Daily US grain report: markets higher on upbeat attitudes regarding China

US grain futures are posting decent gains in early US pre-market trading Tuesday. Corn is up around 4 cents, soybeans around 8 cents higher and wheat is around 8 cents up.So far this week trader and investor risk appetites are keener and the marketplace appears to be moving beyond the coronavirus outbreak that continues to spread. That’s a positive for the grain markets, too. Latest counts show over 20,000 Chinese citizens afflicted with over 425 dead, with air travel to China being significantly curtailed and global and domestic business there disrupted.

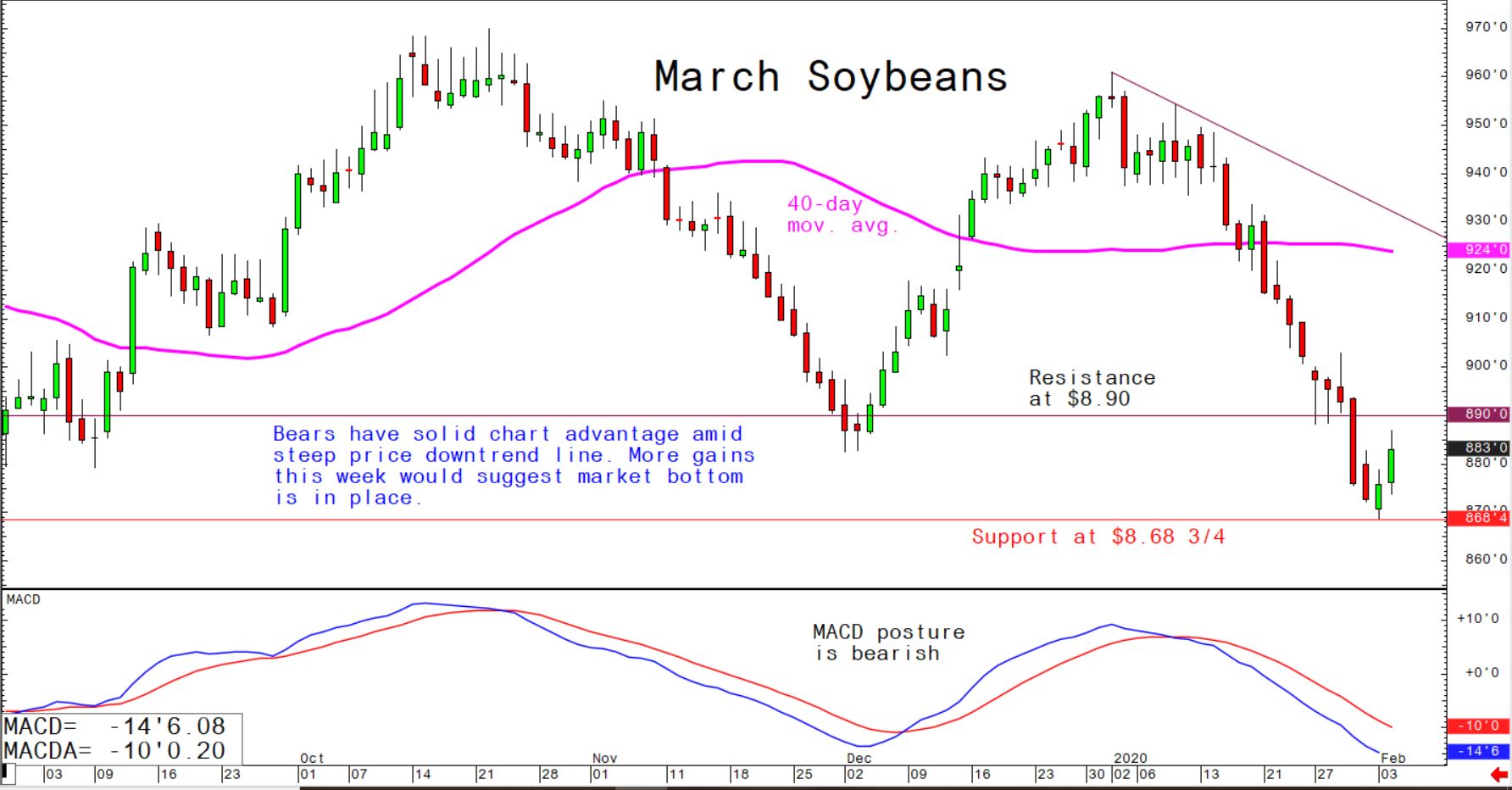

© Jim Wyckoff

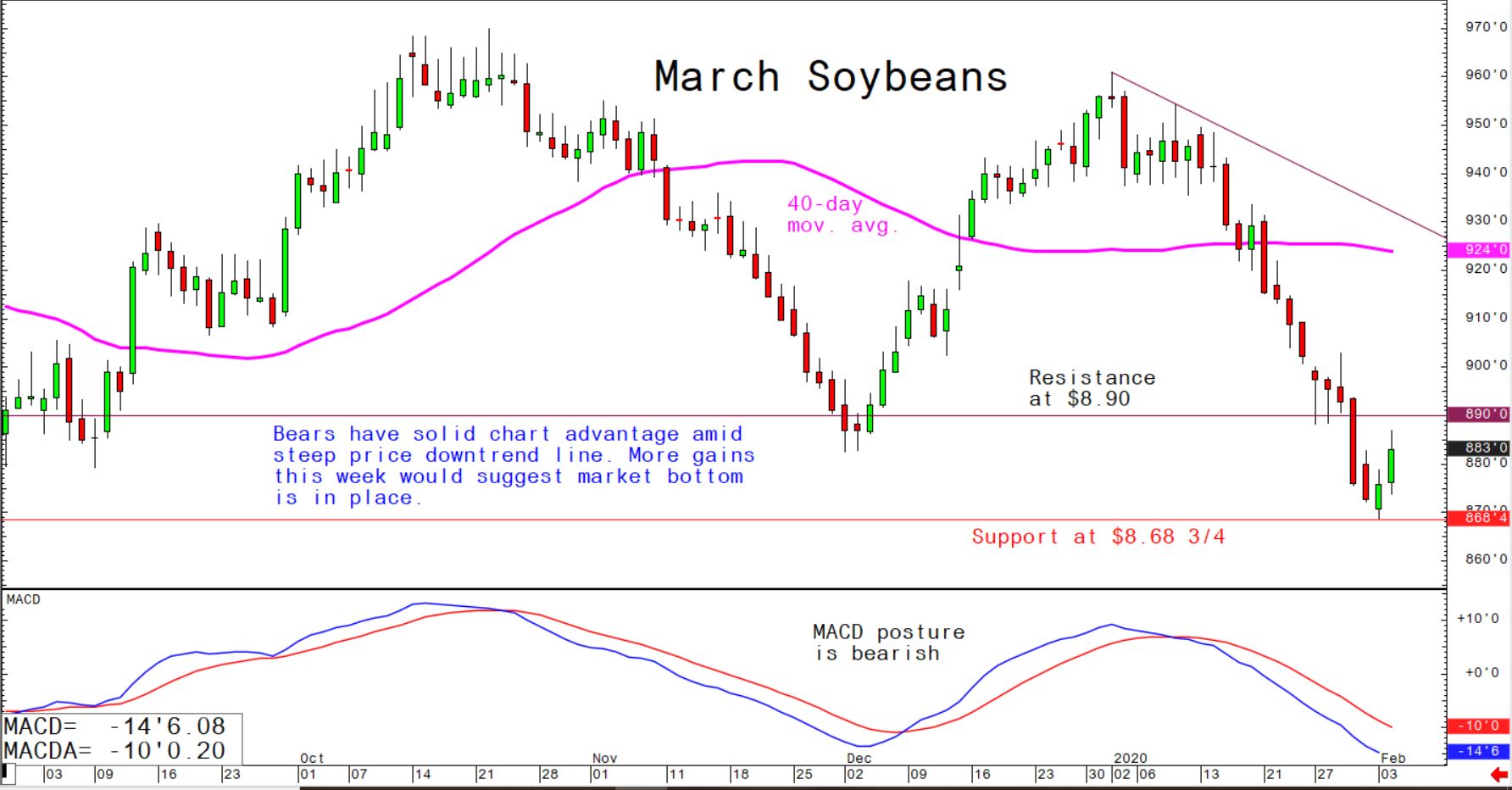

© Jim Wyckoff

Importantly, China’s central bank this week has injected large amounts of money into its financial system to help out domestic businesses that are being hurt by the coronavirus outbreak. This move has helped to assuage Asian investors and grain traders. This has given grain traders some confidence that China will step up its purchases of US ag products. As one market analyst quipped,” The Chinese people still have to eat.”

© Jim Wyckoff

© Jim Wyckoff

Grain traders are still looking at the crude oil market, which hit a 13-month low overnight and has dropped over $13.00 a barrel from the January high. Nymex crude dipped below $50.00 a barrel this week. If crude oil prices keep declining, grain markets will also struggle. However, there are chart clues that the oil market has bottomed out, or is very close to doing so.