

Until now, our working thesis has been that the spread of the virus along the Mississippi flyway will be bullish for turkey and egg prices while it will be bearish for chicken.

We have tried to segregate the number of birds affected that are located in turkey, egg laying and broiler farms.

The numbers are changing daily but at least based on APHIS confirmed cases we have about 4.154 million turkeys and 11.2 million egg laying chickens affected by the disease (this does not include the 5.5 million egg laying hens that are presumed positive).

Turkey slaughter for Q2 of 2015 was earlier projected at 61.4 million head but that number could be around 57.5 and may be revised even lower if the disease impacts other large operations.

Turkey slaughter for Q2 is now expected to be down about 2 per cent compared to a year ago, a dramatic change from forecasts earlier in the year looking for a +4 per cent increase in slaughter.

In the case of eggs, the spread of the disease has the potential to be inflationary although so far we have not seen an impact in the price of eggs trading.

This is because producers already were in an expansionary mode and thus the losses, whilst catastrophic for the producers involved, have been offset by production increases elsewhere.

The price of shell eggs in the wholesale markets is about 4 per cent lower than a year ago while liquid egg prices are down about 30 per cent.

Chicken producers continue to struggle with a backlog of leg quarters, the price of which is down about 40 per cent from a year ago. Exports to China and Russia have been cut off completely while shipments to Angola in February were down by more than 80 per cent.

As the disease spreads, it is unlikely that current bans will be lifted soon. This remains a negative for the broiler market in the short term.

If there is any upside risk for chicken is the potential that the virus could spread in the Southeast this fall as bird migration reverses. The potential for heavy supply losses is there, let’s hope producers will be able to strengthen their defences in the meantime.