CME: Broiler Chicken Production Down From Last Year

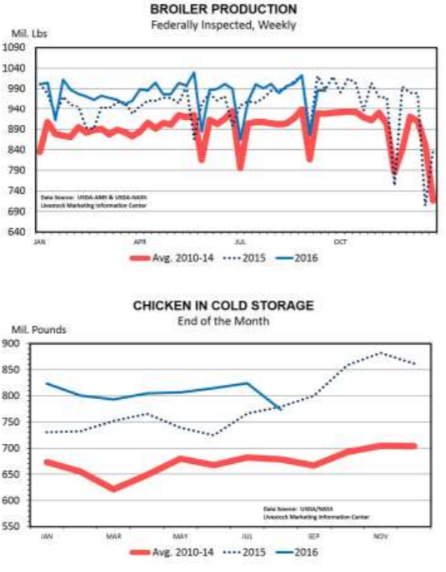

US - Broiler-type chicken production since July has been running close to, or slightly below last year. The ready-to-cook weight of production during July and August was down 0.2 per cent from a year ago and given the weekly trends of September, summer quarter broiler production could be down as much as 1 per cent from the summer of 2015.This would be the first year-over-year quarterly decline in production since the summer of 2012. Bird slaughter has traced the values of a year ago. Average bird weights at time of processing have been lighter by as much as 3 per cent during some weeks of September. Average bird weights during August were half a percent lighter than in August 2015.

The decline in production is a product of lighter bird weights. This is unusual for the chicken industry because of a focus on efficiency that has encouraged processing birds at heavier weights. A decline in bird weights this summer would be the first year-over-year decline in average bird weight for a quarter since the last quarter of 2011. Since 1999, there have only been four quarters when birds have weighed less than the same quarter a year earlier.

The downward trend in bird weights this year from August to September is even more significant compared to changes from quarter to quarter or year over year. Weekly chicken production data for

September points to a 1 per cent decline in average bird weights from August.

This is unprecedented in modern times, as cooler temperatures as summer wanes has always led to birds gaining weight more readily and being heavier at processing time. Typically, this trend continues into October and November for the same reason. If bird weights were to remain unchanged from August through the last quarter of the year, broiler meat production would be reduced by 1.5 per cent from last year, independent of changes in the number of birds slaughtered.

The chicken industry is capable of boosting production by way of increasing the number of chicks coming out of the hatchery to be moved to grow-out farms and then to processing plants. The hatchery supply flock hen population was up 6.0 per cent from a year earlier in August and is projected to be up 6.4 per cent and 6.8 per cent in September and October.

Chick hatchings have been increasing by a fraction of a percent since a decline was registered last May, and weekly hatchery data suggests that September hatchings will be up similar to prior months or slightly more, consistent with the modest gains in the hatchery flock population.

These chicks would be the basis for October-December broiler slaughter to be one percent higher than last year, although there is one less weekday in the fourth quarter of this year compared to 2015. Adding up all of these production factors (chicks hatched, average bird weights and number of work days) leads to a forecast of broiler production for the last quarter of 2016 that could range from unchanged to down 2 per cent from a year ago.

For perspective, a 1 per cent change in broiler production amounts to 100 million pounds. Chicken exports for the quarter are forecast to be up 150 million pounds from last year, which would be an additional reduction to supplies available to the domestic market. In this situation, a substantial movement of product out of cold storage to satisfy consumer demand should be expected.

Frozen chicken inventories are currently around 750 million pounds, which compares to 600 million pounds a couple year ago. A decline in production will be helpful in reducing cold storage inventories

that have been close to record-large during the past year.