Coronavirus scare continues to squelch the grain market bulls

The US grain futures markets remain held hostage by the coronavirus scare that has roiled the global marketplace. Do not look for this situation to stabilise anytime soon.There is still too much uncertainty among traders, investors and health officials worldwide. Traders hate uncertainty and that means the grain market bears will remain in control for at least the near term. For perspective on the coronavirus matter: Moody's Analytics has reported it expects the coronavirus outbreak to cause China's economy to contract in the first quarter and reduce full-year growth by 1 percent - down to 5.4 percent. In the US, the virus is forecast to shave 0.6 percent from first-quarter gross domestic product and 0.2 percent off of full-year GDP, leaving GDP at 1.3 percent in the first quarter and 1.7 percent for the year. That's if the virus is contained.

"A pandemic will result in global and US recessions during the first half of this year."

--

"A pandemic will result in global and US recessions during the first half of this year."

--

That’s a dour outlook that will keep global commodity markets tamped down in the coming weeks, or longer. As has been the case for several weeks, US grain traders will look to the weekly USDA export sales reports for clues on better export demand for US grains, especially from China.

The next week’s likely high-low price trading ranges

May soybean meal futures: $290.70 to $305.00, and with a slight upside bias.

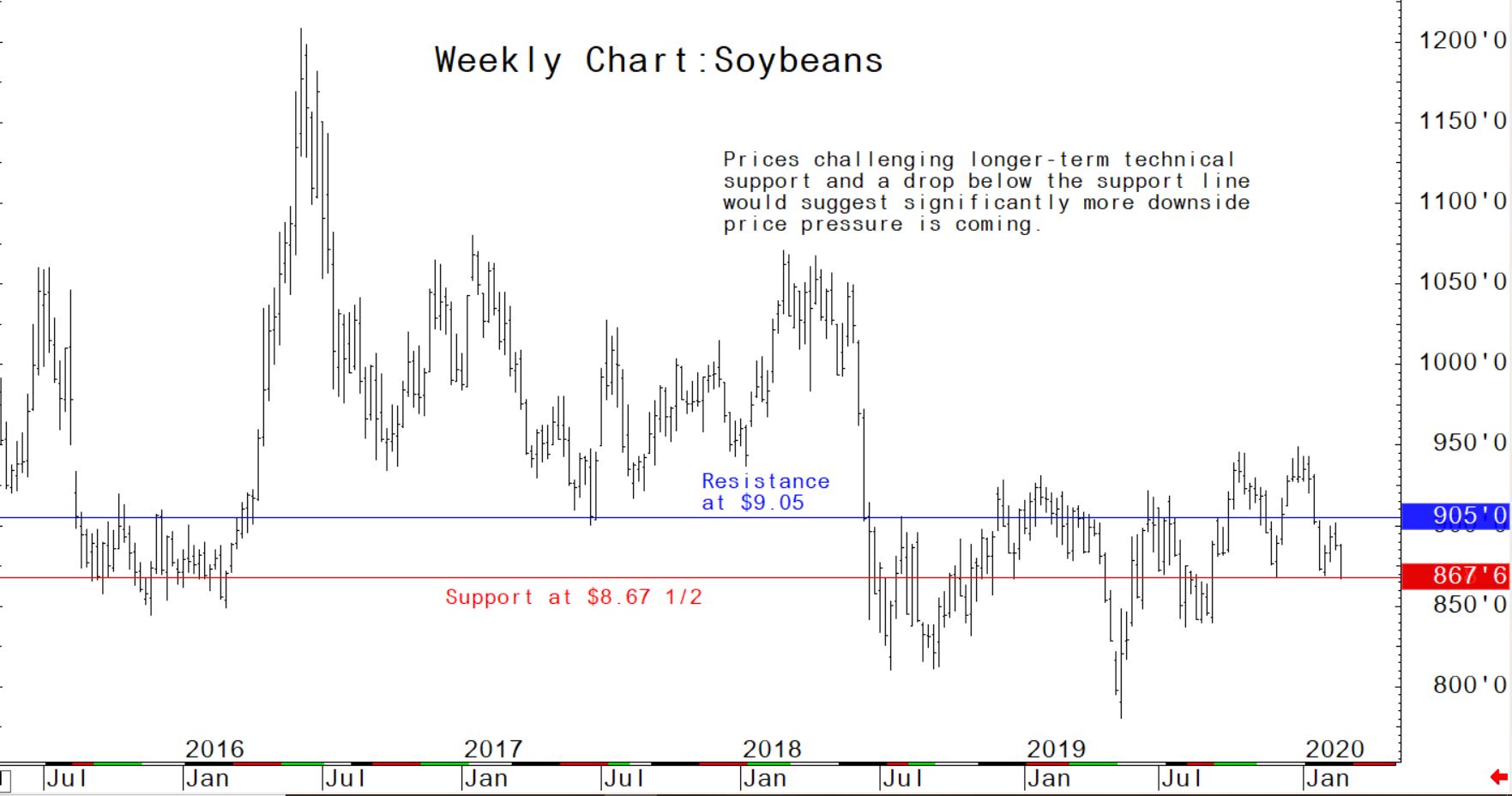

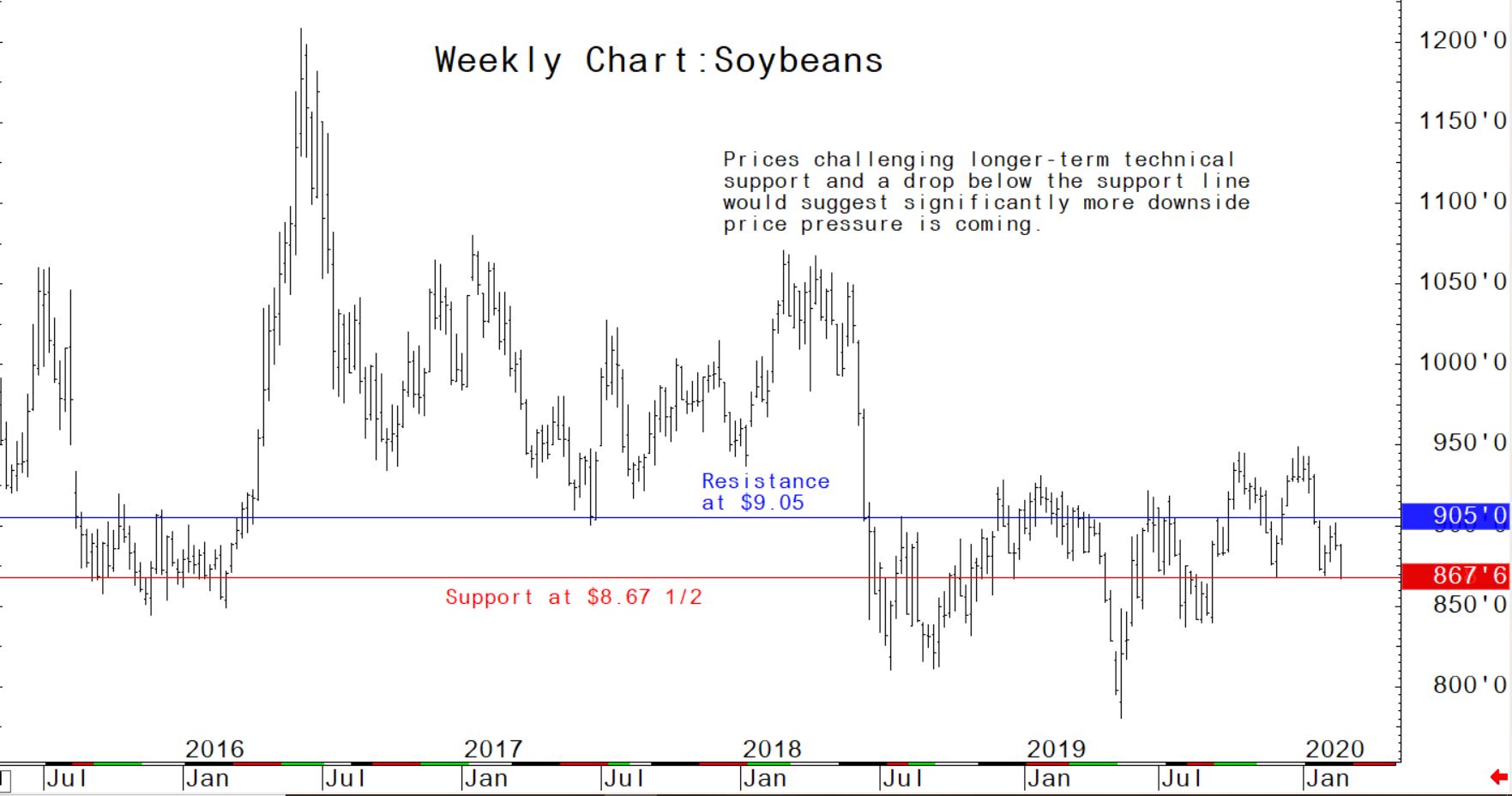

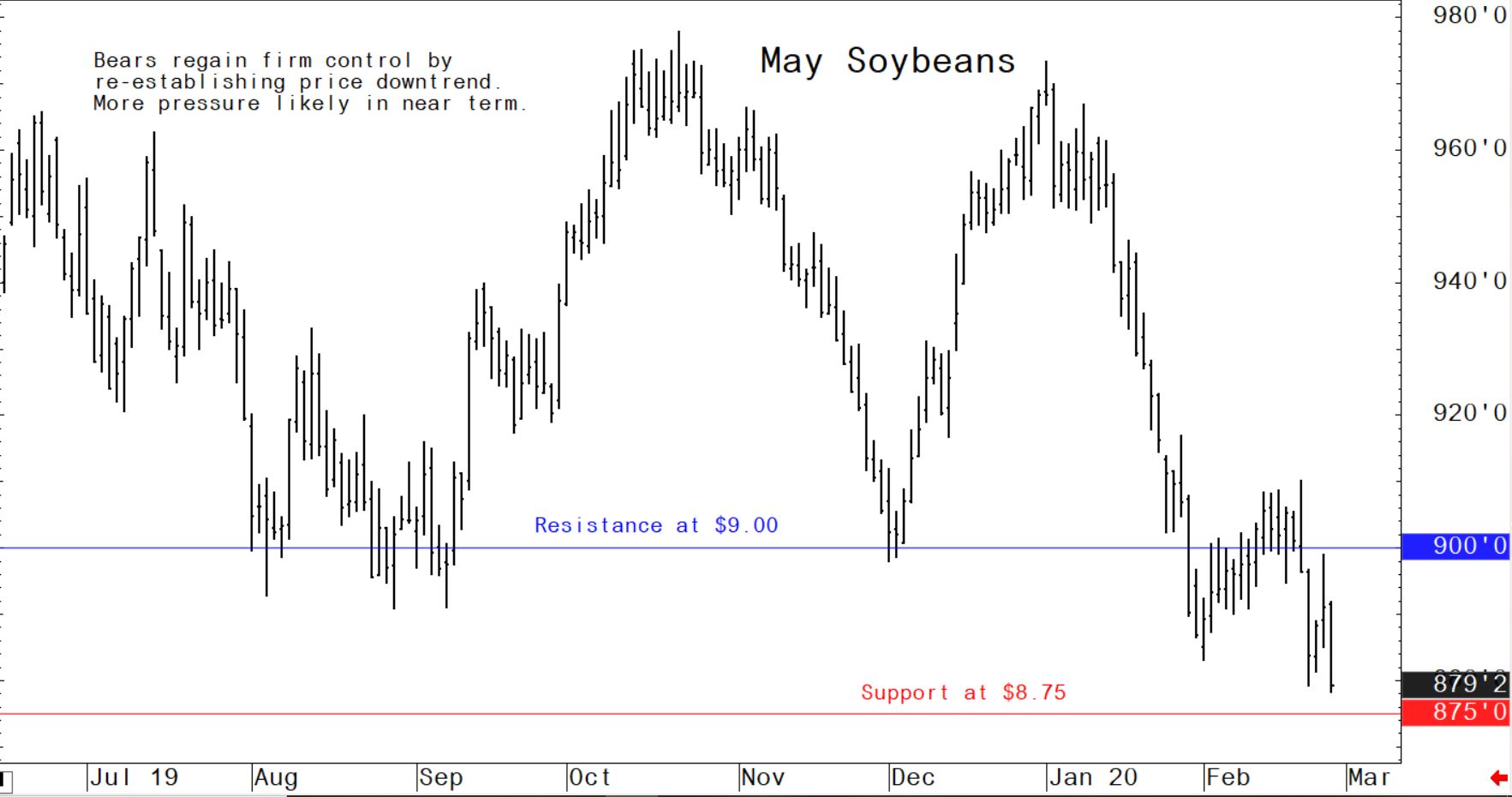

May soybean futures: $8.75 to $9.10 and with a sideways, choppy bias.

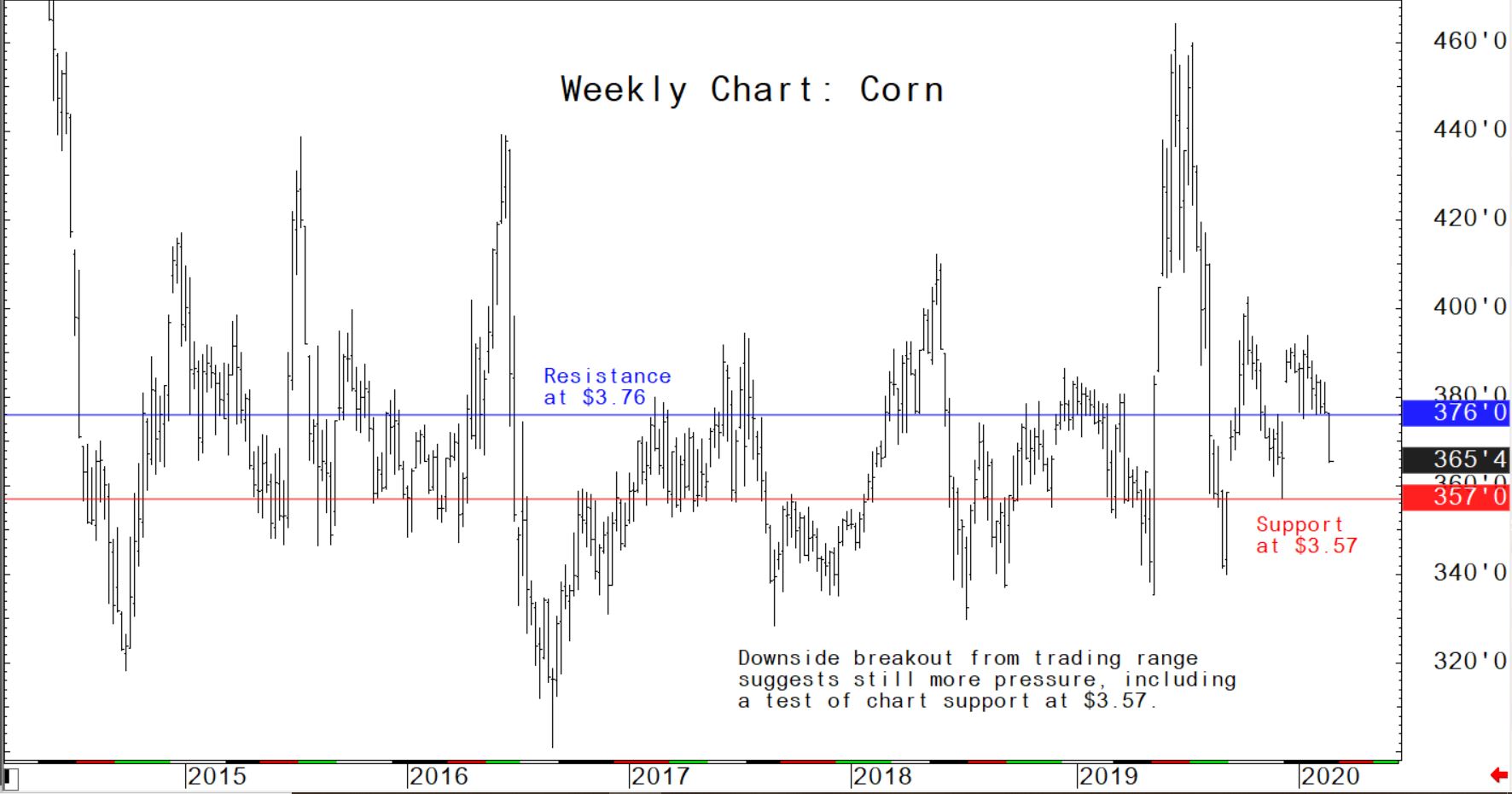

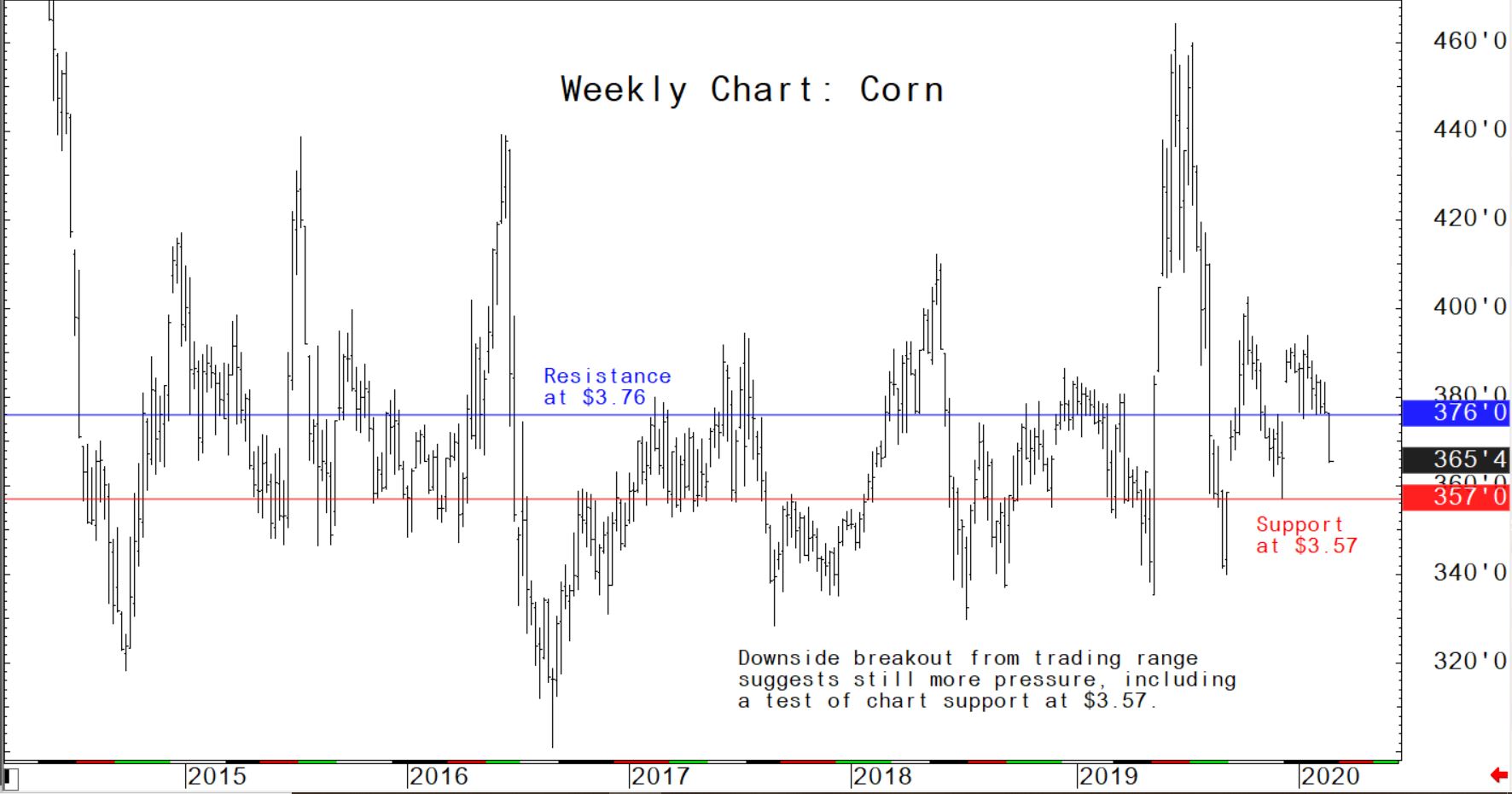

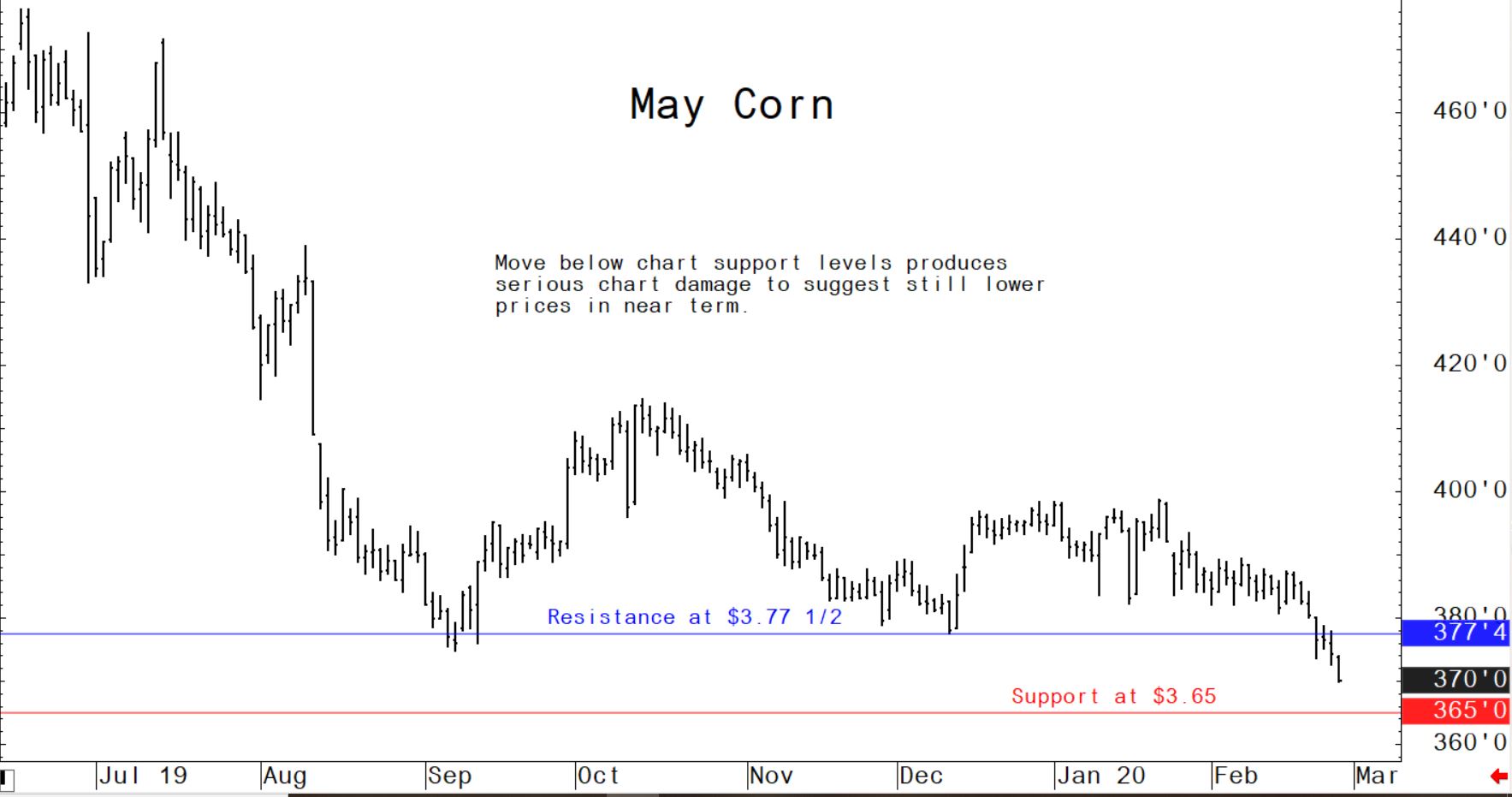

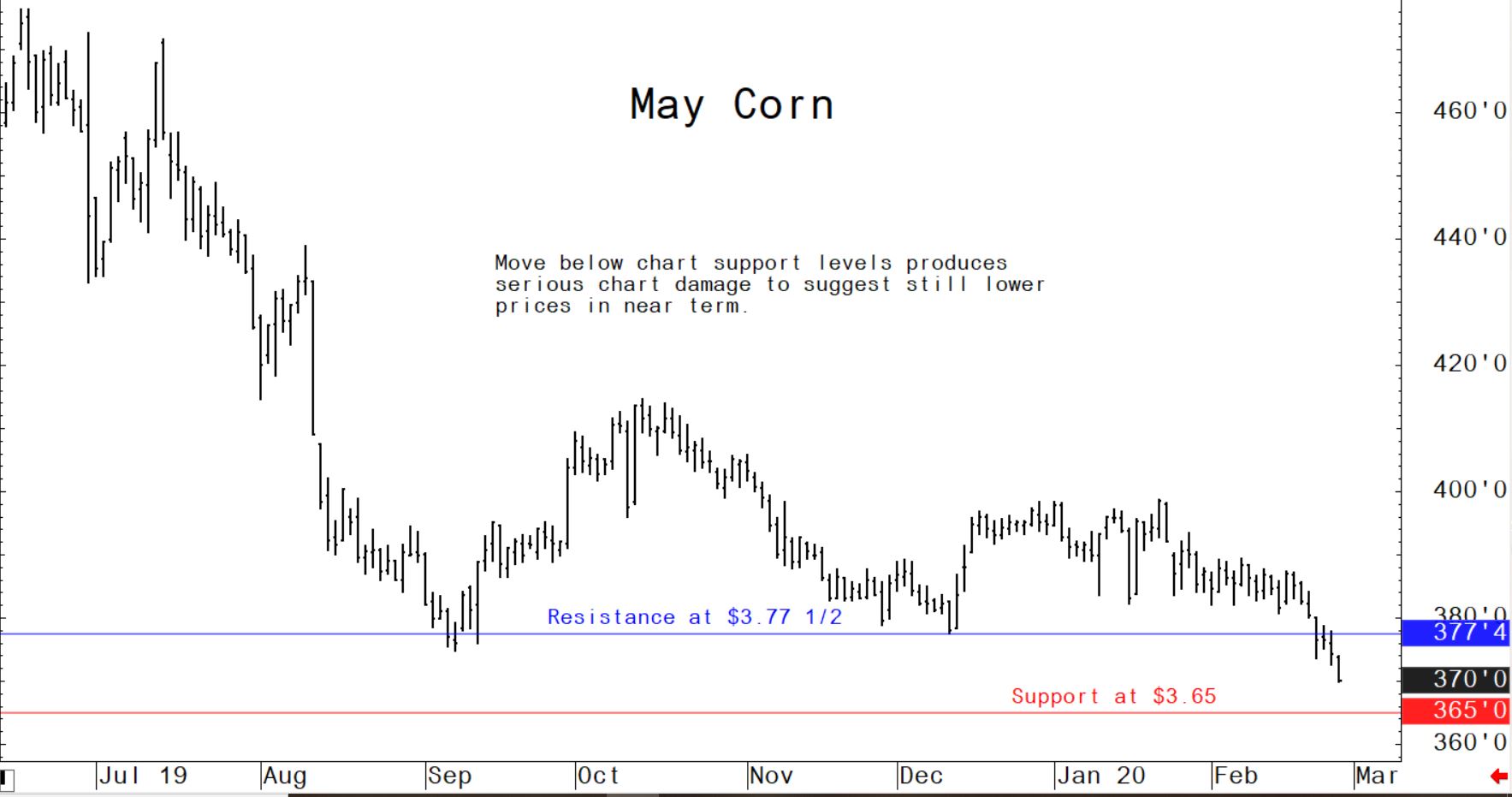

May corn futures: $3.65 to $3.77 1/2, and a downside bias.

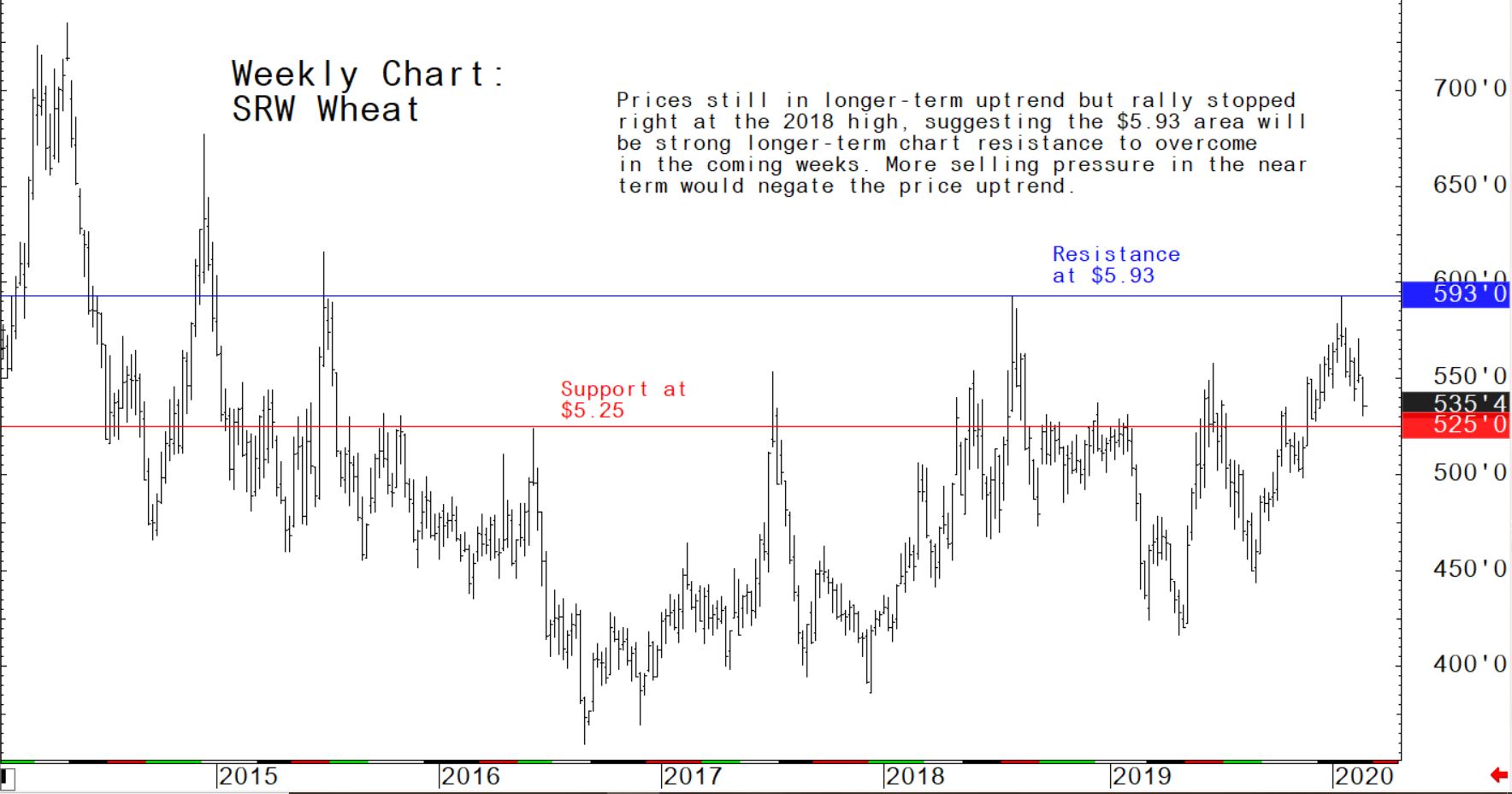

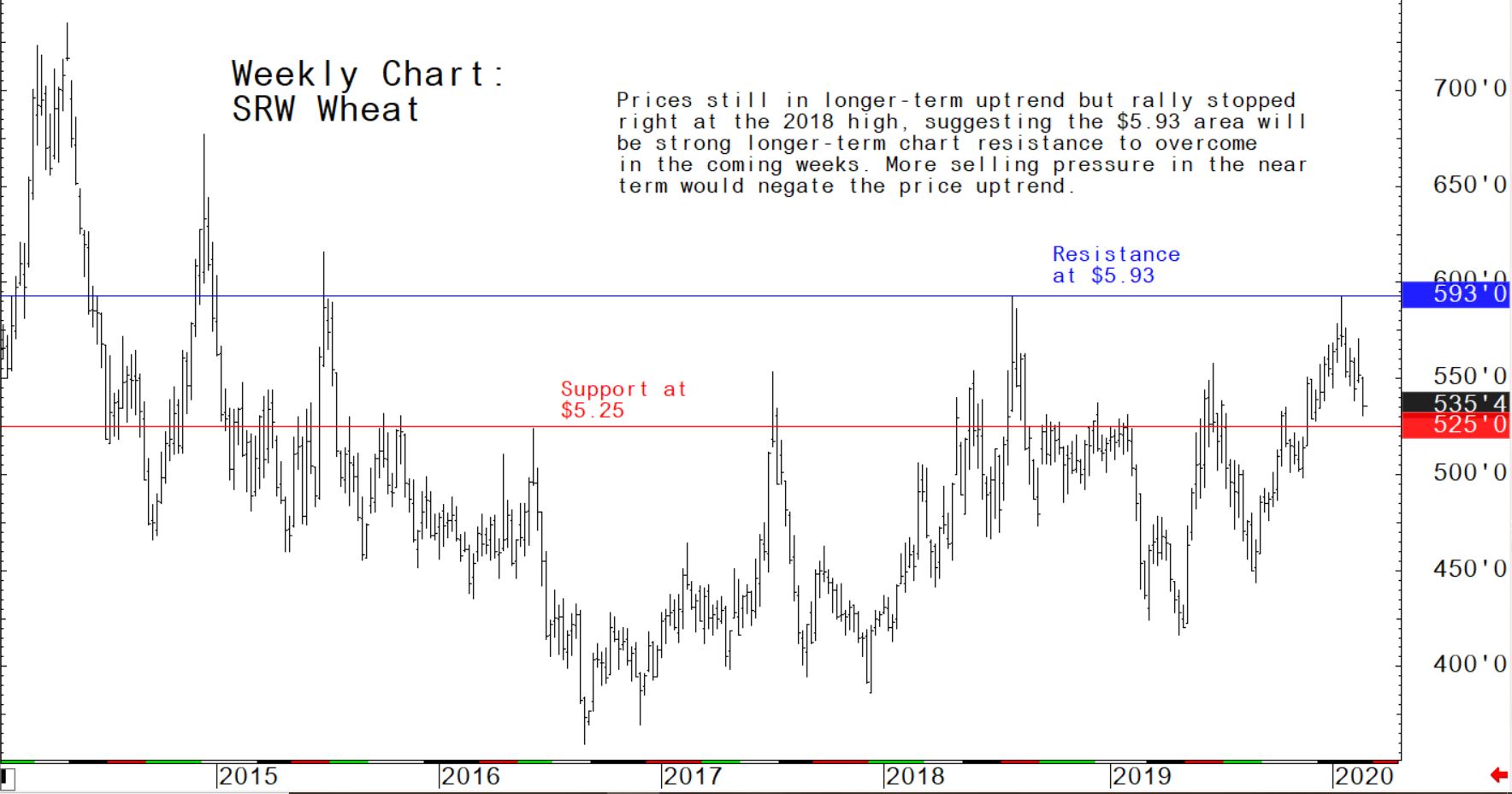

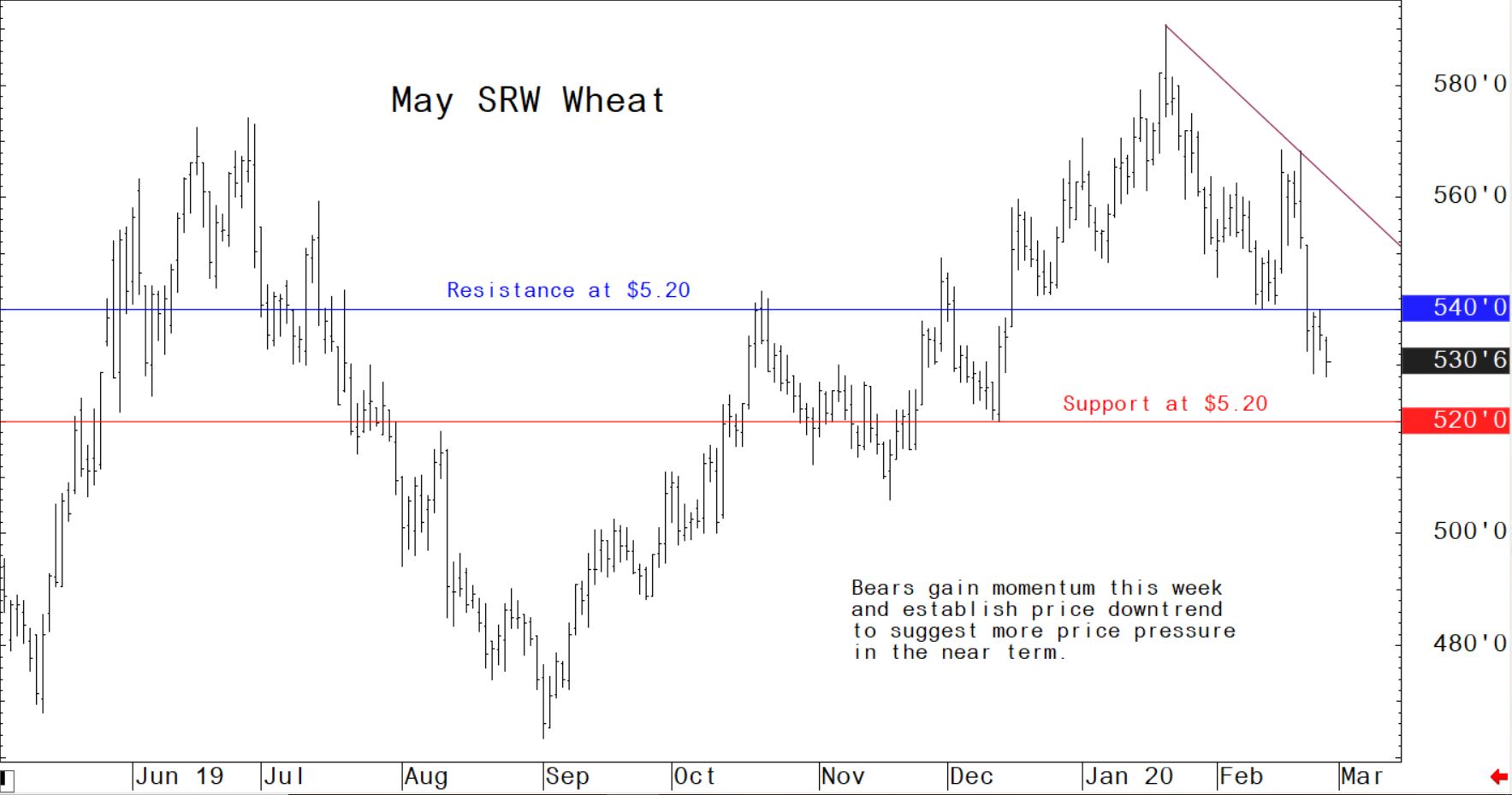

May soft red winter wheat futures: $5.20 to $5.40, and with a downside bias.

Latest US Department of Agriculture (USDA) reports

USDA says China taking significant steps to implement January trade agreement with US

US Secretary of Agriculture Sonny Perdue and US Trade Representative Robert Lighthizer announced this week that China has taken numerous actions to begin implementing its agriculture-related commitments under the US-China Phase One Economic and Trade Agreement on schedule. The agreement entered into force on 14 February.

These actions include:

- signing a protocol that allows the importation of US fresh chipping potatoes (US Chipping Potatoes Protocol Announcement);

- lifting the ban on imports of US poultry and poultry products, including pet food containing poultry products (Poultry and Poultry Products Announcement);

- lifting restrictions on imports of US pet food containing ruminant material (Pet Food with Ruminant Ingredients Announcement);

- updating lists of facilities approved for exporting animal protein, pet food, dairy, infant formula, and tallow for industry use to China;

- updating the lists of products that can be exported to China as feed additives; and

- updating an approved list of US seafood species that can be exported to China.

In addition, China has begun announcing tariff exclusions for imports of US agricultural products subject to its retaliatory tariffs (Tariff Exclusion Process Announcement), and it announced a reduction in retaliatory tariff rates on certain US agricultural goods (Tariff Rate Adjustment Announcement). These types of actions will facilitate China’s progress toward meeting its Phase One purchase commitments.

“President Trump and this Administration negotiated a strong trade agreement with China that promises significant benefits for American agriculture,” Secretary Perdue said. “We look forward to realising these benefits this year and are encouraged by progress made last week. We fully expect compliance with all elements of the deal.”

Ambassador Lighthizer said, “President Trump signed the Phase One agreement a little more than a month ago and we are already seeing positive results. Under the President’s leadership, we will ensure the agreement is strictly enforced for the benefit of our workers, farmers, ranchers and businesses.”

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff