How Well Did the UK Poultry Industry Perform in 2014?

UK - The Agriculture and Horticulture Development Board in the UK will release its Pig and Poultry Pocketbook this month, and this article analyses some of the key information found in the publication.In 2014, UK production of poultry meat decreased for the first time since 2009, while chicken production was lower, after six consecutive annual increases. UK poultry meat production fell 1 per cent to 1.64 million tonnes during the year but this was still nearly twice as high as pig meat.

However, these falls were offset by import increases, so consumers have enjoyed a price drop on poultry products and demand remains high.

Broilers

The majority of poultry meat in the UK comes in the form of broiler chicken meat, which accounts for 84 per cent of production.

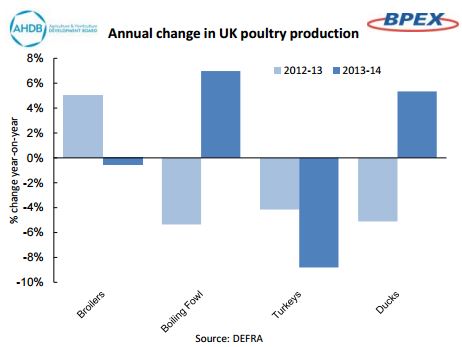

Broiler chicken production also fell by 1 per cent in 2014, to 1.38 million tonnes. This follows a large 5 per cent increase in 2013 when, as with other meats, retailers increased their commitment to domestic produce in the wake of the horse meat scandal.

The decline in 2014 came as the result of a number of factors, including a 1 per cent reduction of chick placements on farms.

Placements fell to 937 million chicks, as hatcheries reduced output due to a fall in demand at the end of 2013.

Hatcheries also voluntarily phased out the use of certain antibiotics which led mortality amongst the breeding flock to increase. This reduced the size of the breeding flock and, therefore, chick output.

Other Poultry

Turkey production accounts for 10 per cent of the UK poultry meat production, the second largest share.

Production of turkeys has been falling in the UK for two years, with production in 2014 down 9 per cent. This follows a 4 per cent decline in the number of poults placed.

Production of boiling fowl (spent layers and parent stock) increased in 2014, up 7 per cent as a result of an increase in size of the UK laying flock.

Following a fall in 2013, UK duck production increased by 5 per cent.

Imports

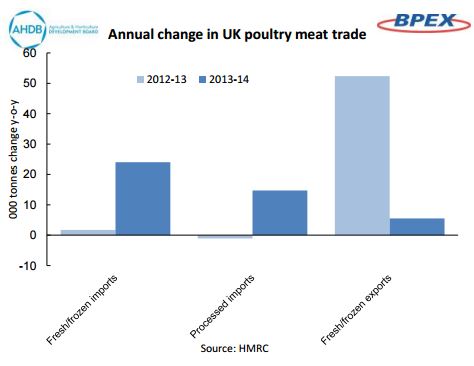

With production falling in 2014, imports of fresh and frozen poultry meat to the UK grew to 407,800 tonnes, up 6 per cent compared to a year earlier.

The Netherlands remained the largest supplier of poultry meat to the UK but its shipments remained stable.

Most of the increases came from Poland and Ireland, with shipments increasing 8 per cent and 38 per cent respectively. These increases follow significantly higher levels of production in both countries in 2014.

Imports of processed poultry products also increased last year but the gains were smaller at 5 per cent . Most of the rise came from the top two suppliers, Thailand and Brazil, with imports up 7 per cent and 39 per cent respectively.

However, imports from the EU fell 1 per cent. This led to total poultry meat imports to the UK being 6 per cent higher than in 2013 at 769,675 tonnes.

Exports

Exports of fresh and frozen poultry meat from the UK also increased in 2014, although by much less than the previous year.

They were up 2 per cent at 348,000 tonnes, due to an increase in shipments to markets outside the EU. Exports to other EU countries actually fell by 3 per cent , although they still accounted for nearly 70 per cent of the total.

Among the key growth markets outside the EU were South Africa, Hong Kong and Benin. However, shipments to South Africa have been on hold since November after an outbreak of Avian Influenza in Yorkshire.

The increase in imports offset the fall in production and higher exports, leading to supplies available for consumption in the UK increasing 1 per cent in 2015 to 2.1 million tonnes.

With higher supplies available, the average wholesale price of a broiler in the UK, reported by DEFRA, fell 5 per cent in 2014.

However, Kantar Worldpanel reports that retail prices for fresh and frozen poultry meat were little changed from the previous year, with consumer purchases falling for the second year in a row.

This Year's Outlook

2015 has got off to a good start for the UK poultry industry, with promotions from retailers leading to higher demand, which has encouraged producers to increase output.

Both placements and slaughterings in the first quarter have been higher year on year, with broiler chick placements up 3 per cent at 241 million chicks, while slaughterings have increased by 1 per cent to 226 million head.