Avian Flu Critical for US Market Prices

US - The news continues to be good regarding the two “pending” animal health issues in the US market: porcine epidemic diarrhoea virus (PEDv) and highly pathogenic avian influenza (HPAI), write Steve Meyer and Len Steiner.Both have been market movers over the past two years and remain significant risk factors for the remainder of this year and 2016.

The primary questions are:

- Will PEDv’s winter 2015-2016 impact will be as mild as last year or more like 2013-2014 when the US herd was naïve to the virus? There will be fewer sows with high immunity levels this year but producers and veterinarians know much more about combatting the disease and have enhanced biosecurity measures considerably since the initial appearance of PEDv in the spring of 2013.

- Will HPAI appear in commercial flocks the Atlantic migratory bird flyway which touches major broiler production areas in DelMarVa, North Carolina, Georgia and Alabama? Will it re-appear in the Mississippi flyway and its major production centers in Arkansas and eastern Oklahoma and Texas?

The University of Minnesota’s Swine Health Monitoring Project (which will soon move to the newly-created Swine Health Information Center led by long-time National Pork Board Science and Technology VP Dr Paul Sundberg) surveys 26 large production systems weekly.

These systems operate 1000 sow farms with a total of 2.5 million of the nation’s roughly 5 million sows so the sample is large.

Those 1000 sow farms have reported only 8 PEDv breaks since May 1. Last year that number was 15.

The seasonal growth in sow farm breaks (remember that viruses survive better outside of a host in colder, damper conditions) began last year on about November 1. We expect the number to increase again this year but by how much?

The 2013-2014 peak was 24 farms in early February 2014. Last winter’s peak was 9 farms in late February 2015.

It is important to note that PEDv is not a “reportable” disease and thus has no impact on US pork exports. But that also means that the only data we have regarding PEDv’s impact is the U of M survey data on sow farm breaks and the total number of positive case accessions at state animal health laboratories.

None of those data include the number of animals lost to the disease, leaving the industry to estimate the actual impacts on supplies.

There has not been a reported HPAI break since mid-June. Summer temperatures and prevention measures have worked to quiet the virus for now.

Most observers are very concerned about this fall, however. Unlike PEDv, HPAI is a reportable disease that will be closely monitored by USDA Animal and Plant Health Inspection Service.

We know how many birds of what species and use (ie. laying hens vs. turkeys vs. broiler chickens) are infected on a weekly basis. What we do not know is whether the impacted birds are from market or breeder flocks.

That would be VERY USEFUL information to gauge the longer-term supply impacts of HPAI.

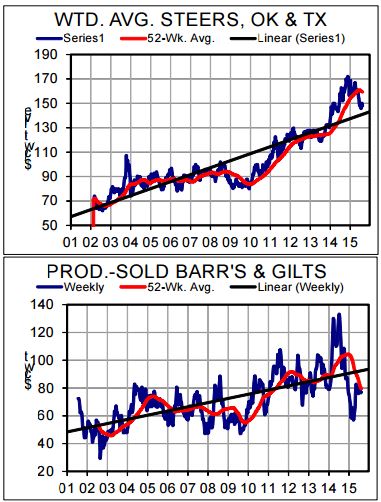

How much does this matter? We believe it is critical. In fact some of the largest swings in prices witnessed since 2000 have been due to disease issues.

The spike high in cattle prices in May 2003 was driven by the discovery of BSE in Canada and the resulting interruption in cattle and beef flows into the US.

Interestingly, the discovery of BSE in the US in December 2003 left barely a mark in the price chart - largely because Mexico resumed imports of US beef quickly.

The PEDv shock to hog markets is clear in 2014 but perhaps a more interesting situation was the 2007 introduction of circovirus vaccines that allowed millions of pigs to survive that otherwise would have died.

That survival pushed US slaughter to record levels and nearly 10 per cent yr/yr growth rates from October 2007 through to September 2008. But the price impact was short lived because China began it’s massive pre-Olympic buying binge in early 2008.

In spite of MUCH larger supplies, US hog prices hit record highs in summer 2008. The moral of that story: Sometimes you get lucky.