Daily US grain report: slumping greenback a positive for grain markets heading into 2020

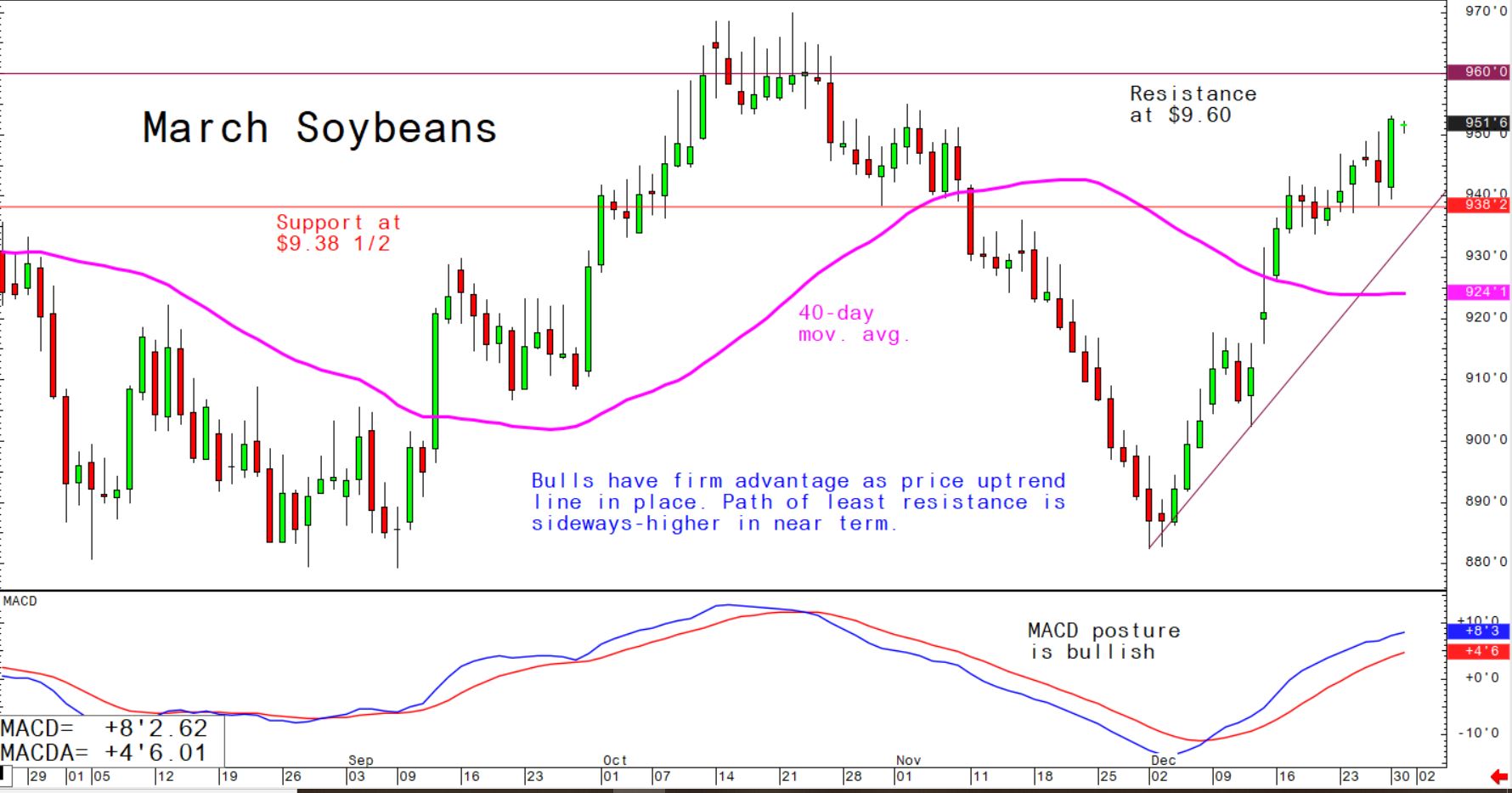

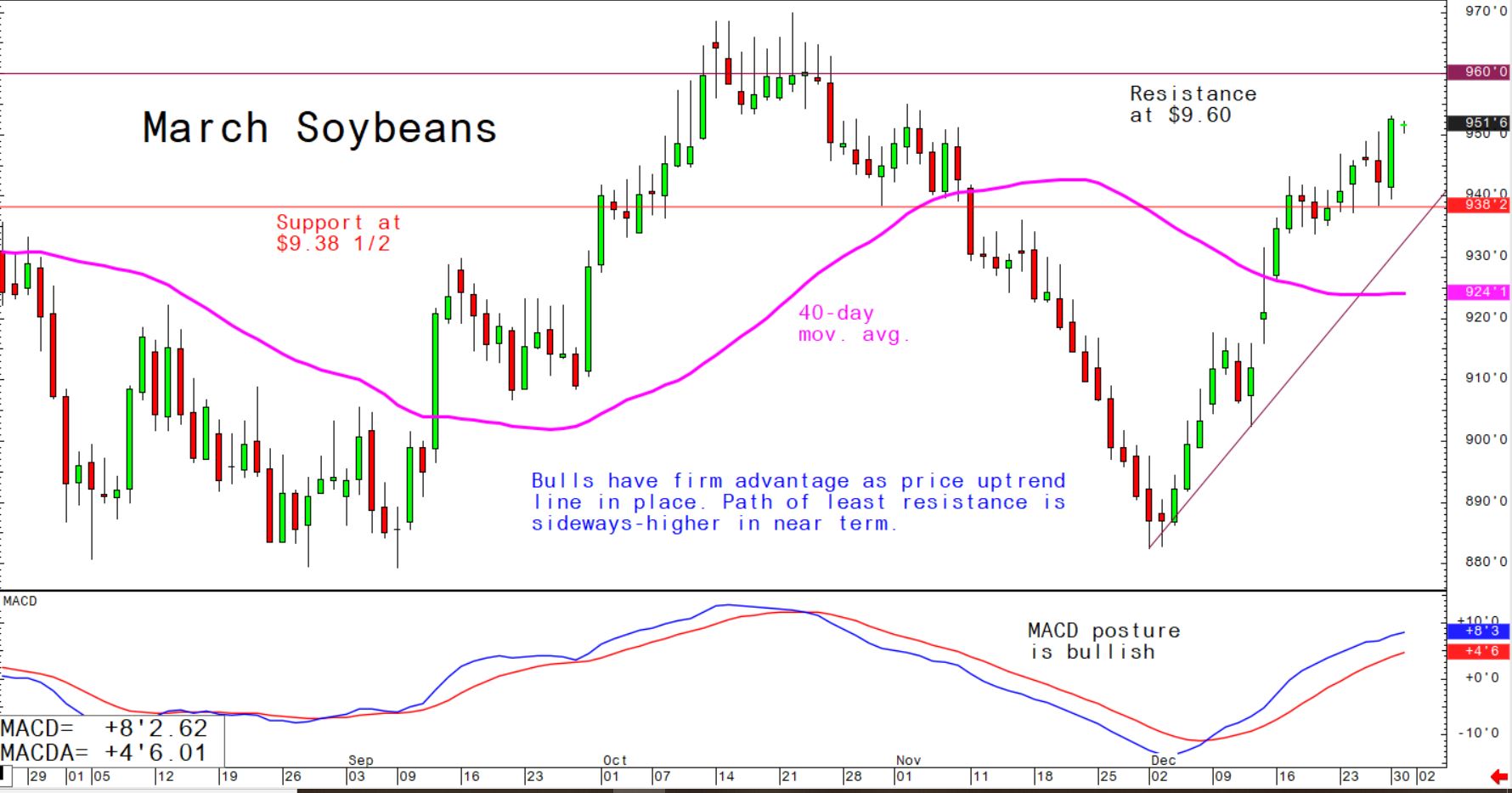

US grain futures prices were narrowly mixed overnight and trading around 1 cent on either side of unchanged in pre-holiday trading.Grain market bulls are exiting 2019 with a bit of momentum on their side, especially in soybeans and wheat.

A feature in a generally quiet, holiday marketplace the past few days has been many currencies rallying significantly against the US dollar, including the Swiss franc, Euro currency, Japanese yen, Canadian dollar and Australian dollar. The US dollar index hit a five-month low overnight and is poised to close at a technically bearish monthly low close today, which would suggest more downside price pressure for the greenback in early January, or longer. This is a bullish development for the raw commodity sector, including the grains, as most raw commodities are priced in US dollars on the world market.

© Jim Wyckoff

© Jim Wyckoff

The US-China trade war has significantly thawed amid recent positive comments from officials on both sides, and that’s also supportive for grain markets as the year winds down. A partial trade agreement is expected to be signed in January.

© Jim Wyckoff

© Jim Wyckoff

The January 10th monthly USDA supply and demand report is the next major data point for the grain markets, as estimates of the updated size of the US corn and soybean crops will be issued following a rocky harvest season that was plagued by inclement weather.

Weather in South American corn and soybean regions remains mostly non-threatening, but grain traders will continue to monitor mildly dry pockets that could become a bigger concern in January.