Daily US grain report: markets see support from lessening coronavirus worries

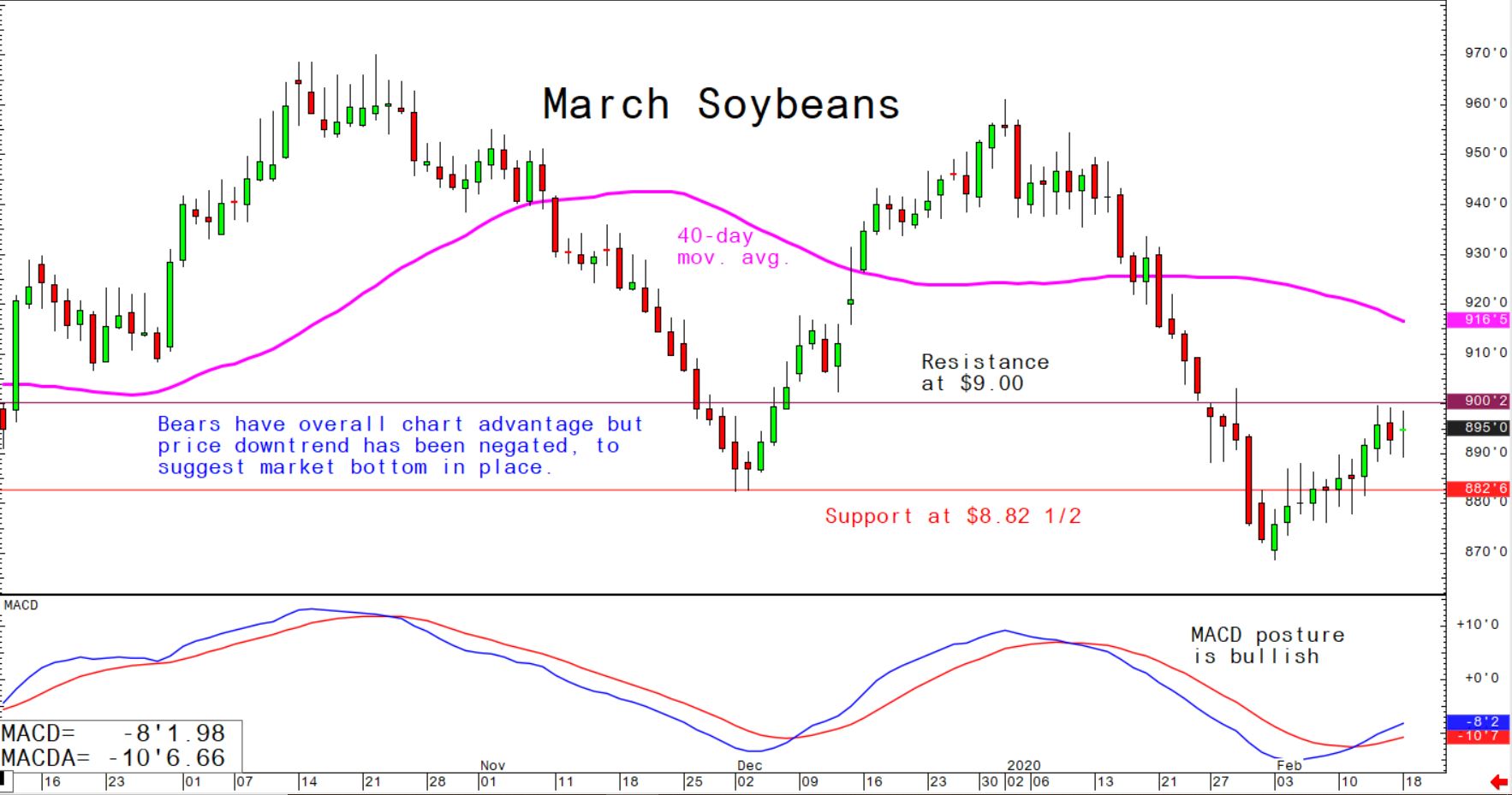

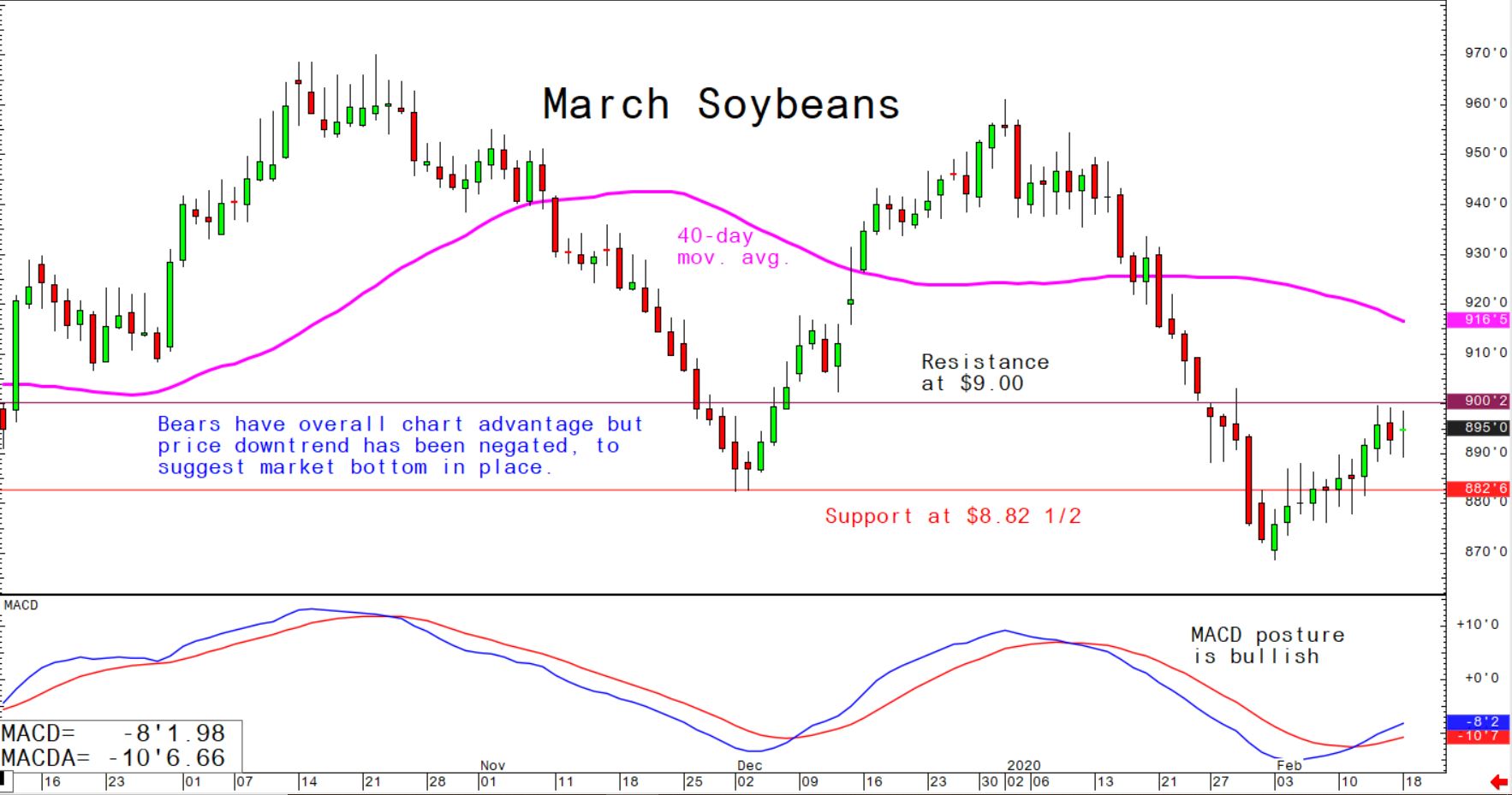

US grain futures are higher in early US pre-market trading Tuesday. Corn is 3 1/2 cents higher, soybeans around 4 cents higher and wheat is around 10 cents up.The rate of daily spread of the Coronavirus illness in China has slowed to the lowest since January, reports said. That has at least temporarily assuaged the grain markets early this week. Over 1,800 people have died in China from the illness. The global supply chain has been significantly impacted, as seen by the Apple sales-miss news. Reports also said over 730 million in China are still effectively quarantined, suggesting supply-chain disruptions will continue as the world’s second-largest economy is presently crippled.

Grain traders are still looking for stepped-up China purchases of US agricultural products in the near term.

Wheat prices are seeing support from reports the Australian wheat crop is being pegged at the lowest production in many years.

Labor unrest in Brazil is also threatening to reduce soybean shipments from that country.

US grain futures traders will closely examine the monthly NOPA crush report due for released today, along with the weekly USDA export inspections report.

The latest CFTC commitments of traders report from last Friday shows the big speculative funds short 72,084 corn futures contracts, short 92,172 soybean futures contracts, and long 45,940 wheat futures contracts.

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff