Daily US grain report: coronavirus scare intensifies at mid-week; grain market bulls are spooked

US grain futures are modestly down in early US pre-market trading Wednesday. Corn is down around 3/4 cent, soybeans steady to 2 cents lower, and wheat down around 1 1/2.Global stock markets are lower at mid-week as the coronavirus outbreak and its expected human toll and negative world economic fallout continue to intensify. That’s bearish for grain markets. There is no consensus on how or when this situation will wind up playing out. That suggests turmoil in the markets will continue in varying degrees until some kind of end-game for the matter is expected by the majority of market watchers.

The US Center for Disease Control officials at a press conference on Tuesday afternoon said of the outbreak: “This might be bad.” The CDC said the Covid-10 illness is going to spread in the US. The outbreak continues to spread in Asia and Europe.

In a sign of the keen trader and investor anxiety in the global marketplace at present, the yield on the benchmark US. Treasury 10-year note on Tuesday fell to a record low close of 1.328 percent. On Wednesday the yield traded as low as 1.312 percent. Gold is near steady Wednesday after falling sharply Tuesday. The big drop in gold prices Tuesday could be tied to notions of less consumer demand for the metal as global economic growth is dinged by the coronavirus outbreak. China, where the illness has hit hardest, is a leading consumer of gold. Nymex crude oil prices are lower Wednesday, at a nearly 14-month low, and trading around $49.50 a barrel. Brent crude is also trading near a 14-month low. Meantime, the US dollar index is higher today. All of the above are also bearish factors for grain markets.

Financial and currency markets this week are pricing in expected future easing of monetary policies by the major central banks of the world, as traders reckon the coronavirus, or covid-19, illness will prompt the central banks to stimulate their economies to help ward off the negative economic impacts of the outbreak. Such could prompt better global demand for grain markets in the coming months.

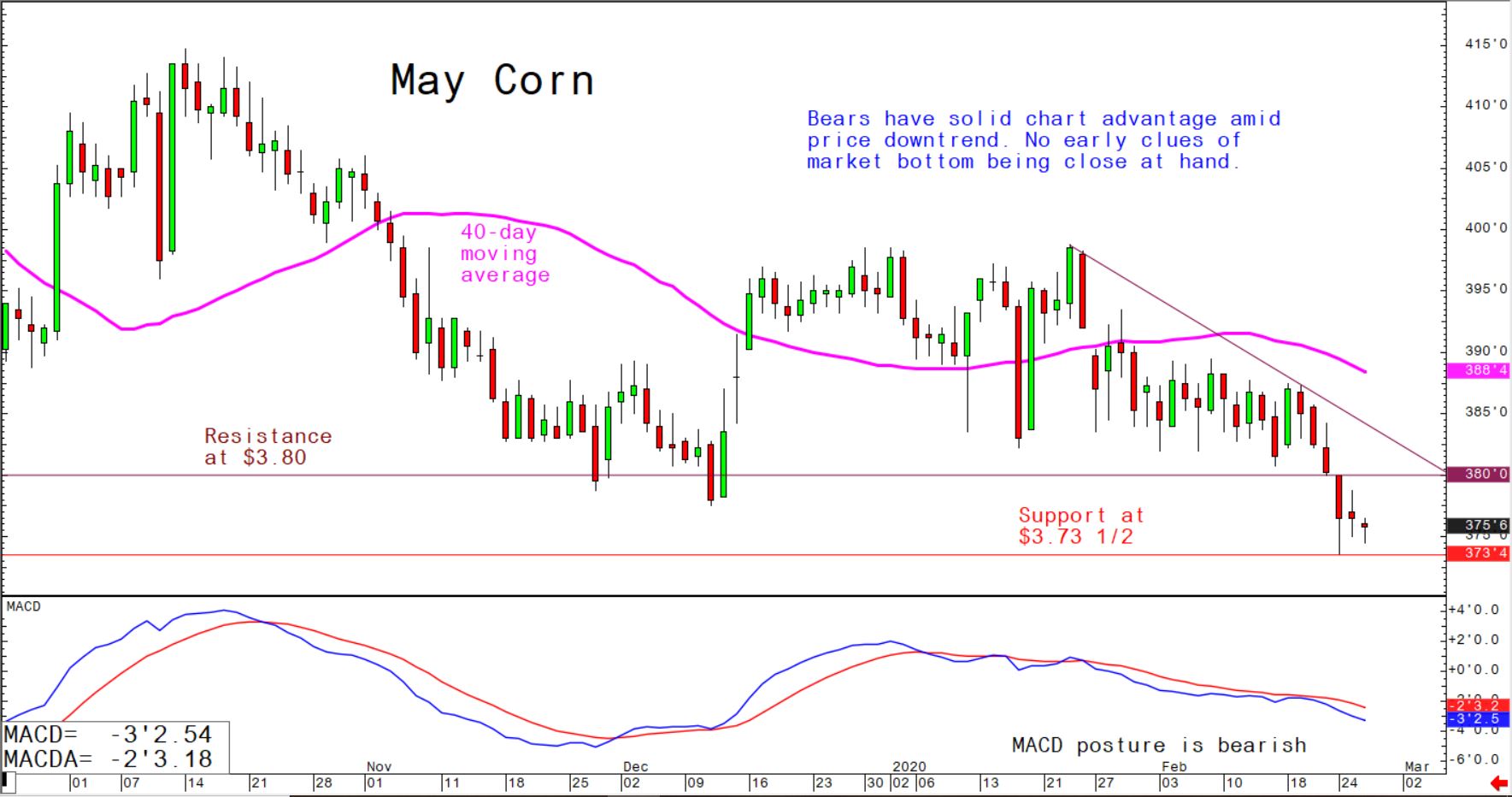

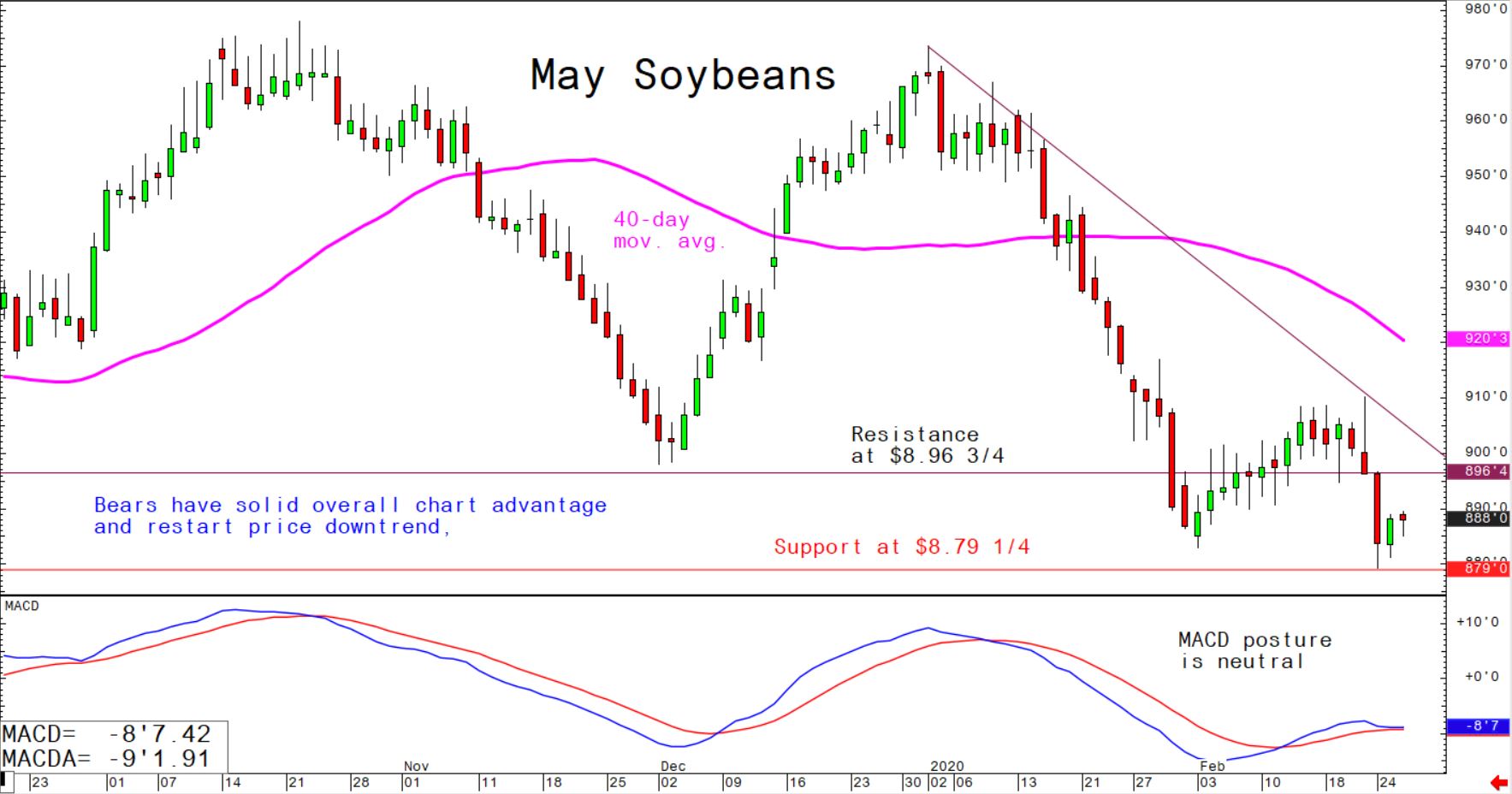

Significant near-term technical damage has been inflicted in the grain futures markets just recently, to suggest any sustained rallies or price uptrends are nowhere in sight, and prices are likely to continue to drift sideways to lower in the near term.

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff