Daily US grain report: grain markets squelched by heightened geopolitical tensions

US grain futures were mixed overnight. Corn was off around 1 1/2 to 2 cents, soybeans down around 1 cent and wheat steady to 1 1/2 cents higher.Geopolitical tensions are high, which means less buying interest in the grains due to the keen uncertainty.

Global markets that were open Tuesday evening US time were rocked when Iran launched at least a dozen missiles at military bases in Iraq where US troops were stationed. Iran immediately claimed responsibility for the attacks, which it called “hard revenge” for the US killing of its leading military general last week. Reports say there are no US casualties. President Trump tweeted “all is well” and said he would have more to say today. At first blush, it appears the Iranian leadership launched the missiles to appease Iranian citizens who were calling for revenge. However, it also appears Iran did not want to kill Americans which would then likely see a massive US retaliation. Reports also said Iranian officials notified the US the missile strikes were coming.

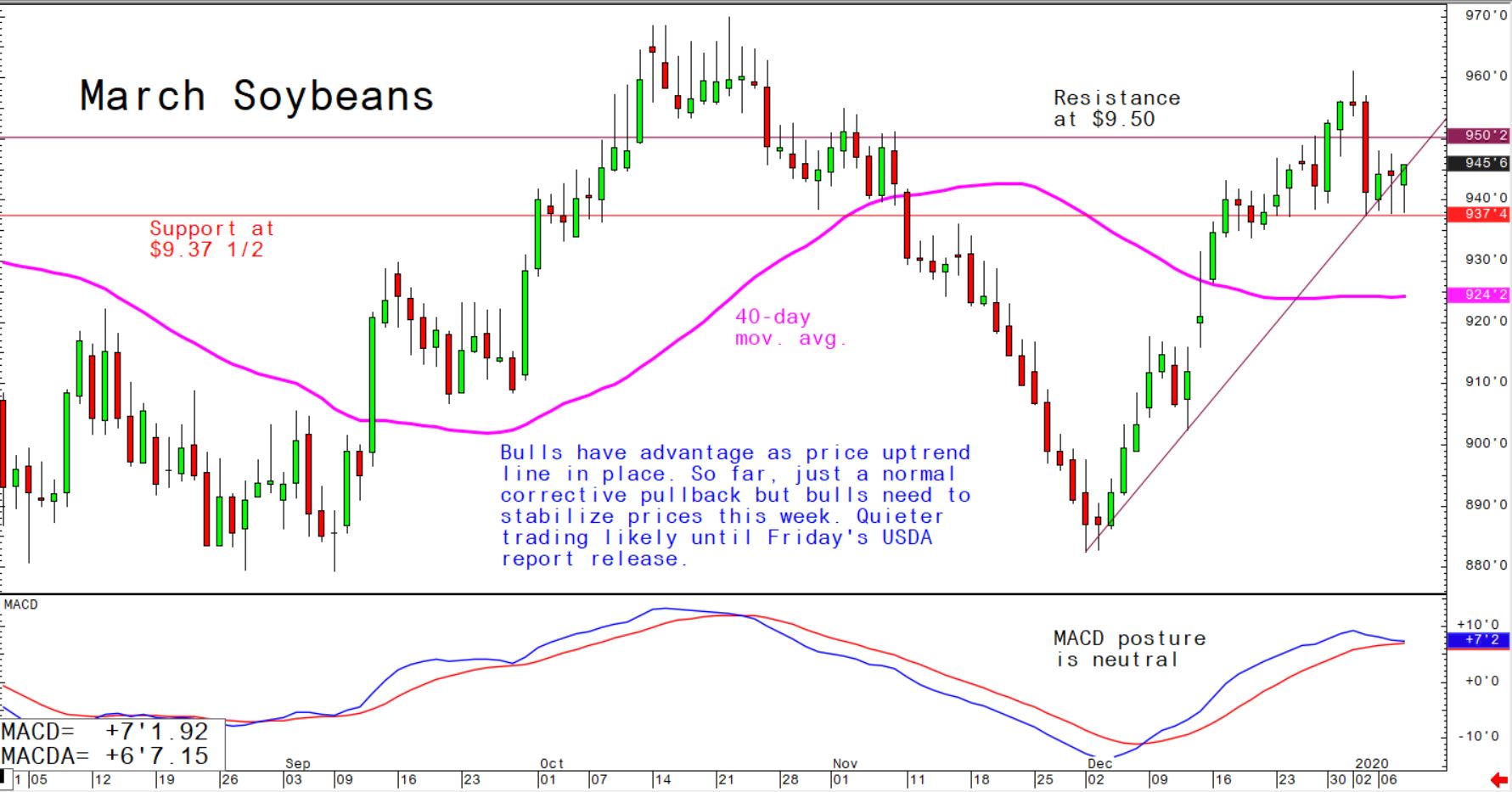

© Jim Wyckoff

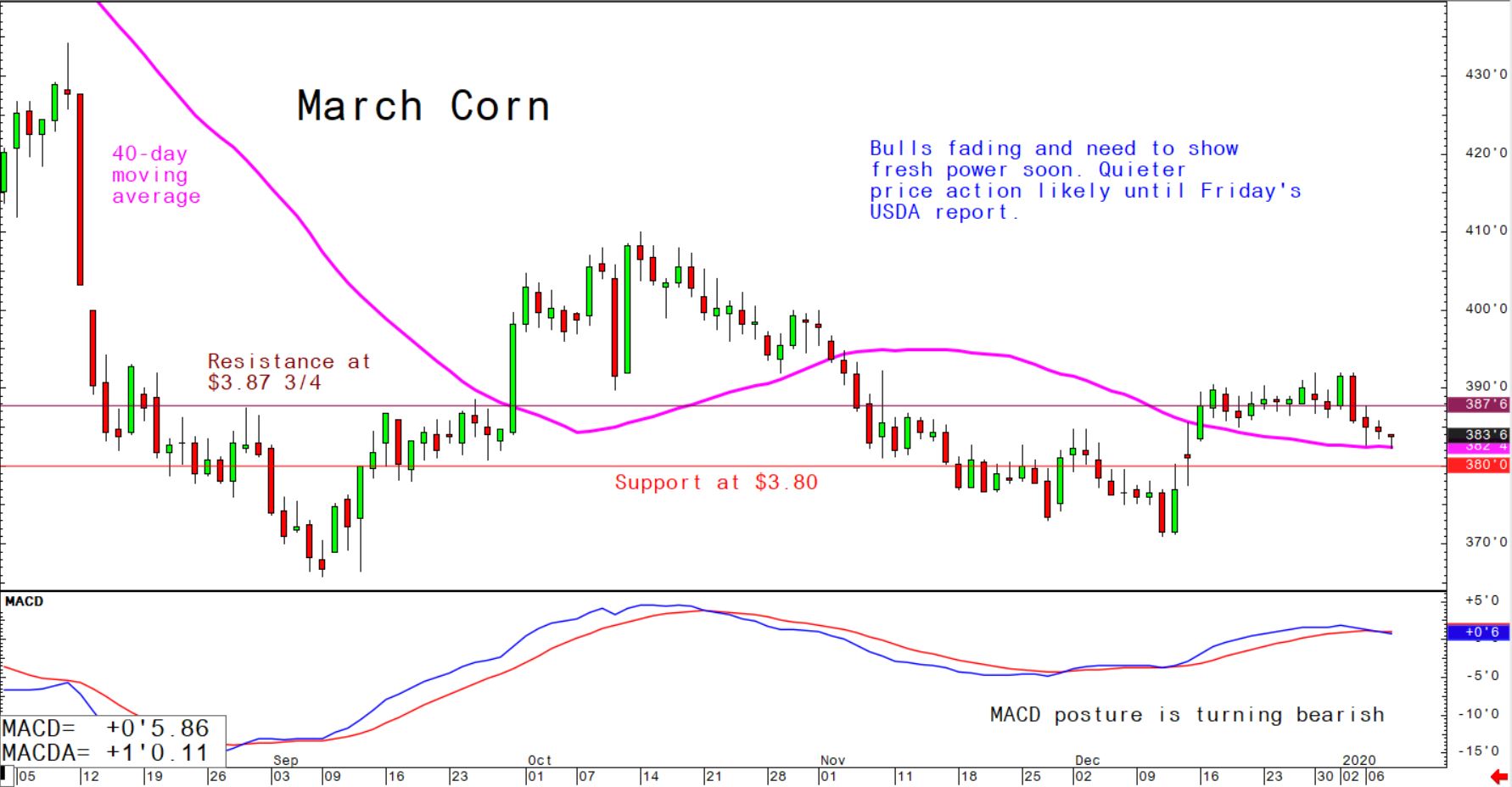

© Jim Wyckoff

Military analysts believe Iran’s missiles are accurate enough to have inflicted more loss of human life, if that’s what Iran’s leaders wanted. But that’s still just speculation. Iran’s leadership did say the missile attacks were “proportionate” and said they did not want an escalation of the conflict. The wildcard is, how will Trump respond? The marketplace Wednesday morning is acting like this situation will de-escalate from here, at least for the near term. If the markets remain calmer, the grain market bulls will regain some confidence on the buy side.

Grain traders are awaiting Friday’s monthly USDA supply and demand report. The agency will update estimates of the size of the US corn and soybean crops.

© Jim Wyckoff

© Jim Wyckoff

The key “outside markets” remain friendly for the grain futures markets, as the US dollar index is trending lower and crude oil prices are trending higher. Other raw commodity markets like gold, silver, sugar and cotton are also making bull moves, which should further support some speculative buying interest in the grains in the near term.