CME: Turkey Markets Approaching Finish Line for Winter Celebrations

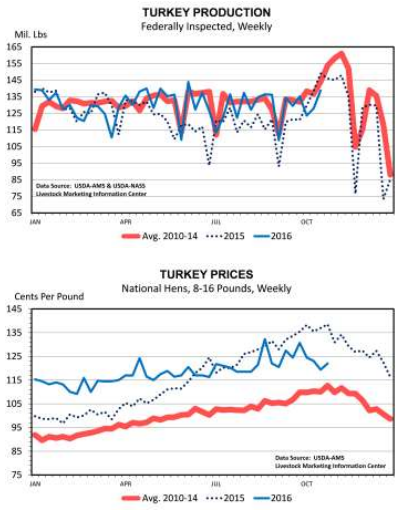

US - Turkey markets are approaching the finish line for Thanksgiving preparations, according to the Daily Livestock Report is published by Steiner Consulting Group, DLR Division, Inc.Concerns about available supply are not an issue, in contrast to a year ago, when avian influenza played havoc with production during the prior six months.

Hatchery output during the spring quarter was up 5 per cent from a year earlier and summer quarter hatchery output was up 10 per cent.

Frozen inventory of whole birds on October 1 was only up 1 per cent from a year earlier, but frozen inventories of parts and meat were up 32 per cent. This should allow for more of the increase in October and November production to be marketed as whole birds.

Turkey production during the current quarter is projected to be up 100 million pounds from a year ago, based on the expanded hatchery output of the spring and summer.

Oddly, turkey production during the first three weeks of October was down from a year earlier. Much of this can be attributed to Hurricane Matthew, that created massive flooding in turkey production regions of North Carolina. Estimates of losses were close to two million birds, which would account for 3 per cent of US production for the quarter.

Also, with more of an orientation to marketing whole birds for Thanksgiving instead of breast meat for delis, some processing schedules will be pushed back a few days to get closer to actual grocery store Thanksgiving marketing efforts.

Turkey consumption during the October-December quarter has been in the range of 1.5-1.6 billion pounds for the last ten years. Occasionally, it will move above 1.6 billion pounds, if pricing relative to ham is supportive and if grocery store retail sales are posting impressive gains.

That is not the case this year. The ratio of wholesale turkey prices to the value of the ham primal, as reported by USDA-AMS, during the first nine months of this year was 1.84. This is about the same as last year, but is 80 per cent higher than in 2014 and 30-40 per cent higher than the average in the years before that.

Grocery store retail sales growth in the last quarter of last year was 1.5 per cent, down from a 5.1 per cent growth pace in the fall of 2014. Turkey consumption in the holiday quarter of 2015 declined by 20 million pounds from the same quarter of 2014.

This year, with wholesale turkey prices again being high relative to ham prices and grocery store retail sales growth on track to come in lower than in recent years, turkey consumption for the holiday quarter is expected to come in 20-30 million pounds less than in 2015 (LMIC forecast).

In recent years, the turkey industry has tried to target end-of-the-year frozen inventory at 200 million pounds. At the end of 2012, frozen inventories were 296 million pounds and in 2008, the year-end carryout was 396 million pounds.

If turkey production this quarter would come with a 100 million pound increase from a year ago, along with consumption close to, or slightly less than last year, frozen inventories at the end of the year would be close to 350 million pounds.

The same level of production as a year ago for the current quarter gives an end-of-the-year inventory of 250 million pounds which is more than the turkey industry likes to see. Given the increase in turkey hatchery output in prior months, holding production unchanged would be a surprise.

The decline in turkey prices since late September suggests that the turkey industry is cognizant of these issues and is making efforts to encourage more consumption before the end of the year.