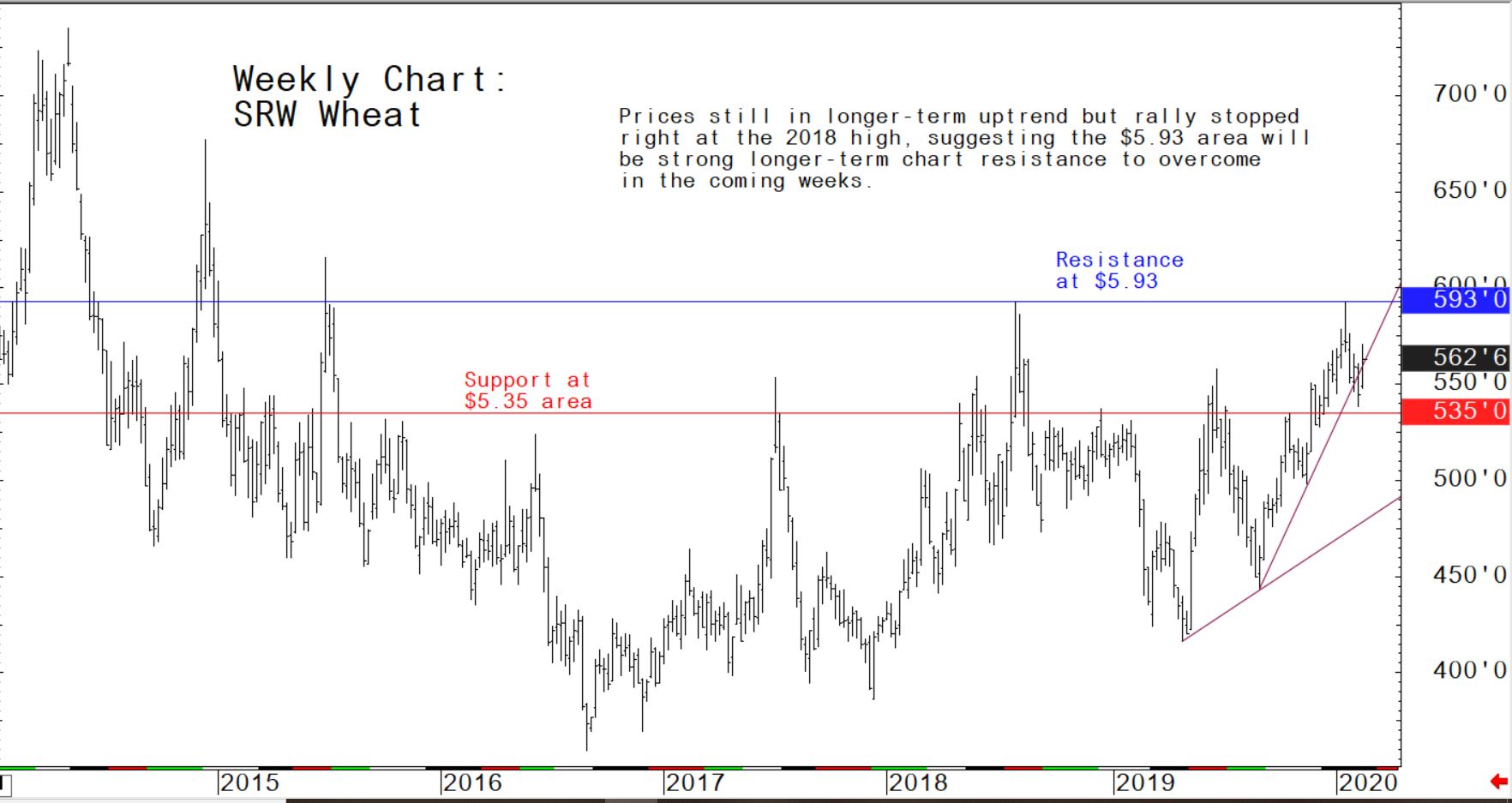

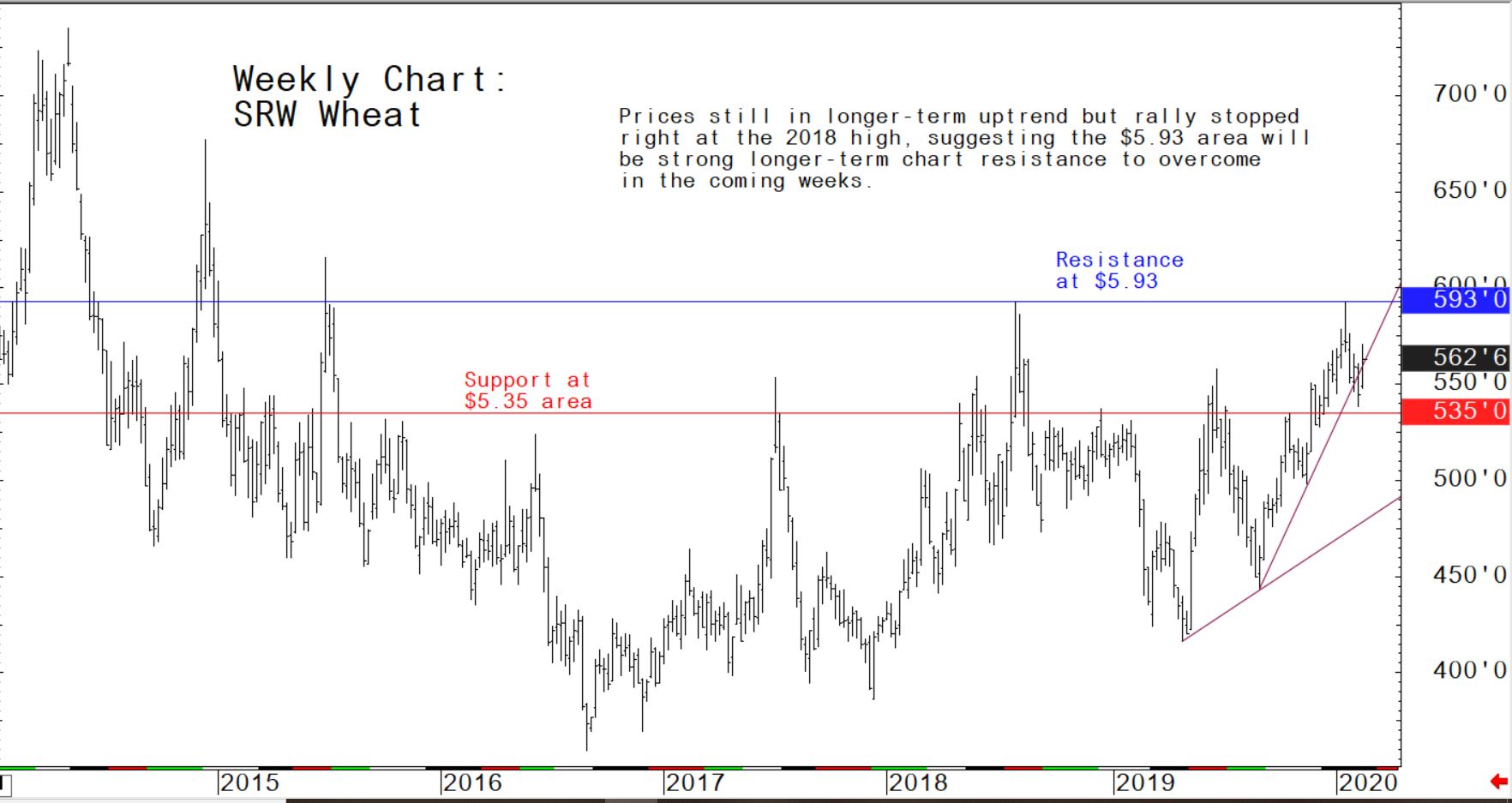

Wheat market bulls come back to life in week eight

While corn and soybean markets the past week have been subdued by the coronavirus outbreak, wheat futures pushed solidly higher this week on notions of a smaller Australian wheat crop and reports of adverse weather in other major wheat regions.Wheat futures may challenge their January highs on the aforementioned concerns. However, the next likely chance for significant rallies in the corn and soybean markets will come several weeks from now, when the US corn and soybean planting seasons come about. There are some long-term weather forecasts calling for a cool and wet spring in the US midsection, which would be a bullish development for corn and soybeans if such actually develops. The US National Weather Service this week warned farmers in some Midwest areas that springtime flooding is likely, due to saturated soils and heavy snowpack heading into spring thawing. As has been the case for several weeks, US grain traders will look to the weekly USDA export sales reports for clues on better export demand for US grains, especially from China.

The next week’s likely high-low price trading ranges

May soybean meal futures: $294.50 to $303.00, and with an upside bias.

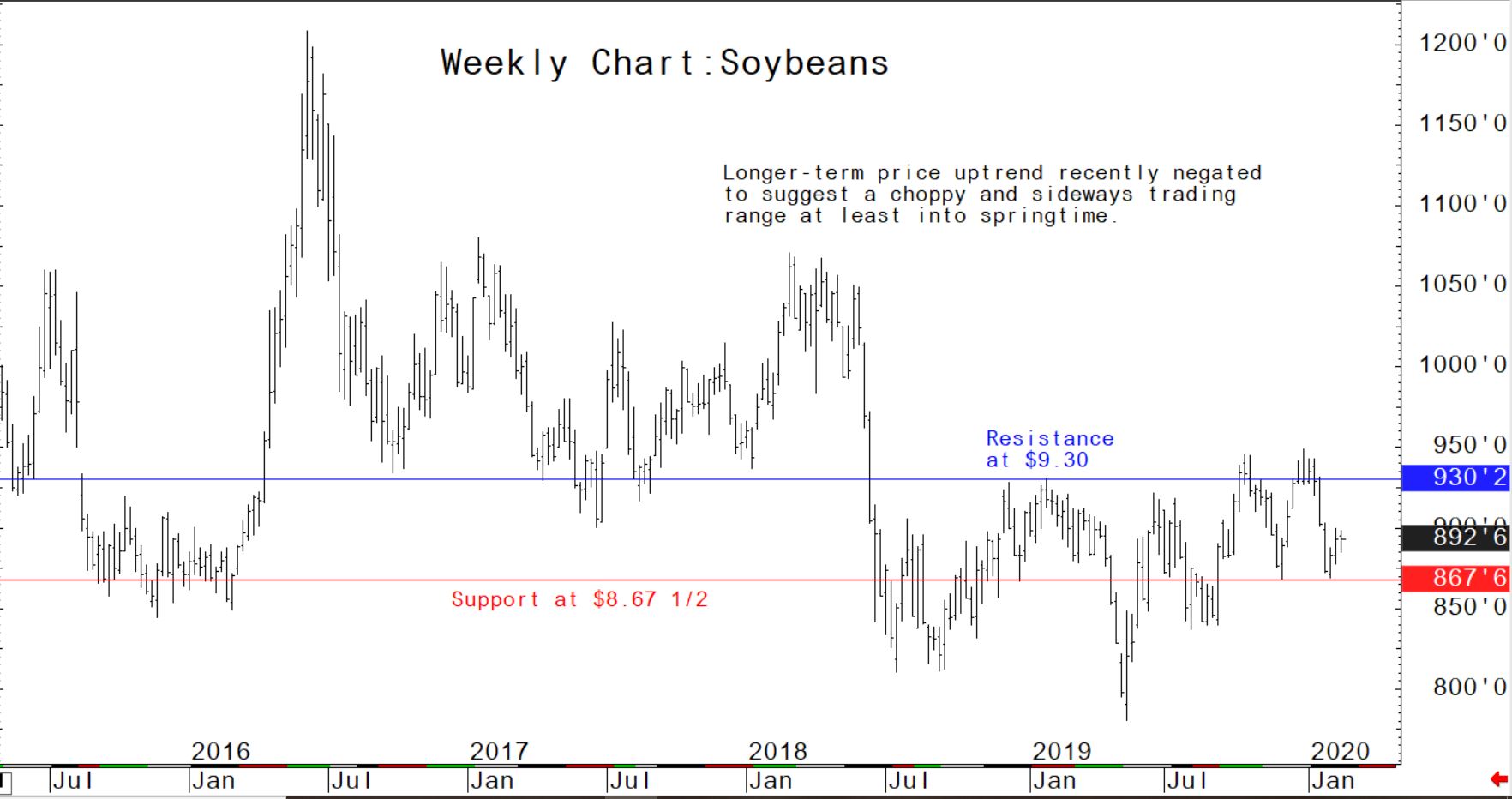

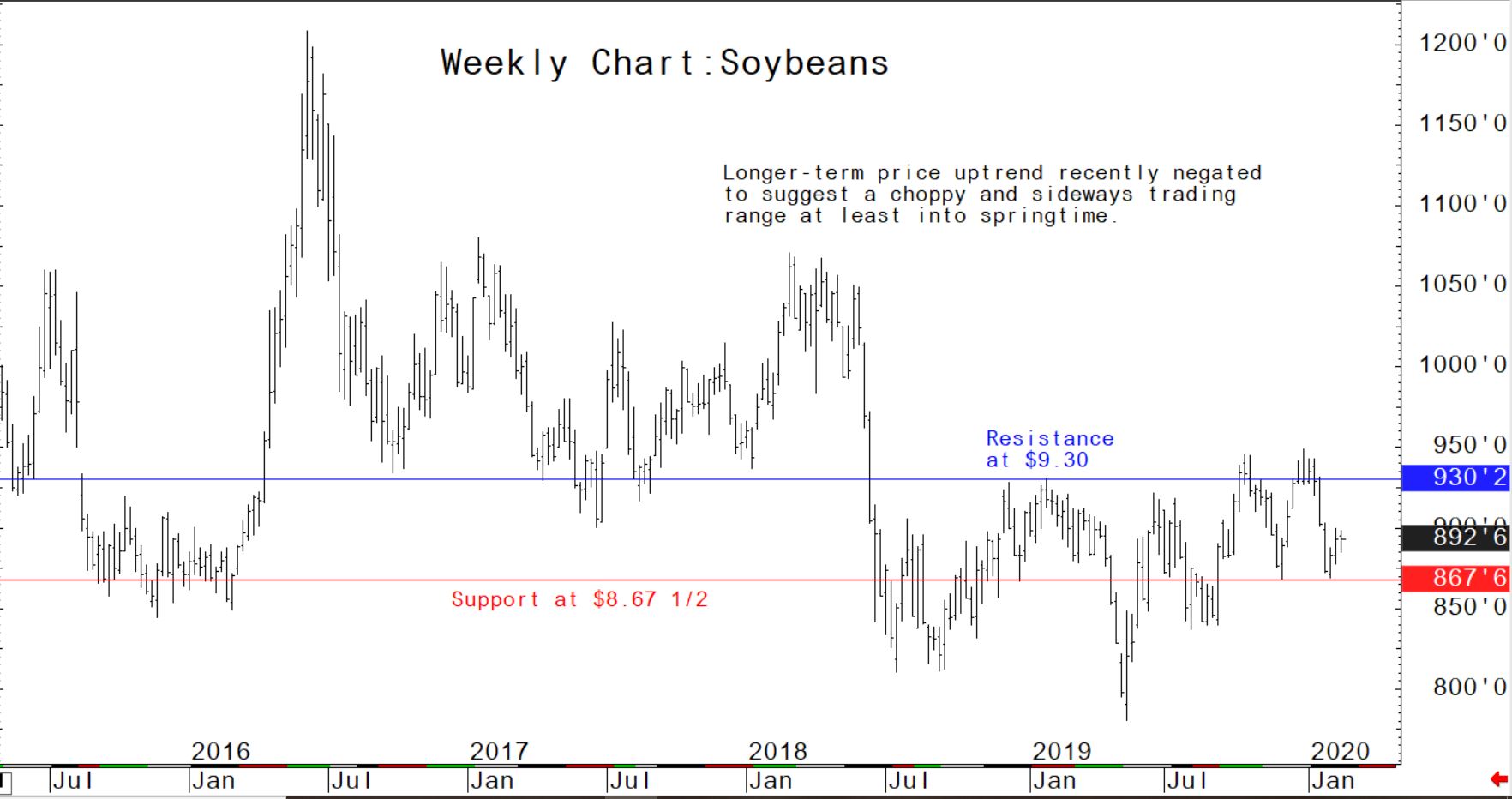

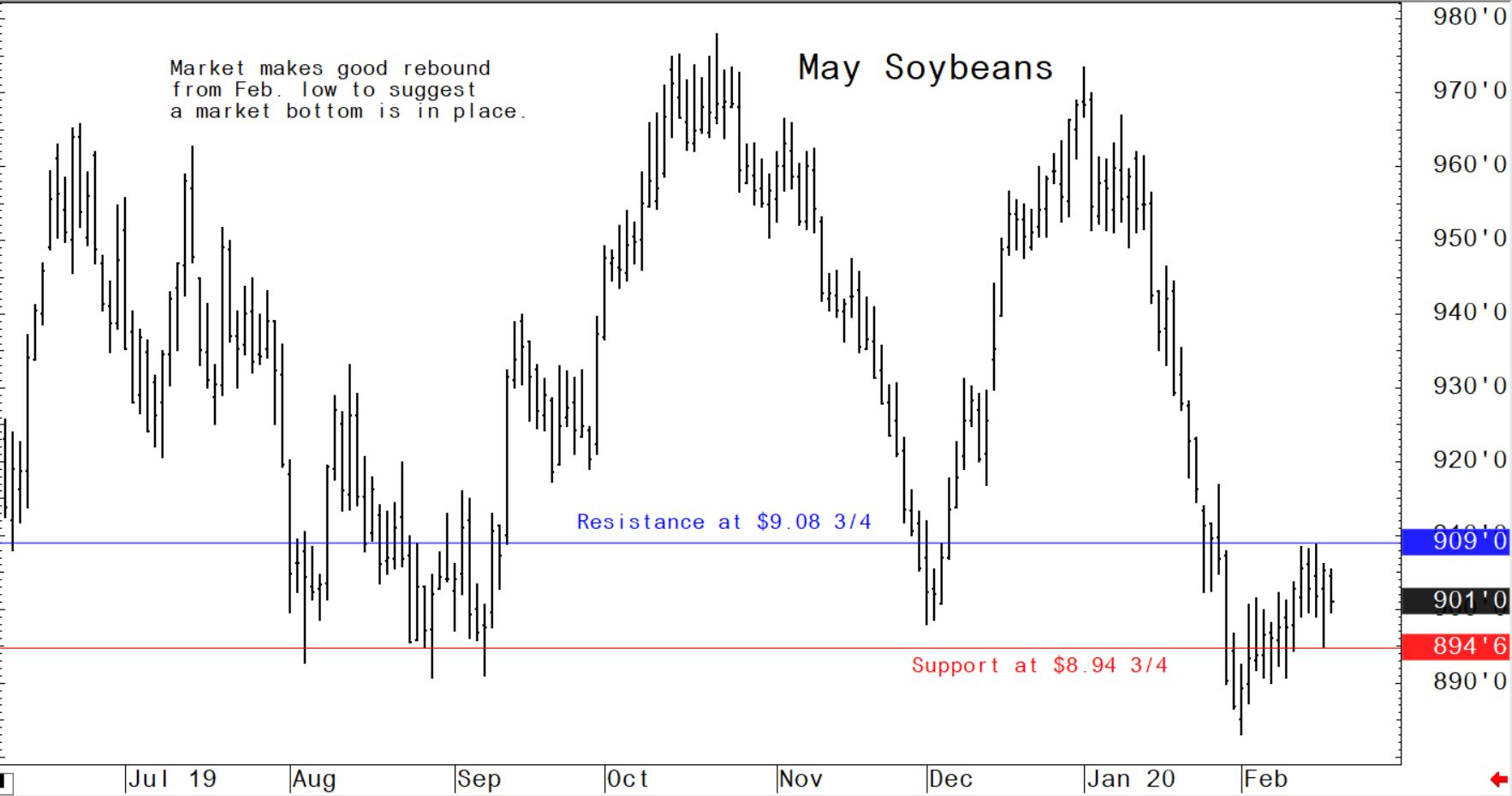

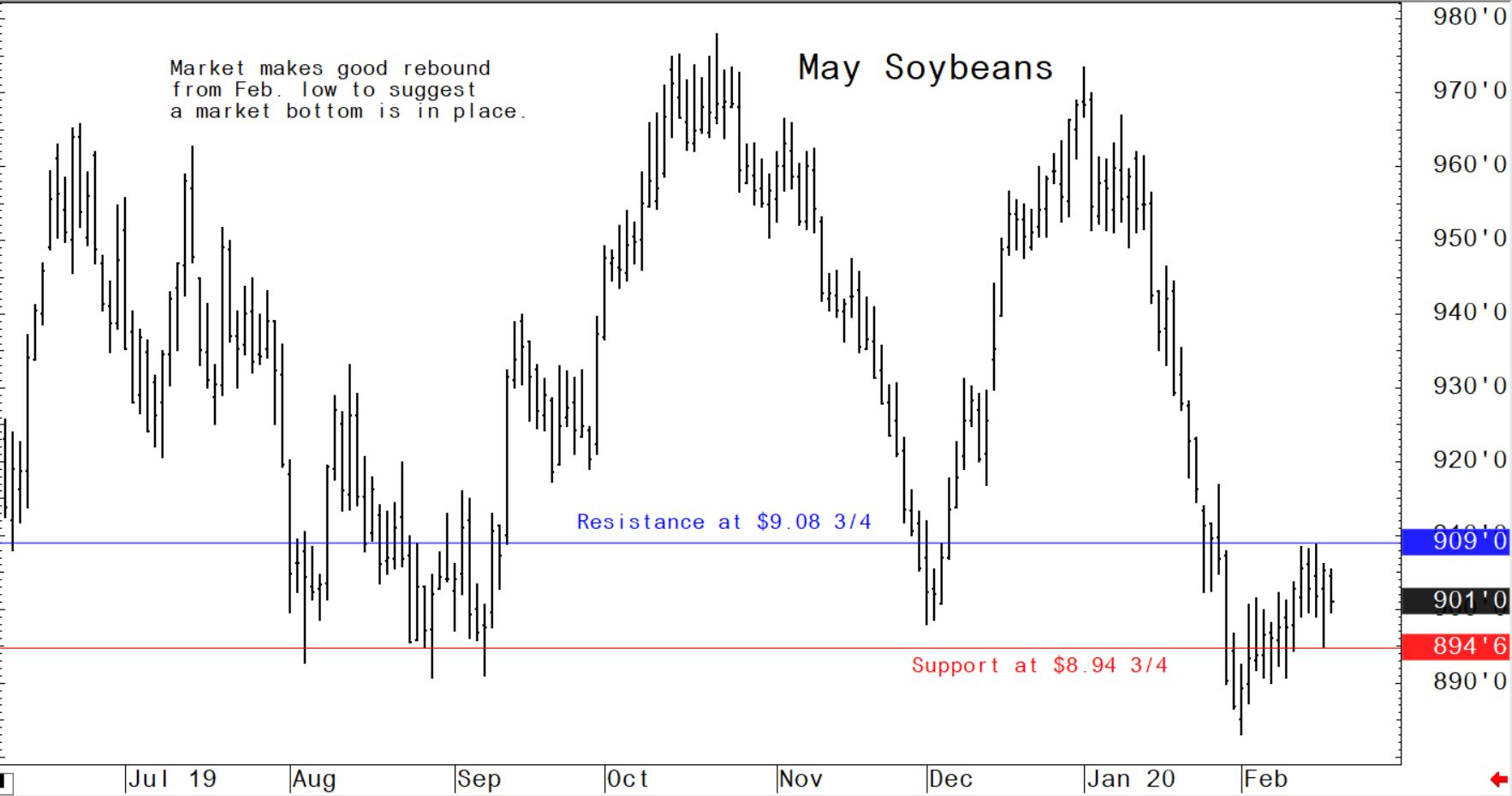

May soybean futures: $8.94 3/4 to $9.17 and with an upside bias.

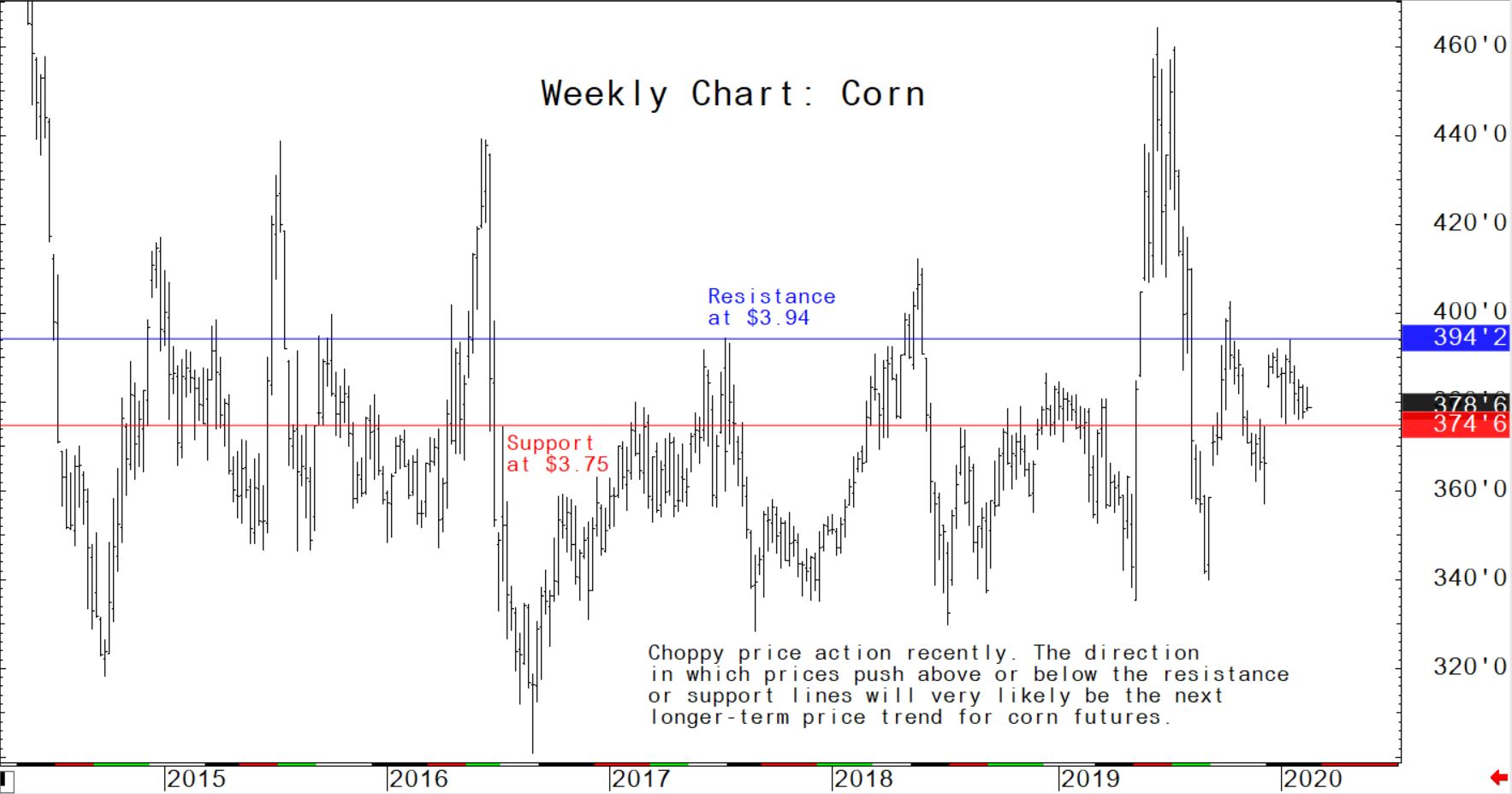

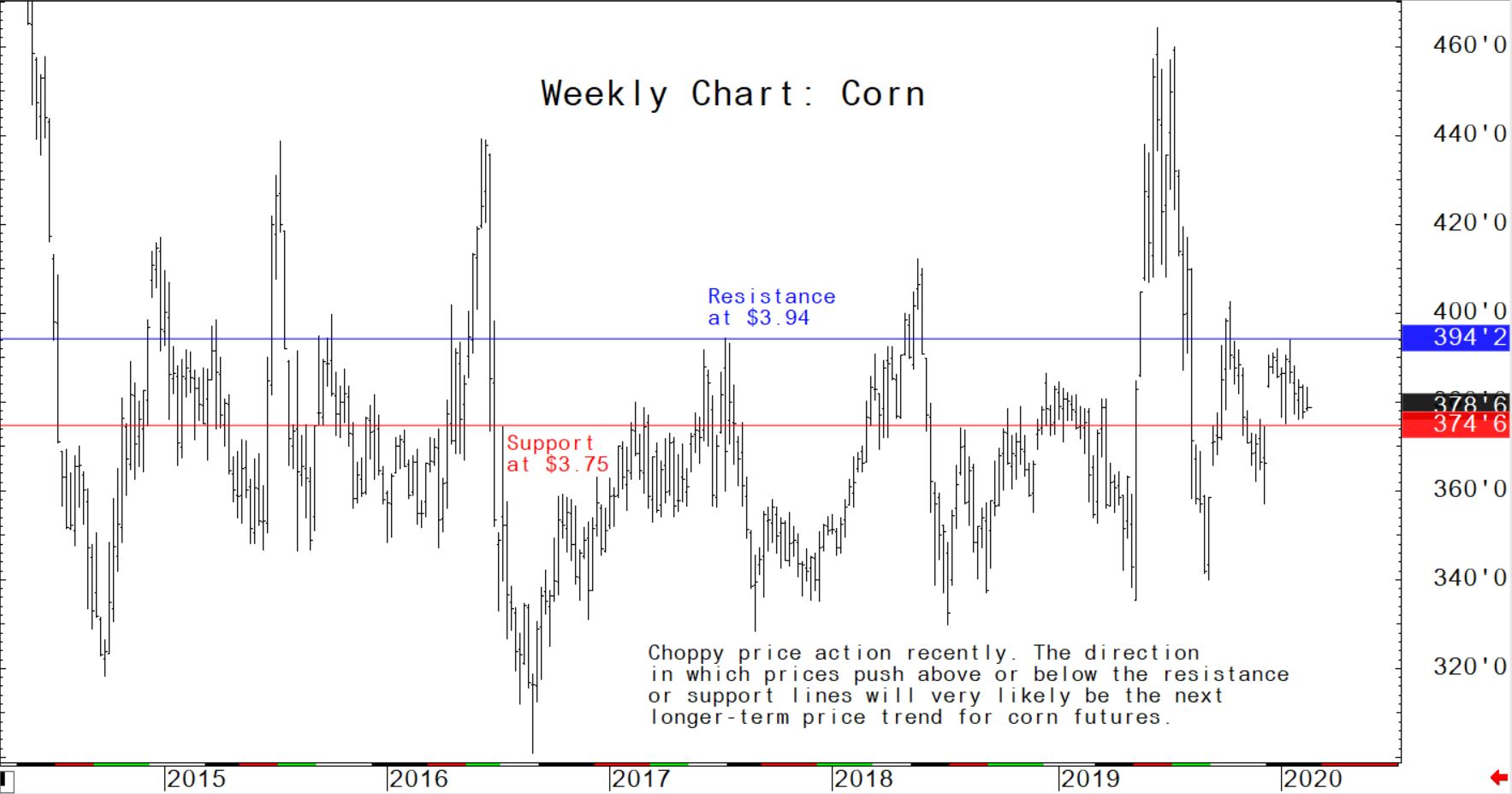

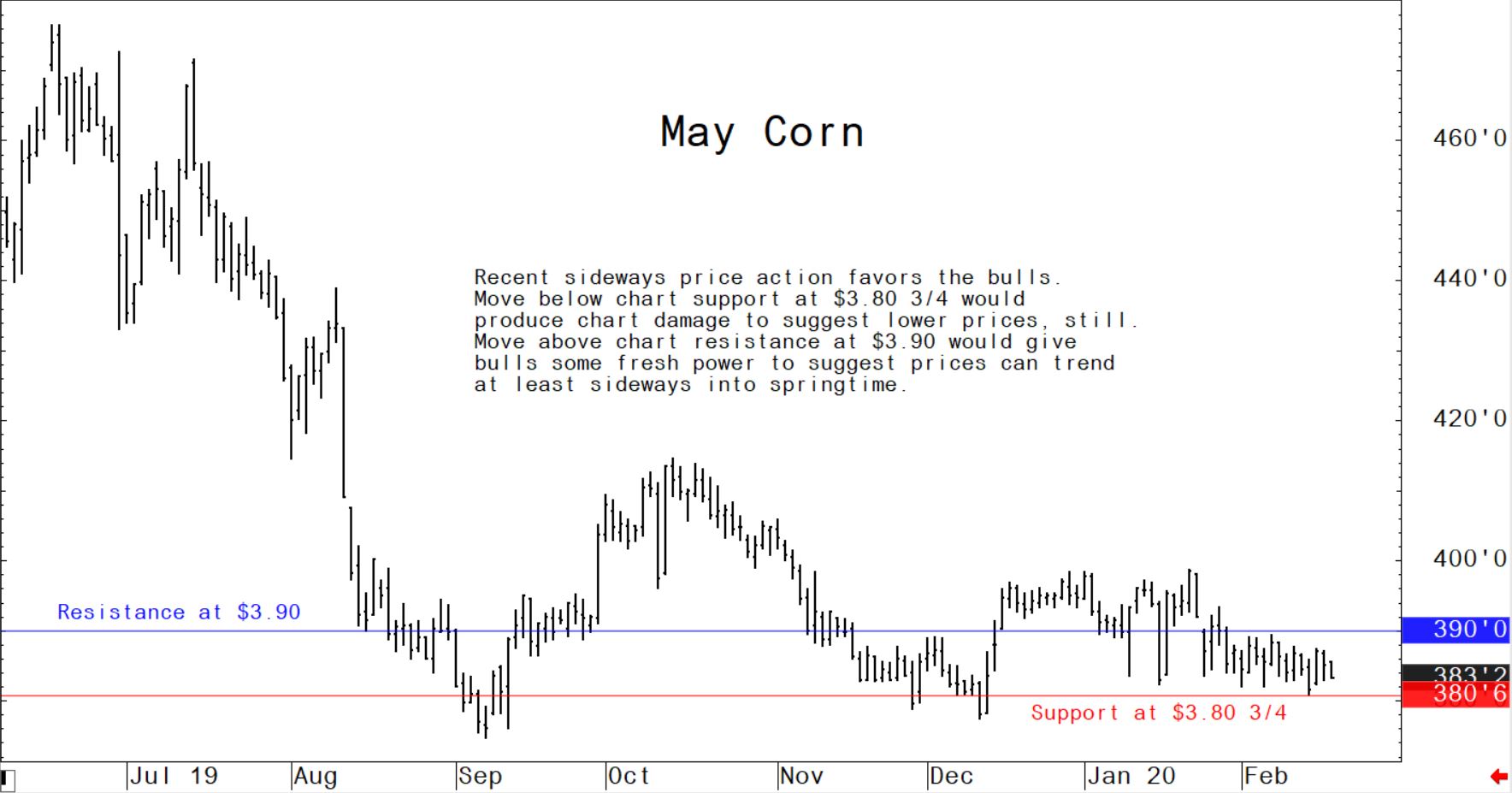

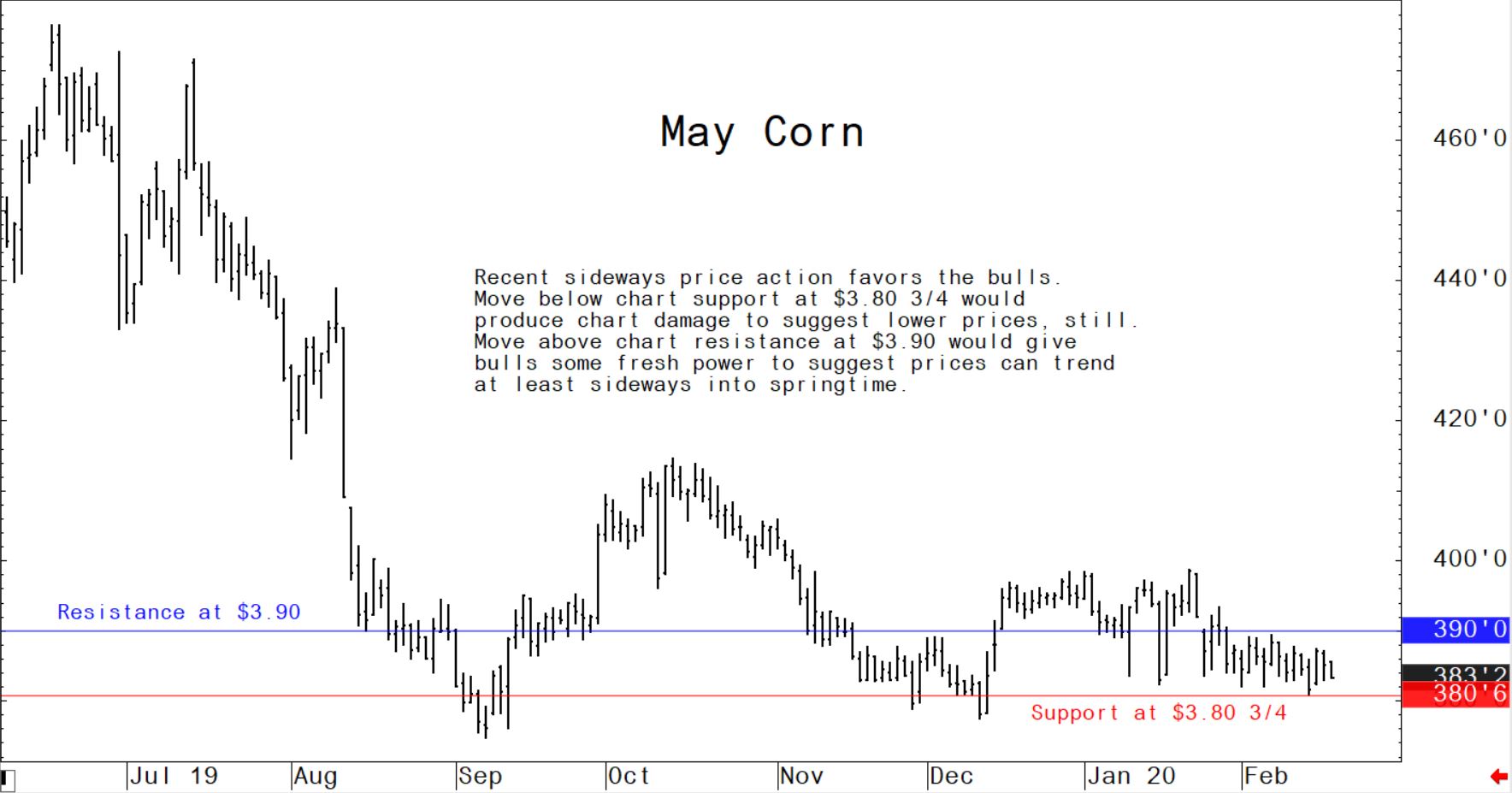

May corn futures: $3.80 to $3.90, and a sideways bias.

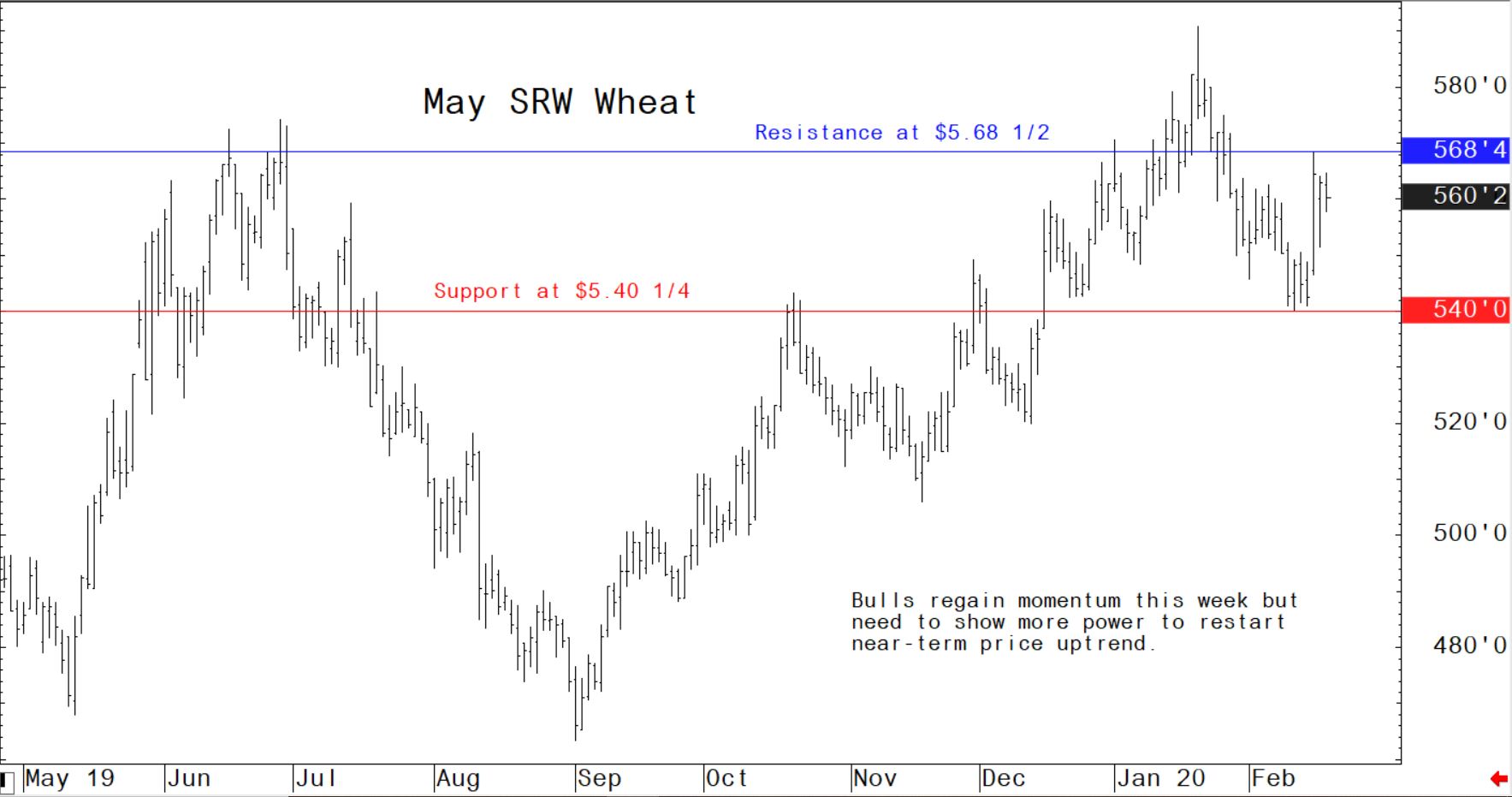

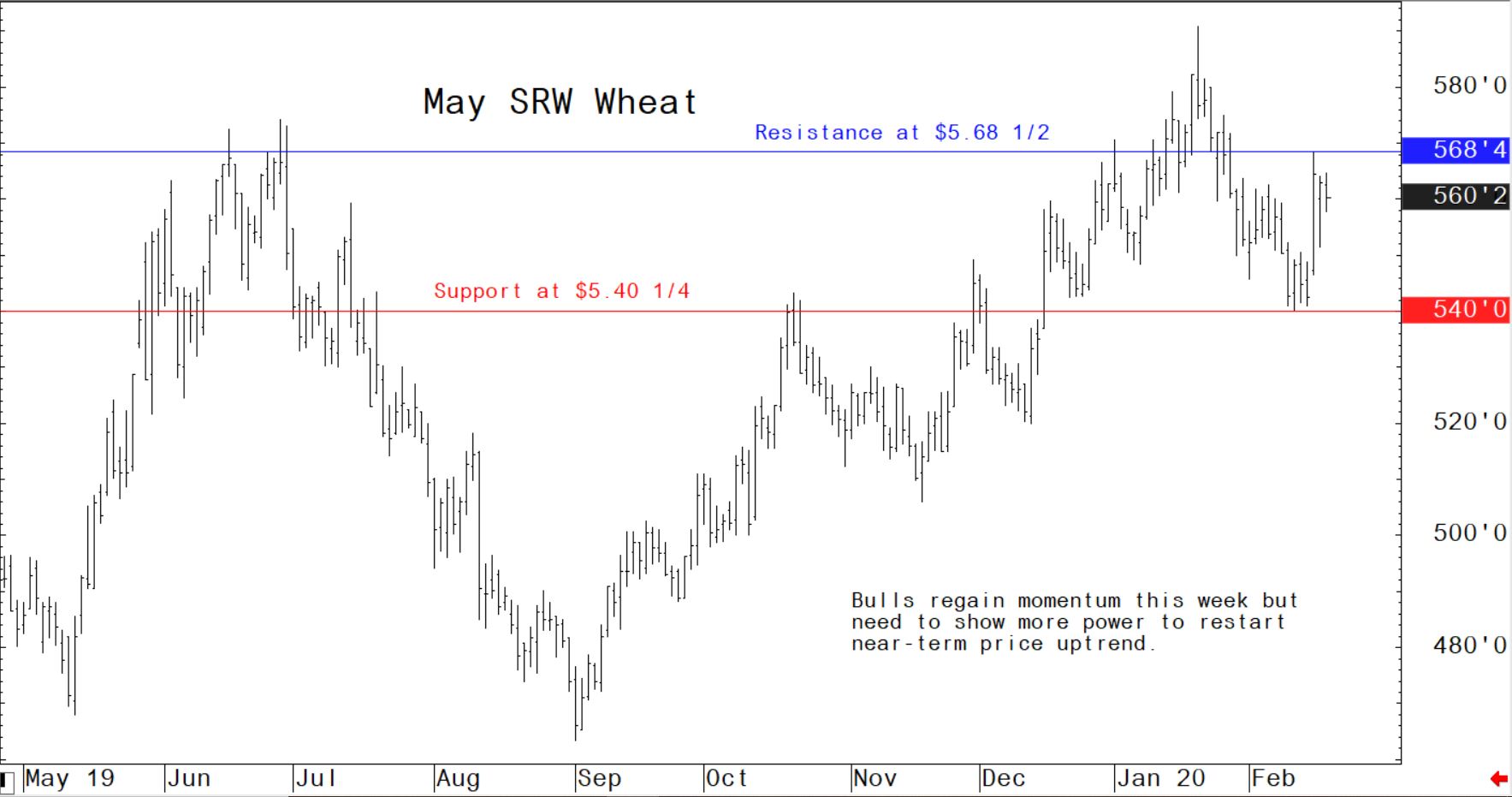

May soft red winter wheat futures: $5.45 to $5.75, and with an upside bias.

Latest US Department of Agriculture (USDA) reports

USDA Ag Outlook Forum: better US ag exports in 2020. Coronavirus impacts economic growth prospects

The highly anticipated supply and demand projections released Thursday morning by the US Department of Agriculture (USDA) show US agricultural exports in fiscal year (FY) 2020 are projected at $139.5 billion, up $500 million from the USDA’s November forecast, as higher soybean, wheat, and poultry export forecasts more than offset reductions in corn and soybean meal.

Soybean and wheat exports are projected up $400 million each on higher volumes. Corn exports are forecast down $500 million due to strong competition from Brazil, Argentina, and Ukraine. Overall grain and feed exports are forecast at $29.7 billion, $200 million higher than the November forecast. Soybean meal exports are projected $300 million lower, while total oilseed and product exports are unchanged.

China

US exports for China are raised $3.0 billion from the November forecast to $14.0 billion, largely based partly on higher projected volumes for soybeans. The current outlook for exports to China is tempered by significant uncertainties surrounding the Covid-19 outbreak, which may affect the timing of China’s purchases under the Phase One Agreement during the calendar year.

From a global regional perspective, USDA forecast US exports to China rising $3.0 billion from November to $14.0 billion, in part based on higher projected volumes for soybeans. The current outlook for exports to China is tempered by significant uncertainties surrounding the Covid-19 outbreak, which may affect the timing of China’s purchases under the Phase One Agreement during the calendar year.

Hong Kong

Forecast exports to Hong Kong are reduced by $600 million to $3.0 billion due to lower-than-expected shipments of consumer-oriented products, especially tree nuts, beef, and prepared food. Exports to Japan are lowered $500 million to $12.0 billion from the previous forecast on reduced prospects for corn. October-December 2019 U.S. corn sales to Japan lagged well behind the previous year, while Brazil ramped up its corn exports to Japan. Similarly, forecast exports for South Korea and Taiwan are down $300 million and $100 million, respectively, as U.S. corn market share decline due to higher Brazilian and Argentine supplies.

Thailand

Forecast exports to Thailand are down $100 million to $1.8 billion based on the shipment pace of soybeans and distiller dried grains in the first quarter.

India

The forecast for India is raised $300 million to $1.8 billion on strong tree nut sales. Exports to South Asia overall are forecast $400 million higher, with the remaining $100 million due to strong soybean and cotton sales in Pakistan.

EU

US Exports to the EU are forecast at $12.3 billion, which is $1.0 billion lower than the November projection due to reduced demand for soybean, soybean meal, and feeds and fodders.

Russia

Exports to Russia are forecast down $100 million on lower demand for planting seeds. 10 Outlook for US Agricultural Trade, AES-111, February 20, 2020 USDA, Economic Research Service and Foreign Agricultural Service

Global

In its global economic outlook forecast, USDA said the per capita world gross domestic product (GDP) growth forecast is unchanged from November at 1.5 percent in 2019 and 2020. US per capita GDP growth is consistent with the prior forecast for 2019 at 1.6 percent but is lowered 0.2 percentage points (ppt) to 1.1 percent for 2020 due to diminished business prospects. A slowdown across the Eurozone, declining growth rates in China and the recent damaging global impact of the Covid-19 outbreak is expected to dampen growth prospects worldwide. Adverse impacts from the Covid-19 are expected mostly in the first quarter of this year.

USDA said recent impacts from the Covid-19 outbreak have caused the US dollar to appreciate significantly, as investors see the U.S. currency as a safe-haven during turbulent times. With inflation at or below the Fed’s target, it appears unlikely further interest rates cuts will occur in the short term. However, comments by Chairman Jerome Powell indicate they are ready to cut rates if the epidemic begins to slow markets.

The lowered uncertainty over the United States-Mexico- Canada Agreement (USMCA), the US-Japan Trade Agreement and the recent Phase One agreement with China, has been a positive factor for future growth prospects. However, the revised 2020 projection for US growth is likely to reduce the prospects for both Canada and Mexico. Mexico had a technical recession in 2019, as the economy started 2020 smaller than when 2019 began. Canada had a stronger than expected end to the year as per capita GDP increased 0.1 ppt from the prior forecast to 0.2 percent for 2019 and lowered 0.2 ppt to 0.2 percent in 2020.

Short term prospects for per capita GDP growth in Asia and Oceania are affected by the Covid-19 outbreak. Still, the impacts are projected to subside quickly if the epidemic does not overly expand. Per capita GDP growth for 2019 is expected to increase 0.1 ppt from the prior forecast to 3.5 percent and to remain at 3.3 percent in 2020. China is anticipated to have a brief interruption to consumption, investment, and business activity but not see significant impacts beyond the first quarter of 2020. GDP per capita growth prospects for China are unchanged for 2019 at 5.7 percent, while 2020 per capita GDP growth has been downgraded 0.2 ppt from the prior forecast to an annualised rate of 5.2 percent. Continued lowered demand domestically and the Covid-19 has reduced prospects for India by roughly 1.0 ppt from the prior forecast for both 2019 and 2020 to 3.9 and 4.6 percent, respectively.

Industrial output has continued to struggle in the European Union’s two largest economies, Germany and France. The German economy was flat across the fourth quarter of 2019, before the outbreak of the novel Covid-19. The outbreak is expected to further diminish growth prospects across the EU, as many supply chains are closely linked to Chinese manufacturers. Per capita GDP growth is anticipated at 1.0 percent in 2019 and 0.8 percent in 2020.

USDA lowers Russian wheat production

The USDA Foreign Agricultural Service from Moscow has forecast Russian wheat production will reach 73.5 million metric tons (MMT) in marketing year 2019/2020, a decrease from the previous forecast of 74 MMT based on industry and official data. Barley and corn production forecasts are unchanged at 19 MMT and 13 MMT, respectively. Year-on-year increases are expected for barley and corn due to significant expansion of harvested areas and expected increases in yields. Considering the preliminary statistical data provided by the Russian Government, as well as various domestic analytical experts, USDA estimates that total Russian grain exports in MY 2019/2020 may reach 45MMT, of which wheat exports will comprise of 33.5 MMT, down 500 TMT from the last forecast and a decrease of 1.7 MMT from the MY18/19 wheat export estimate.

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff