CME: US Meat Export Volumes Down

US - International trade is a hot topic in the protein markets, and with good reason, write Steve Meyer and Len Steiner.Looking at the first half of 2015, comparing exports year-over-year, shows a volume decrease of 9 per cent for beef, 5 per cent in pork, 9 per cent for broiler, and 21 per cent for turkey.

The long-term trend has been growing US exports, mainly due to powerful income shifts in other countries, creating a growing middle class and giving people more purchasing power to achieve increased consumption of animal based proteins in their diet.

While recent numbers are concerning for the domestic industry, we need to reflect on what has transpired in the market place so far in 2015.

This includes: western port issues, a significant increase in the value of the dollar relative to other currencies, Russian trade bans on US (and other countries’) meat and poultry, significant economic slow-down in China, and some countries temporarily suspending poultry from certain states or from all US sources due to HPAI.

In addition to this mix of 2015 specific circumstances, the US has experienced supply shifting parameters across the protein industries.

The beef sector continues to see extremely tight cattle and beef supplies, with 2016 forecasted as the first year-over-year increase in beef production since 2010.

Pork production has rebounded very quickly in 2015, after being hit hard by PEDv in 2014 which significantly reduced supplies at the time.

The poultry industry faced significant challenges with HPAI this year and although mainly affecting the egg laying industry, trade ban effects were also felt in the poultry markets (broiler and turkey).

Let’s put the recent export numbers into a bit more context, that is, relative to production levels.

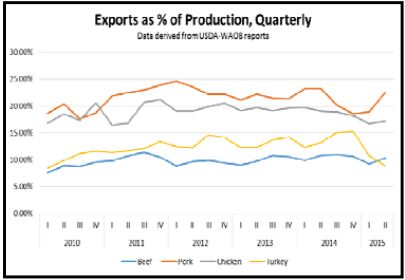

In calendar year 2014, the beef industry exports represented 11 per cent of domestic production, pork 21 per cent, broilers 19 per cent, and turkeys 14 per cent.

Of course, meat production is measured in carcass weight and poultry in ready to cook weight so the tonnage of variety meats and other items sold to foreign markets are not included.

So, when taking into account how production has changed the first half of 2015 compared to 2014, how are trade volumes really faring in each industry?

For the first half of 2015 compared to the same time-frame in 2014, the beef sector has experienced a 0.5 per cent decrease in export volume relative to production year-over-year, that is, exports represented 10.3 per cent percent of production last year and that dropped to 9.8 per cent this year. That is a modest change.

This calculation helps to brings into context the 4 per cent reduction in supply and the 9 per cent decline in export volume the industry experienced through June of 2015.

Also, important to note on the beef side are import levels. For the first half of the year beef imports were up 37 per cent compared to 2014. Through the first half of 2014, import volumes represented 11 per cent of production; the first half of 2015 saw that percentage rise to 16 per cent of production.

Compared to beef, the pork and broiler industries have had more change in this measure so far this year.

Through June, in 2014 pork export tonnage was 23 per cent of production while in 2015 exports were 20 per cent of production. That change is the result of 7 per cent more pork produced with a 5 per cent decrease in export volume the first half of 2015 compared to 2014.

The broiler sector had export volume in 2014 making up 19 per cent of production and in 2015 that percentage slipped to 17 per cent. This encompasses a 4 per cent increase in production and a 9 per cent decrease in exports through June 2015 compared to 2014.

Through June, turkey exports have significantly declined year-over-year (down 21 per cent) with production up 2 per cent (note on a quarterly basis, most of the year-on-year drop in U.S. turkey output caused by HPAI is expected to occur in the third quarter).

The first half of 2014 recorded turkey exports at 13 per cent of production, 2015 saw exports at 10 per cent of production levels. In the case of turkey, sliding exports helped compensate for the domestic production shortfall.

While changes in supply are not the only factor affecting export volumes, the relationship between exports and production often provides a clearer picture of the health of the export markets.

On this basis it’s clear how much more dependent on the US pork and broiler industries are on exports compared to beef.

Additionally, as indicated in the accompanying graphic, this relationship demonstrates more consistency and stability in the numbers over the long run than one might expect, however recent volatility in the export volumes is demonstrated in the graph.

In the big economic picture, at this time, 2016 seems to have more uncertainty in key overseas markets compared to the domestic outlook. Stabilisation in the world economy could lead to some modest year-over-year gains in US export tonnage.