CME: Broiler Exports Disappointing

US - USDA-ERS released April’s monthly trade data (on a carcass weight basis) yesterday, compiled from data from the U.S. Department of Commerce, write Steve Meyer and Len Steiner.Starting on the beef side, beef imports continued to track below 2015’s elevated levels. Year-over-year, beef imports were down 21 per cent. The majority of this decrease came from 42 per cent less imported product from Australia and 30 per cent less from New Zealand, compared to April 2015 (down a total of 82.9 million pounds from Australia and New Zealand combined).

We did import 13 per cent, 7 per cent, and 29 per cent more from Canada, Mexico, and Uruguay, respectively, for a total of a 12 million pound increase for those three countries compared to last year.

On the beef export side, year-over-year, exports were down 5 per cent, but continued to stay on track with seasonal movements compared to the past five year average (2010-2014).

Exports were up 27 per cent to Taiwan, up 33 per cent to Mexico, and were even to South Korea compared to April of 2015. Exports were down 7 per cent to Canada, down 37 per cent to Hong Kong, and down 11 per cent to Japan.

The decrease in exports to Japan was disappointing, as Japan has been a consistently strong market throughout our high beef prices the past two years. Additionally, it would make sense that some of the shift of increased exports to China but decreased exports to Hong Kong comes from the crackdown on the grey market beef trade between Hong Kong and Mainland China.

Moving on to pork trade, pork imports were down 5 per cent year-over -year, with volume increases from Mexico, Netherlands, and Poland but decreases from Canada and Denmark, compared to April 2015.

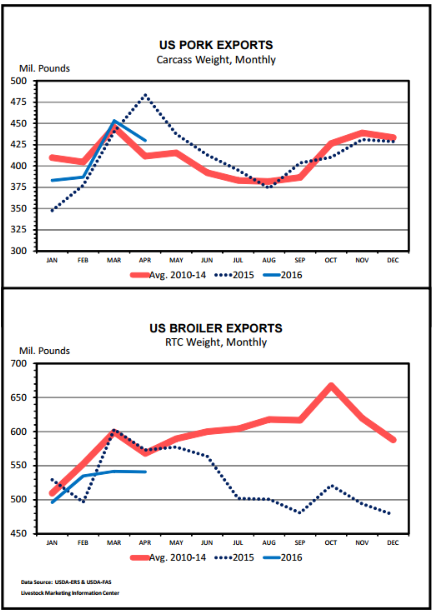

Pork exports were down 11 per cent year-over-year and closely followed seasonal movements. This is compared to unseasonably high export volume a year ago however. Pork exports were down significantly to China/Taiwan (down 50 per cent), Japan (down 28 per cent), and South Korea (down 46 per cent) and down slightly (6 per cent) to Mexico year-over-year. However, several year-over-year improvements were made in exports to individual countries.

Exports increased 5 per cent to Canada, were up 94 per cent to Mainland China, and were up 97 per cent to Hong Kong.

Broiler exports were again one of the more disappointing numbers. Compared to April 2015, total broiler exports were down 6 per cent, and this export volume has been relatively flat since February.

Exports were down 41 per cent to Angola, down 28 per cent to Canada, down 3 per cent to Mexico, and down 27 per cent to the Caribbean. However, exports increased 8 per cent to Mainland China, were up 14 per cent to Hong Kong, and were up 126 per cent to Iraq.

Generally these increases in protein exports (mainly pork and broiler meat) to China and Hong Kong reflect extremely high protein prices in those areas. Additionally, U.S. exports should benefit from a recent decrease in the value of the U.S. dollar and continued lower prices across our protein sectors.

Market dynamics have shifted since the value of our dollar increased in 2015, and for beef specifically, prices hit record highs. Now our market is slowly but steadily trying to take advantage of current global situations and protein demands while working back into a competitive international market.