Daily US grain report: traders wonder how China’s big US ag purchases can happen

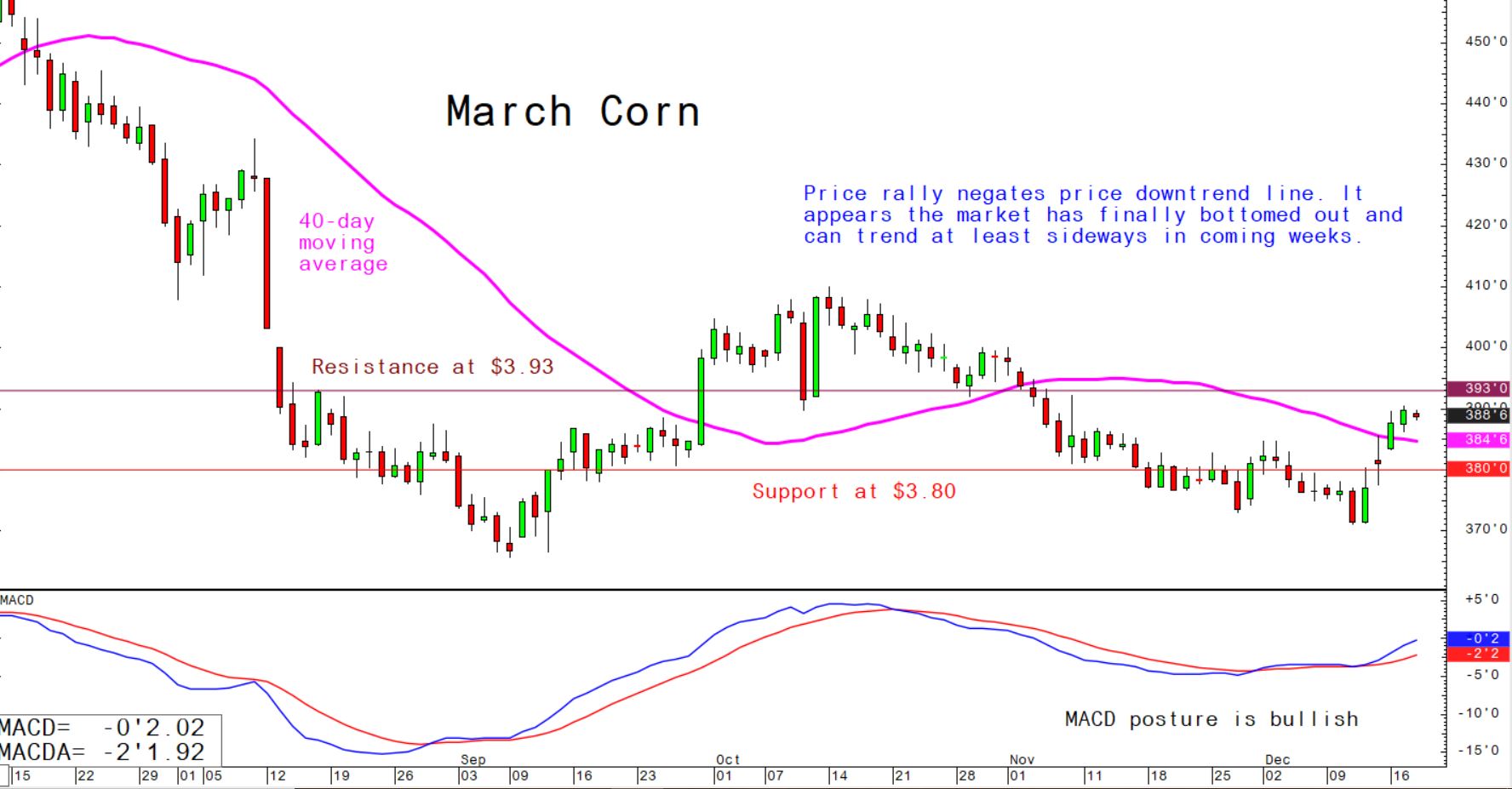

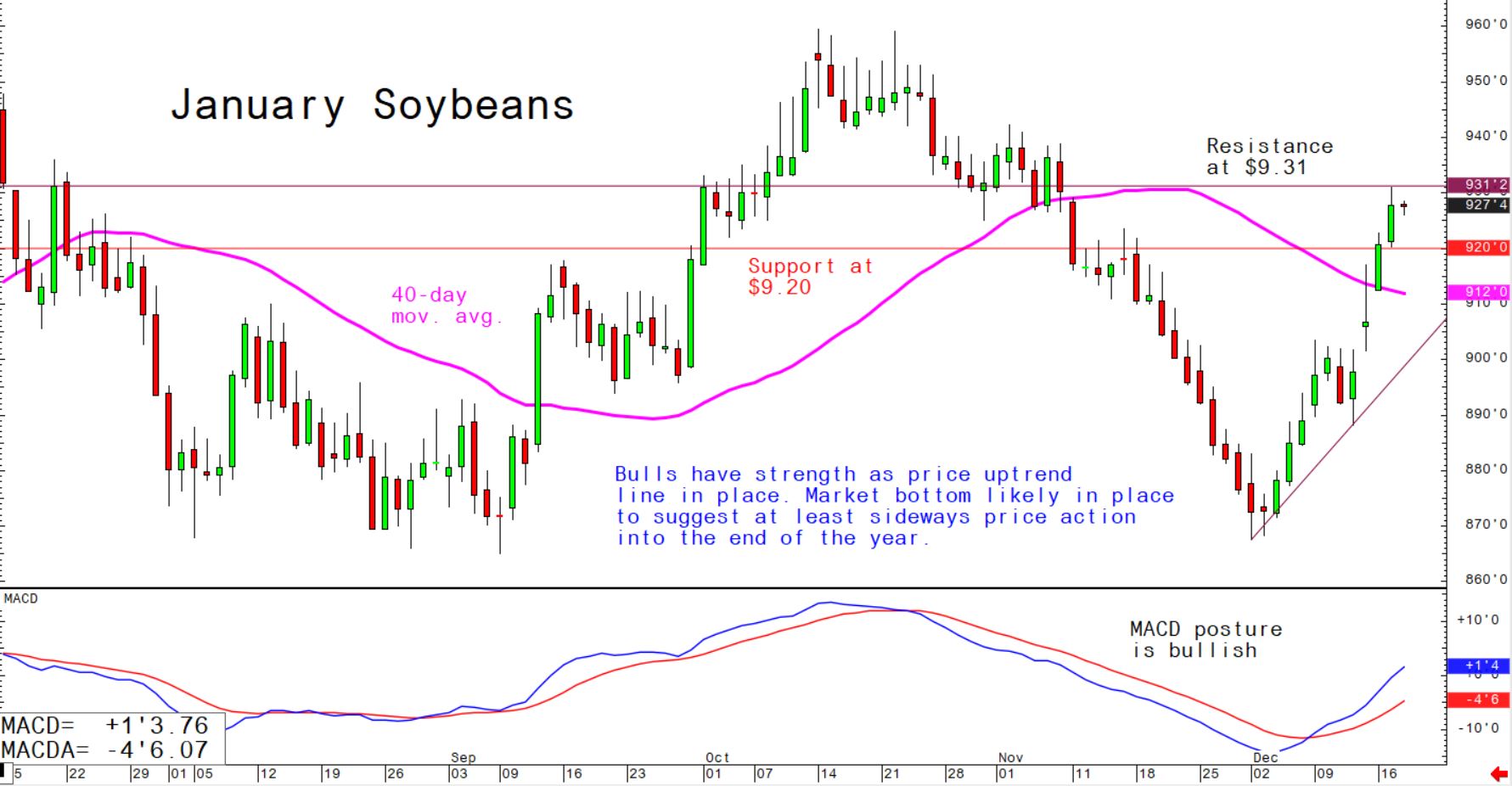

US grain futures prices were weaker overnight. Corn and soybeans were down 1 to 2 cents and wheat was off around 4 to 7 cents.The markets are seeing normal downside corrections following recent good gains that have changed the near-term technical postures to bullish for wheat and soybeans and neutral for corn.

Grain trader enthusiasm has receded a bit at mid-week, following last week’s US-China partial trade agreement. That deal has yet to be signed and there are many sceptics that wonder how China will be able to purchase $40 billion worth of agricultural products, which is about double the previous record-high annual China ag purchases from the US. Some believe part of the total will be US farm equipment and not just ag commodities.

© Jim Wyckoff

© Jim Wyckoff

Soybean oil futures this week hit a 1.5-year high as US lawmakers have amended a government spending bill to extend a tax credit for the biodiesel industry through 2022 and retroactively to when it expired in 2018.

Price action into the end of the year will likely go a long way in determining if the US grain futures markets can sustain price uptrends, or continue to languish and trade sideways.

© Jim Wyckoff

© Jim Wyckoff

Grain traders are looking more closely at weather in South American crop-growing regions. While there are no major problems at present, there are some dry pockets traders are monitoring to see if the dryness persists.