UK publishes new details of Basic Payment Scheme for farmers

The UK's Rural Payments Agency has published the new Basic Payment Scheme entitlement values and greening rates.The Basic Payment Scheme is the biggest of the rural grants and payments that provide help to the farming industry. Farmers apply once a year and payments begin to land in farmers’ bank accounts in December.

Earlier this year, the RPA extended deadlines by a month to allow farmers more time to submit their BPS applications, Countryside Stewardship revenue and Environmental Stewardship claims. Even following this extension, the RPA has made good progress processing and preparing payments so these are ready for when the payment window opens in December.

Despite the challenges presented this year by the coronavirus pandemic, the RPA succeeded in meeting their target of paying 95 percent of 2019 claims for Countryside and Environmental stewardship schemes by the end of June, bringing forward payment timescales by 6 months, as well as exceeding its performance target for processing last year’s BPS payments.

Farmers are also set to see a slight increase in their payments this year, following the decision not to make the usual Financial Discipline deduction from 2020 payments. This was previously used to support an EU crisis fund.

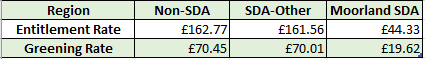

BPS payments for England are set in Euros and then converted into sterling. The BPS exchange rate for 2020 will be the same as 2019 at €1 = £0.89092.

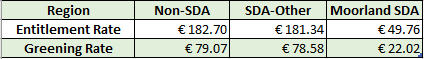

Rates in Euros

Rates in Sterling

Under BPS, farmers need to hold an entitlement for every hectare of eligible land they are claiming on. The size of farmers’ payments will depend on how many entitlements they use, supported by eligible land and the value of those entitlements.

The greening rates have been calculated by taking the number of entitlements farmers have used with eligible land to claim payment, and multiplying them by the greening value.

Farmers are reminded to remain vigilant against fraud, and should remember:

- Your bank, police or the RPA will never ask you to reveal your online password, PIN or bank account details or ask you to make a payment over the telephone.

- Never disclose personal information to someone you don’t know or open unknown or unexpected computer links or emails.

- If in doubt, call the organisation back, ideally on a different telephone, using a number you are familiar with or you know to be official. You can find this on the organisation’s website, correspondence or statement.

If you think you’ve been a victim of fraud, contact Action Fraud immediately on 0300 123 2040 or visit the Action Fraud website.