Farms showing financial stress, producers express concern about future conditions

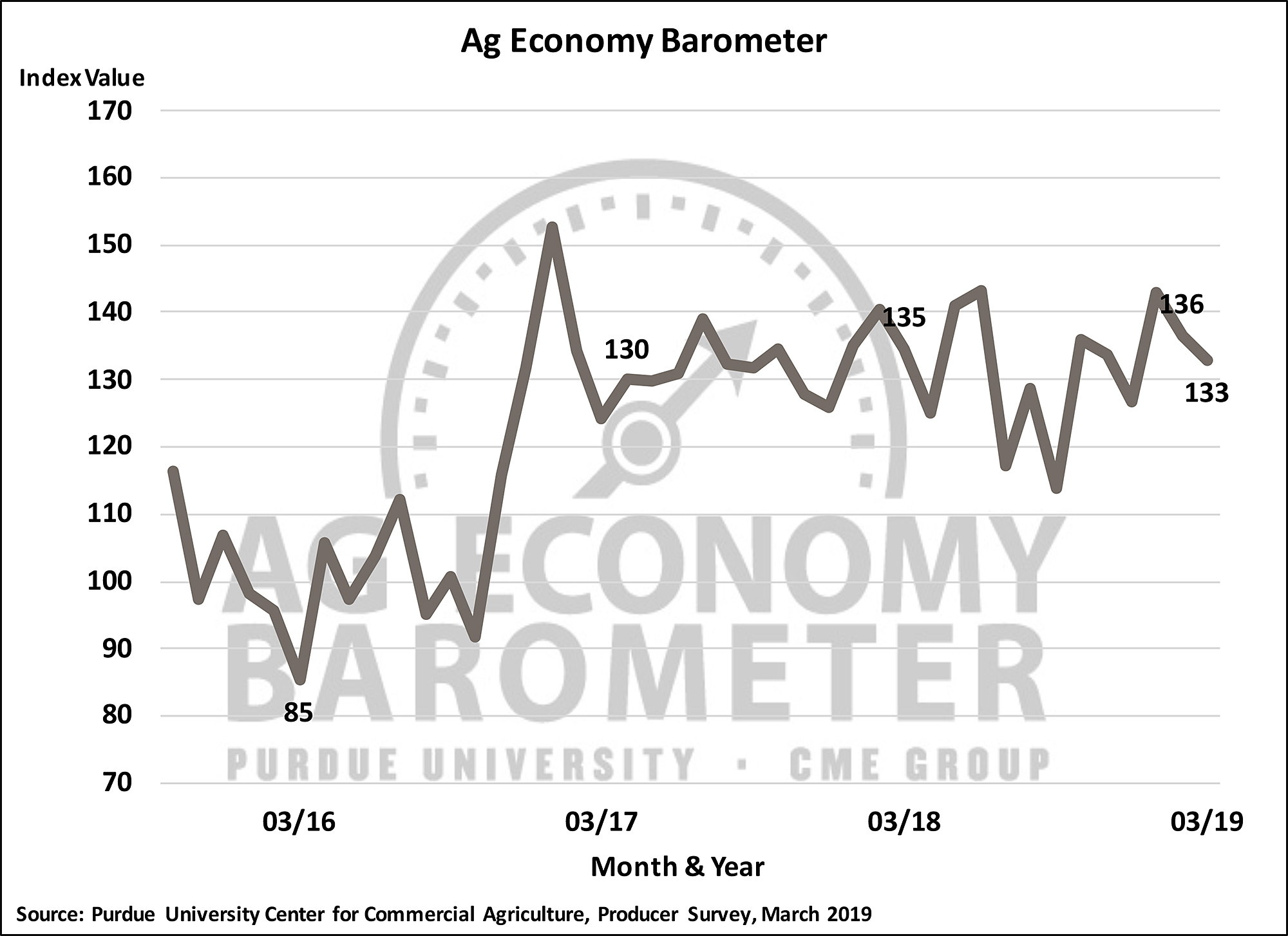

Producer sentiment weakened slightly in late winter, according to the March Purdue University/CME Group Ag Economy Barometer reading.Producer sentiment weakened slightly in late winter, according to the March Purdue University/CME Group Ag Economy Barometer reading. The barometer, which is based on a survey of 400 US agricultural producers, declined 3 points to a reading of 133, down from 136 in February.

“This month’s drop is largely due to producers’ weaker outlook regarding future economic conditions in agriculture and, in some cases, stress regarding their farm’s future financial performance,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

The Index of Future Expectations dropped 6 points, down from a reading of 145 to 139, while the Index of Current Conditions remained relatively unchanged at 120.

Financial stress continues to be a concern in the production agriculture sector. When asked about their financial performance expectations for 2019 compared to the previous year, 59 percent of producers expect their farm’s performance to be “about the same,” and 21 percent actually expect “better,” financial performance; however, 20 percent of producers said they expect their farm’s performance to be “worse than” in 2018. Responding to a separate question, just over half (52 percent) of respondents indicated they are less optimistic about their farm’s financial future compared to a year earlier.

To learn more about financial conditions on US farms, Purdue researchers asked producers about their operating debt, both in the January and March 2019 surveys. Results suggest that 5 to as much as 7 percent of US farms are suffering from some financial stress, using the need to carryover unpaid operating debt as a financial stress indicator. In March, of the 22 percent of farms that expect to have a larger operating loan in 2019, just over one in five said it was the result of carrying over a previous year’s unpaid operating debt.

In contrast to the concerns expressed about financial performance in the March survey, producers seem more optimistic about the future of agriculture exports. Only 8 percent of producers in the March survey said they expect agriculture exports to decrease in the next 5 years. Meanwhile, 68 percent expect exports to increase, which was the most optimistic perspective on agricultural exports provided by farmers since the Purdue researchers began posing questions on exports in May 2017. With respect to the trade dispute with China, 77 percent of producers were confident that it will be resolved in a way that benefits US agriculture; however, less than half expect the trade situation with China to be resolved before July 1.

Read the full March Ag Economy Barometer report. The report includes insights into producers’ attitudes toward farmland values and making large farm investments. The site also offers additional resources, such as past reports, charts and survey methodology, and a form to sign up for monthly barometer email updates and webinars. Each month Dr. Mintert also provides an in-depth analysis of the barometer.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.