Daily US grain report: big speculative “funds” caught on wrong side of grain futures

US grain futures prices were higher overnight. Corn was up around 1 1/2 cents, soybeans up around 3 1/2 cents and wheat around 5 cents higher.As the year winds down the big speculative “fund” traders that had been short the grain futures markets are covering those shorts as grain prices rise. More short covering is likely next week as the big funds appear to have been caught on the wrong side of the market late this year.

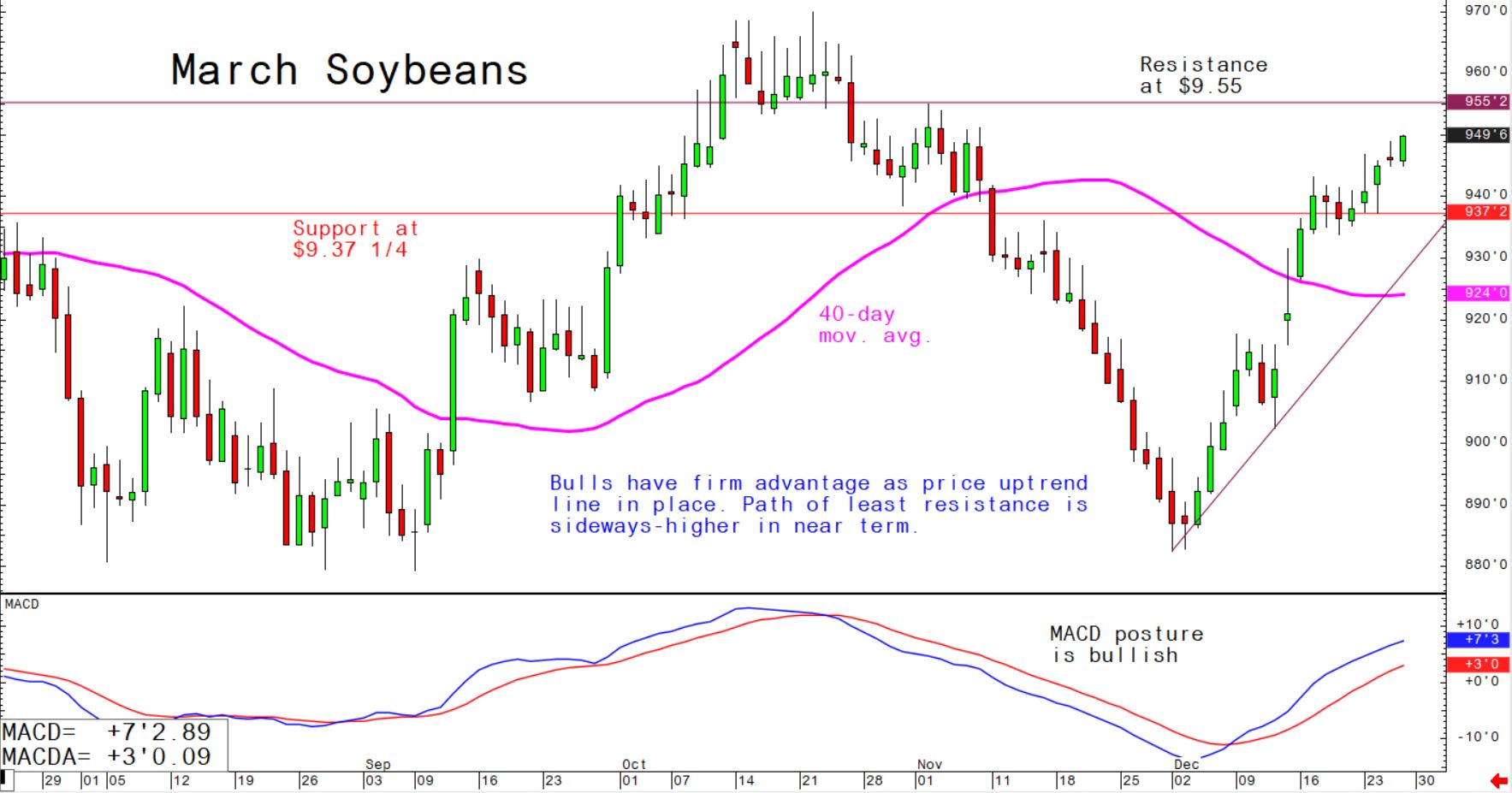

© Jim Wyckoff

© Jim Wyckoff

Today’s focus will be on the weekly USDA export sales report, delayed one day by the Christmas holiday. US corn sales are seen at 500,000 to 1,300,000 metric tonnes, US soybeans at 700,000 to 1,550,000 metric tonnes and US wheat 200,000 to 900,000 metric tonnes.

The US-China trade war appears to be significant decelerating amid the recent positive comments on the matter from officials on both sides.

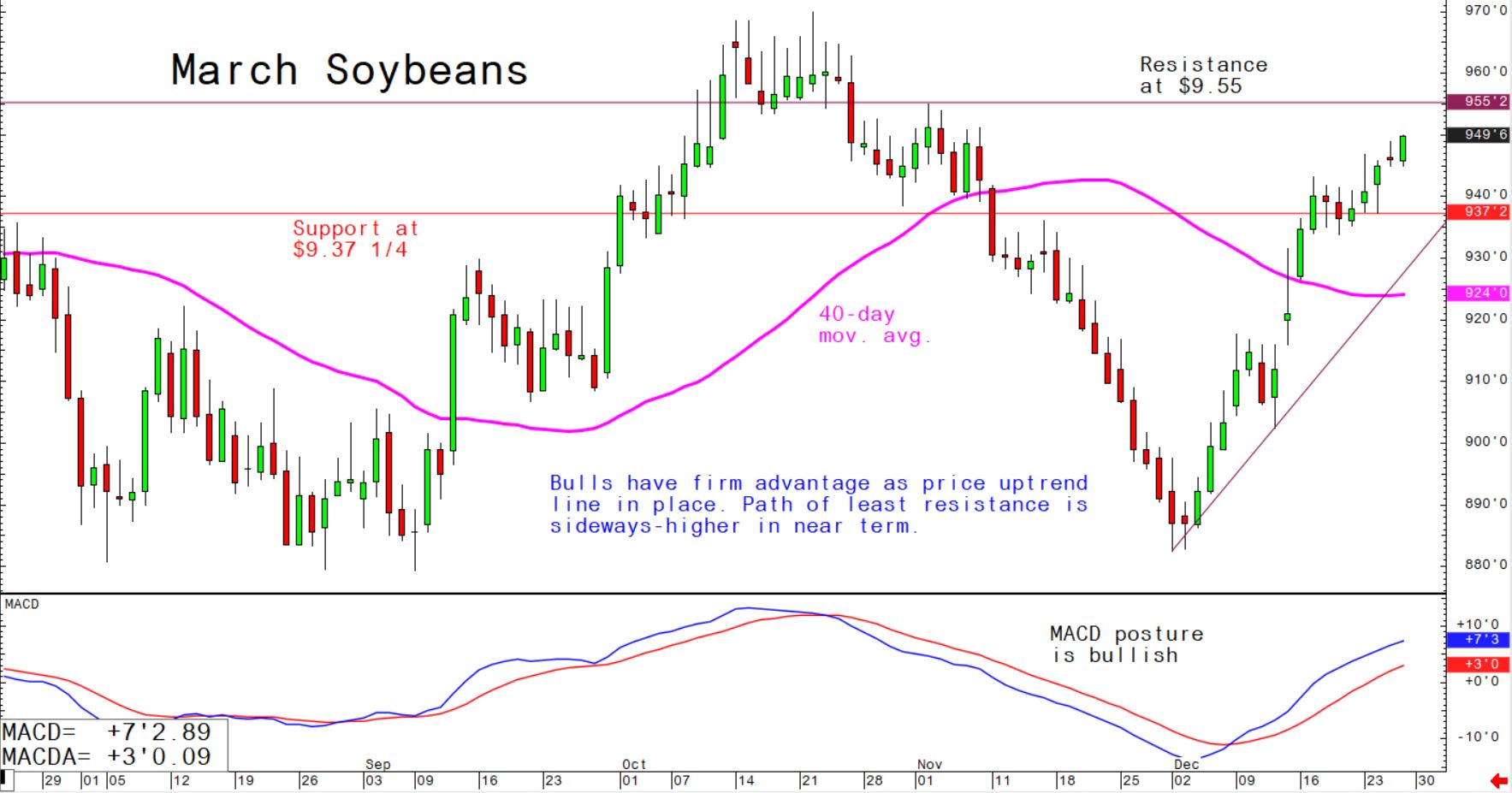

© Jim Wyckoff

© Jim Wyckoff

The January monthly USDA supply and demand report is the next major inflection point for the grain markets, as estimates of the updated size of the US corn and soybean crops will be issued following a rocky harvest season that was plagued by inclement weather.

Weather in South American corn and soybean regions remain mostly non-threatening, but grain traders will continue to monitor mildly dry pockets that could become a bigger concern in January.