USDA Ag Outlook: A path forward for livestock, poultry & dairy after COVID-19

COVID-19 brought on unprecedented challenges for livestock and poultry sectors in early 2020. In the United States, these included reduced slaughter capacity and changes in consumer demand for specific cuts.

However, the second half of the year resulted in quicker recovery than anticipated. This recovery is set to continue in 2021, with slight growth expected for the livestock, poultry and dairy sectors, according to the USDA at their 97th Agricultural Economic Outlook Forum.

USDA Chief Economist Seth Meyer discussed what the US can expect as it recovers from the disruption of COVID-19.

Impact of feed costs on livestock and poultry prices

Livestock and poultry sectors should expect higher feed costs in 2021. However, with an expected demand pattern that’s more stable, livestock and poultry prices should average higher than what was seen in 2020.

The USDA forecasts a slight (1%) increase in red meat and poultry production over 2020. Beef and pork production are expected to increase due to higher slaughter rates and heavier carcass weights.

Pork production is forecast at a 1% increase in 2021 due to greater availability of hogs for slaughter and a return to typical slaughter rates. Although more hogs will be produced in 2021, average carcass weights will reflect a return to normal levels when compared to 2020, where disruptions caused atypical weight gains.

Broilers are forecast to slow down in 2021. Although production is expected to increase due to higher slaughter rates and heavier average bird weights, the combination of higher feed prices and weakening returns are expected to slow the rate of expansion.

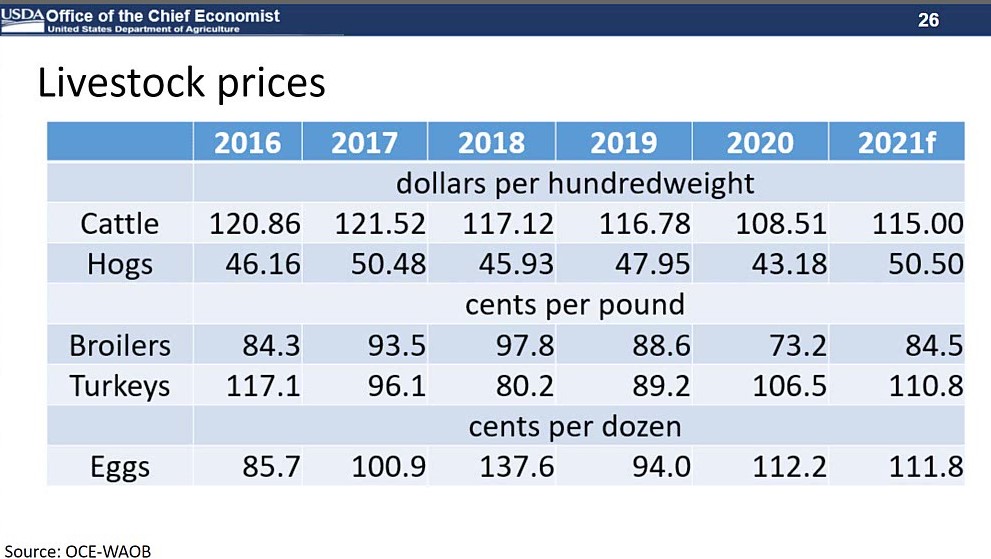

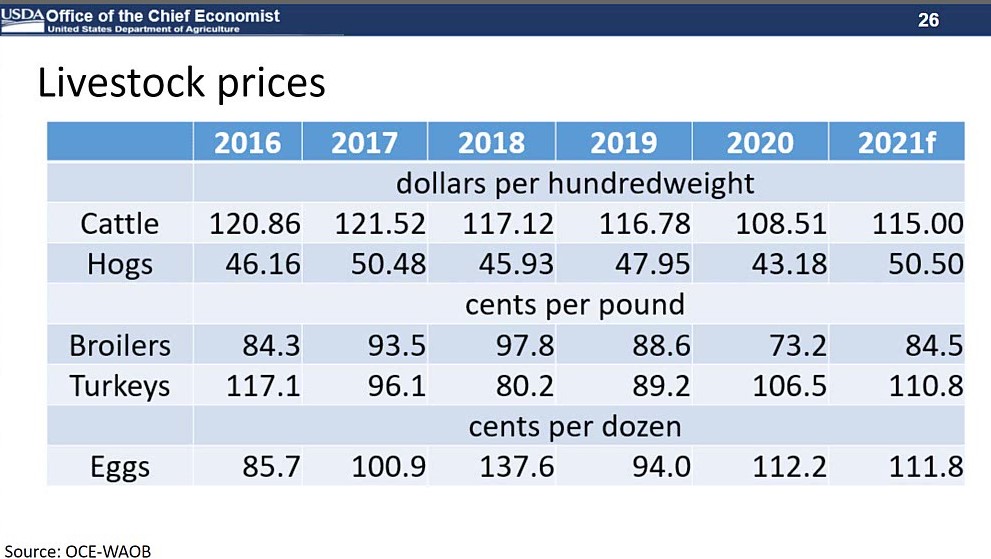

Despite production growth, USDA predicts higher overall livestock prices in 2021:

- Fed steer prices are forecast to average $115 per cwt, up 6% from 2020

- Lean hog prices are forecast to average $50.50 per cwt, up 17% from 2020

- Boiler price is forecast to average 84.5 cents per pound

This is primarily due to increased export demand.

Impact of COVID-19 on the dairy sector

The dairy sector faced high uncertainty in 2020 as COVID-19 led to changing consumer demands, including closures, shutdowns and limitations in restaurants and schools. In spite of this, milk production grew by more than 2% in 2020, supported by growing inventory, gains in milk per cow and an additional milking day.

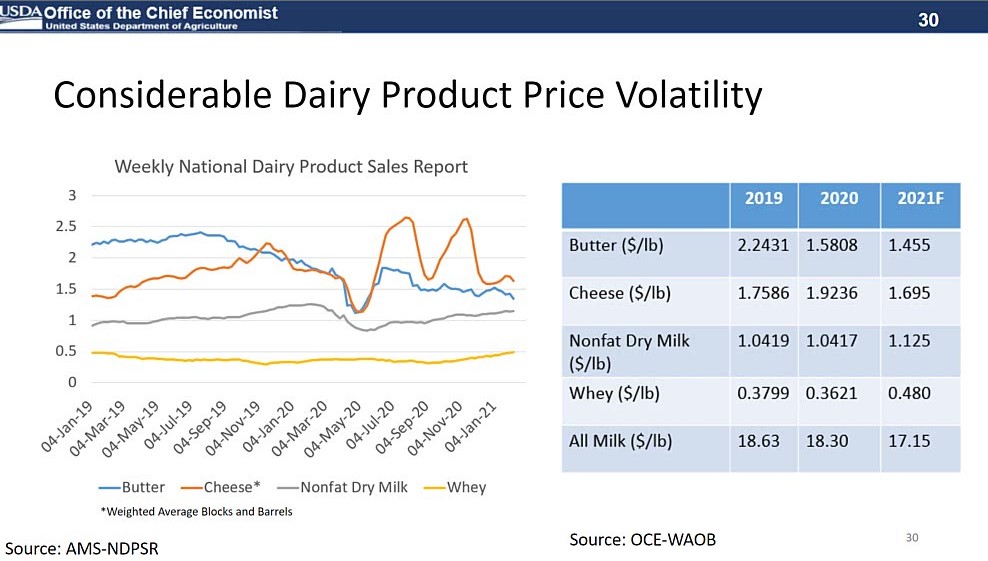

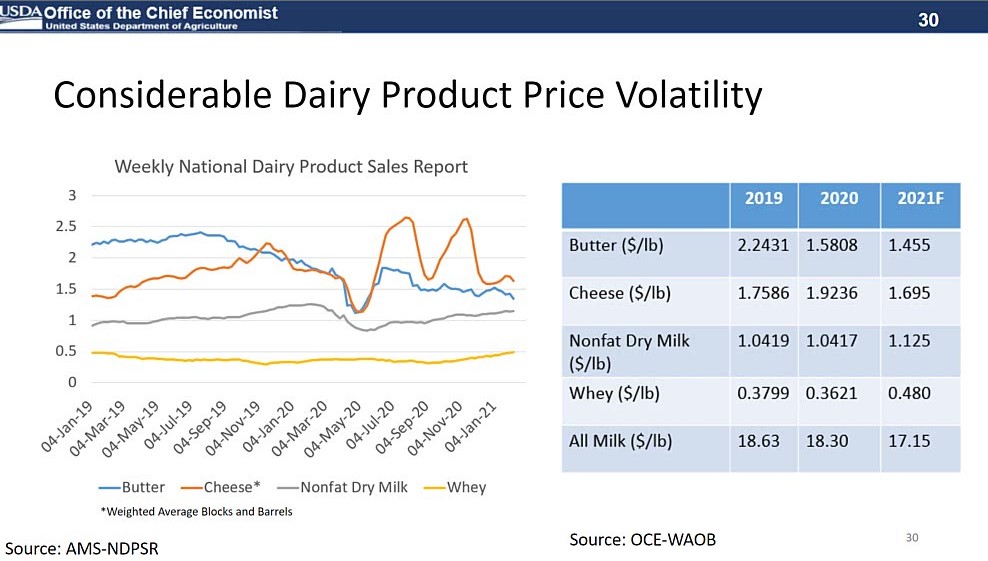

Dairy product pricing remained volatile during the year:

- Cheese prices increased

- Butter and whey prices decreased

- Nonfat dry milk prices remained roughly the same

The all milk price averaged $18.32 per cwt., $0.31 lower than 2019.

Looking to 2021, the dairy sector is expected to face higher feed prices, which will likely lead to a decline in the cow herd during the year. USDA’s Cattle Inventory report estimated that dairy cow numbers started the year 1% above 2020, but producers intended to keep 2% fewer heifers for addition to the breeding herd.

With continued growth in milk per cow, the USDA expects milk production in 2021 to increase just under 2%. While demand is likely to improve, large cheese and butter stocks mean that prices are likely to remain under pressure. However, nonfat dry milk and whey prices are expected to increase due to support from export markets.

The all milk price for 2021 is forecast at $17.15 per cwt, the lowest since 2018.

2021 farm income outlook

The impact of COVID-19 disruption varied widely by agricultural sector in 2020. Lockdowns shifted food consumption from outside the home to inside the home, telecommuting reduced ethanol demand, and school closures shuttered cafeterias nationwide.

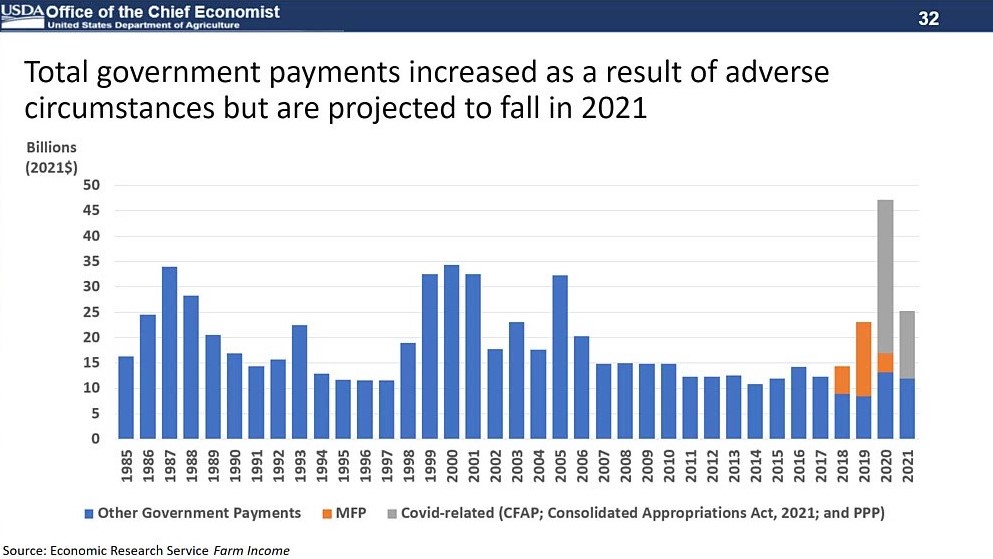

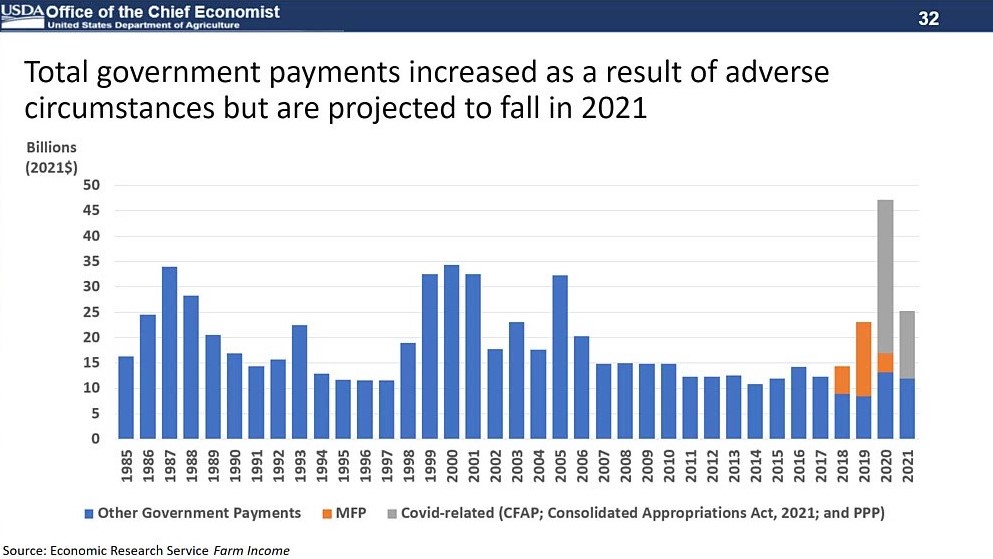

Livestock and dairy sectors faced particular challenges in their supply chains, adjusting to demand shifts from food service to retail grocery. This created sharp declines in commodities in the spring, but prices recovered as conditions stabilized. Programs from lawmakers and the USDA, like the Coronavirus Food Assistance Program (CFAP), provided more than $23 billion to compensate farmers for pandemic-related losses.

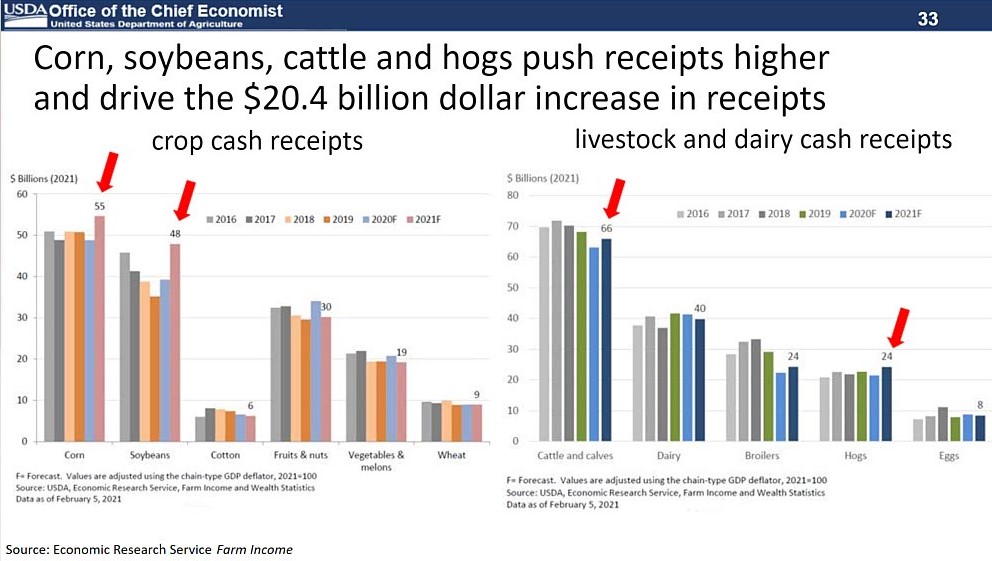

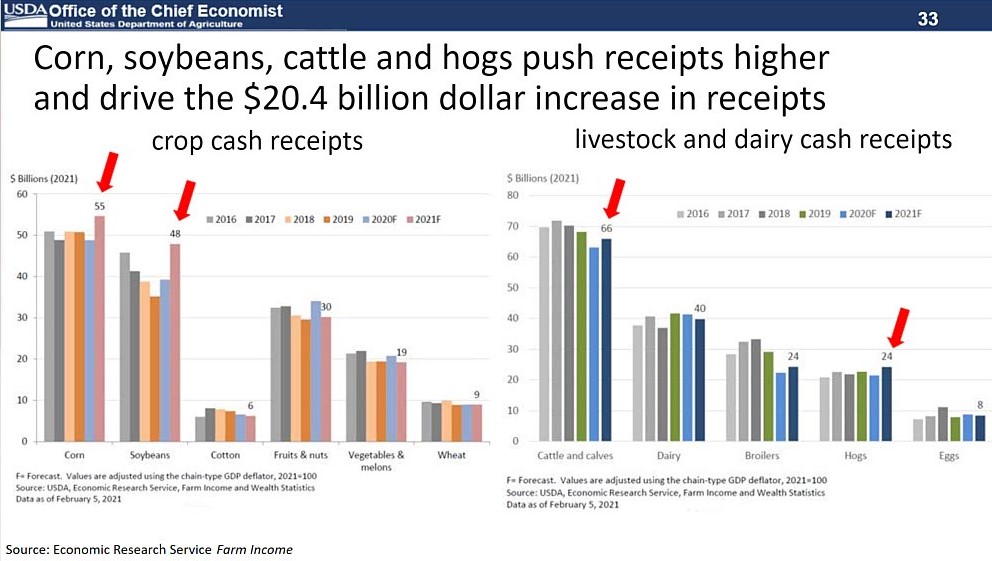

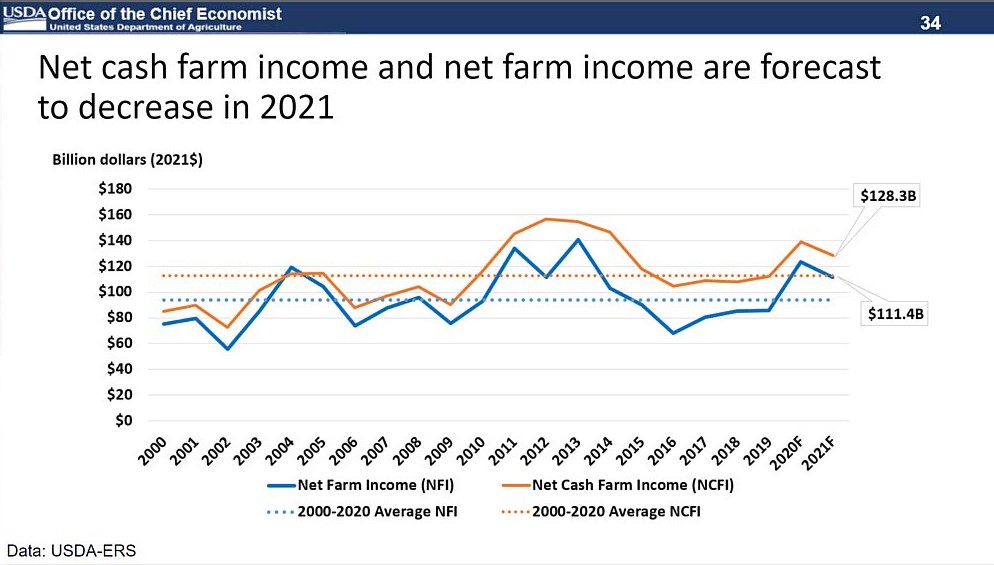

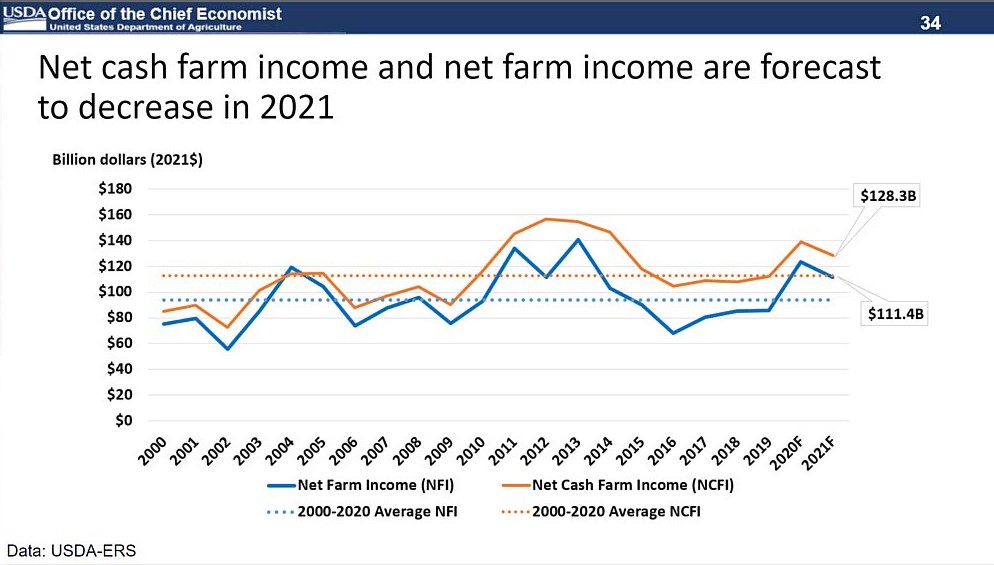

Given that context, the USDA forecasts a $20.4 billion increase in cash receipts, while net cash income is expected to fall to $128.3 billion in 2021, a 5.8% decrease. Net farm income, which includes the value of inventory changes, will decrease 8.1% to $111.4 billion in 2021. This is still 21% higher than the 2000-19 average of $92.1 billion.

Here’s how the cash receipts break down:

- Corn and soybean receipts are forecast to increase by $16.1 billion (19%)

- Animal and animal product receipts, specifically cattle, hogs and broilers, are forecast to increase by $8.6 billion (5.2%)

- Direct government farm payments are forecast to decrease by $21 billion (45.3%)

Production expenses are also forecast to increase $8.6 billion (2.5%) in nominal terms to $353.7 billion in 2021. These increases are primarily due to higher feed, fertilizer and labor costs. However, these production expenses should remain 18.9% less than the record high of $436.1 billion in 2014 (adjusted for inflation).

Short-term volatility, long-term favorability

While the extreme events in the past year have resulted in current market volatility, the long-term demand outlook for US agricultural commodities remains favorable. This is primarily due to global income growth and shifting dietary patterns toward an increasingly diverse set of crop and animal products.

USDA’s long-term projections indicate the following increases would be supported through 2030-31:

- Beef, pork and poultry trade (combined) increases by more than 17%

- Corn trade increases by 22.5%

- Soybean trade increases by 26.7%

The US is expected to capture a significant, but declining, share of this growth with US corn exports projected to grow to 70.5 million tons and soybean exports projected to grow to 59.2 million tons by 2030-31.

While large producers like China, Brazil, the United States and the European Union account for the largest shares of gains, developing countries and regions, including Mexico, India, Iran and Southeast Asia show the strongest growth in feed demand.

With increased demand for poultry products, as well as a projected increase in grain supply, the long-term future for the poultry sector looks bright, even though there will be challenges in the short term.