Daily US grain report: markets cannot escape the bearish grip of coronavirus outbreak

Global stock markets have stabilized and are trading mixed Tuesday, following Monday’s strong selling pressure that wiped out all of the US stock market’s gains for 2020, including seeing the Dow Jones Industrial Average lose over 1,000 points. The key questions on grain traders’ and investors’ minds are: Have the grain markets now fully factored in the coronavirus impact on global demand? Or, “will the next shoe drop” soon?

Here is the latest on the coronavirus outbreak (covid-19). China has over 80,000 confirmed cases, with 508 new cases Tuesday and 71 new deaths to push the total above 2,700. Reports say China may postpone its annual National People’s Congress in March. More than 1,200 cases have been confirmed in 30 countries outside of China. South Kore has 84 new cases and nine deaths. A crew member of Korean Air has tested positive for coronavirus. Northern Italy sees 12 towns quarantined amid 229 cases confirmed and seven deaths. Japan has 160 coronavirus cases. Still, the World Health Organization says it is too early to call the outbreak a pandemic, although other health experts are calling it such. United Airlines says US citizens traveling to China are now near zero.

Financial and currency markets are starting to price in expected future easing of monetary policies by the major central banks of the world, due to the covid-19 outbreak. Fed funds futures markets show an 86 percent chance the Federal Reserve will lower US interest rates by July. The 10-year US Treasury Note yield is nearing a historic low and is currently fetching around 1.35 percent. The grain market bulls should get some comfort knowing that easing monetary policies of the major central banks would grease the skids for likely better global demand for grains.

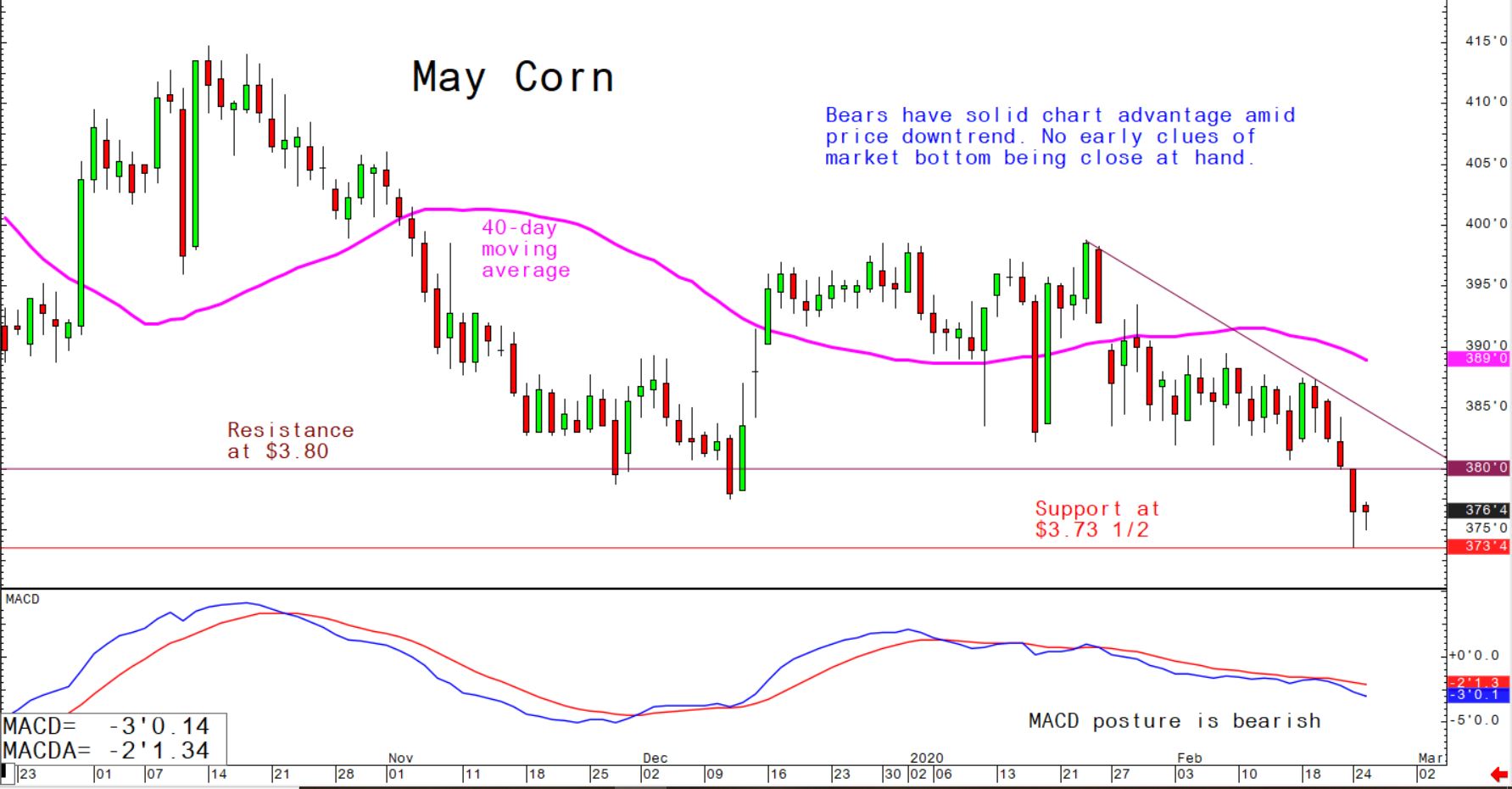

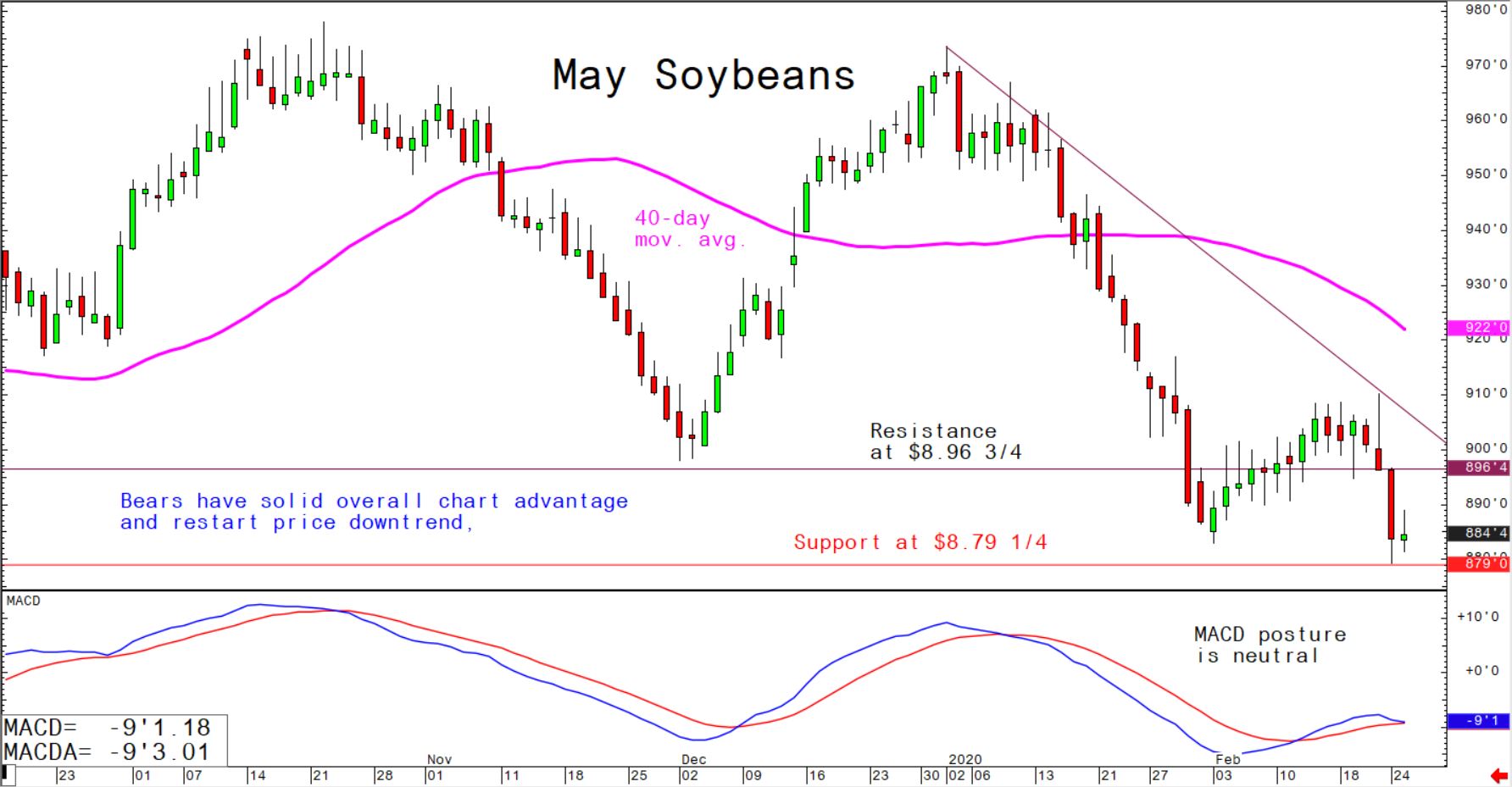

Still, technical damage has been inflicted in the grain futures markets just recently, to suggest any sustained rallies or price uptrends are nowhere in sight.

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff