Bulgarian poultry production experiences volatile year in 2023 - GAIN

The year started strong, but fizzled outThe year 2023 started positively for Bulgarian poultry production with 9.5% higher poultry numbers from the year before, according to a recent US Department of Agriculture (USDA) Global Agricultural Information Network (GAIN) report.

This included a 21% increase in the number of broilers. This growth, however, melted throughout the year due to the challenging production situation and ended with broiler numbers down 11% at the end of the year. At the same time, duck numbers grew by 18%. As a result, at the end of 2023, total poultry numbers were 6.4% lower compared to the start of the year.

Chicken meat supply

Commercialisation and consolidation on Bulgarian farms has continued, and large farms accounted for 99% of Bulgaria’s total chicken numbers in 2023. Vertical integration continued to shape the industry. However, due to a challenging year in 2023, the number of broiler farms decreased by 13% and the decline was spread over all categories of farms. Unlike in the past, the largest farms with over 100,000 bird numbers were also negatively impacted, and their number declined by 21% from 2022. The bird numbers in all categories of farms also decreased except for small farms with up to 10,000 bird numbers.

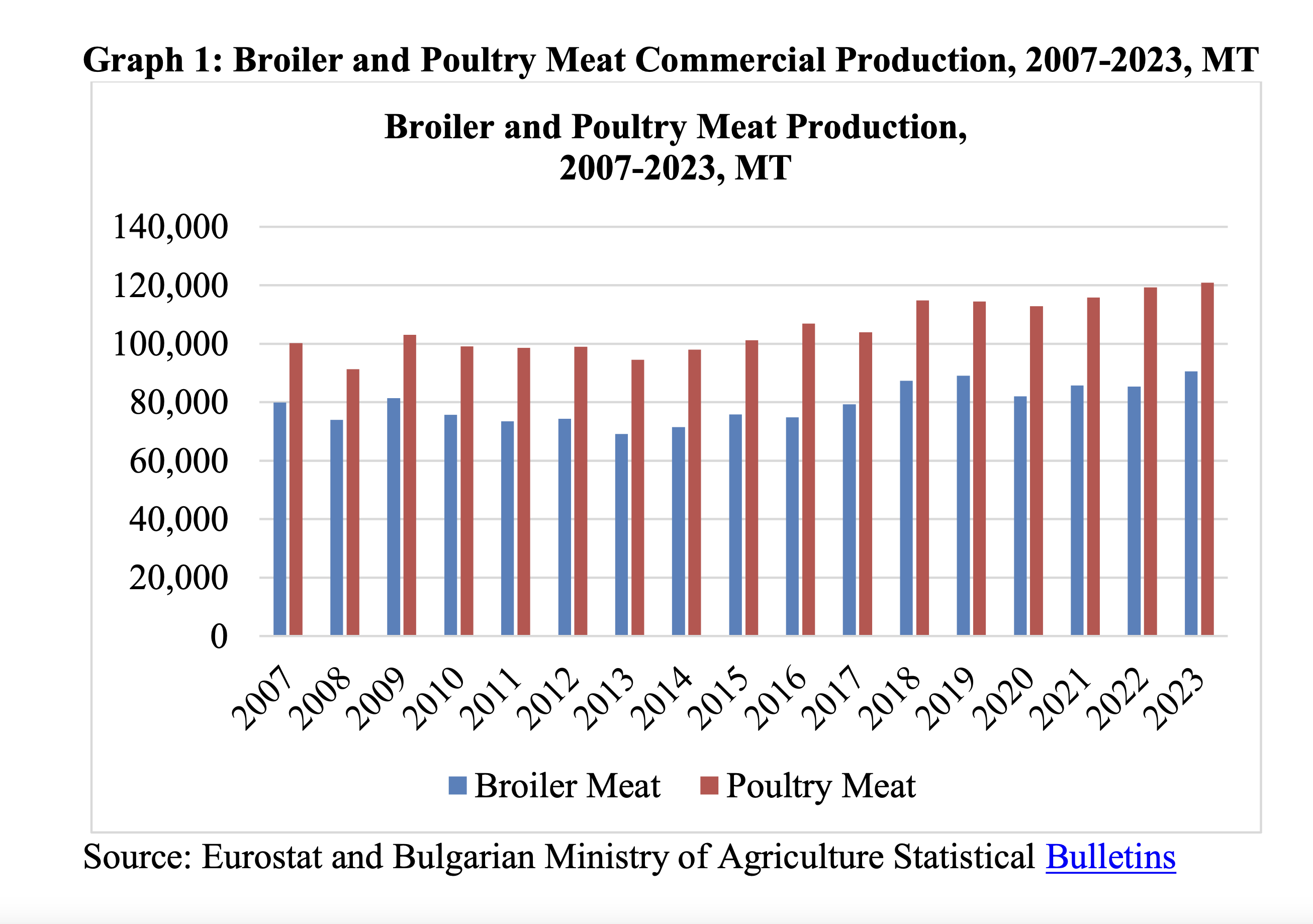

A total of 20 slaughterhouses operated in the country, of which 14 for broilers and eight specialized for ducks only. The latest Eurostat monthly data for commercial production at slaughterhouses in 2023 indicates stable broiler slaughter (+0.7 percent compared to 2022). The average carcass weight for broilers went down by 0.4% due to feeding optimisation and this resulted in flat broiler meat output, at the same level as in 2022 (90,500 MT).

Broiler prices were depressed at an average of €209.10/100 kg for 2023 with a 2.8% decline compared to 2022, while the EU had an average growth in broiler prices of 6.4%. Bulgaria was one of the very few EU member-states with a decline in broiler prices, reportedly, due to lower purchasing power because of inflation and consumer incomes lagging behind prices. This occurred at times of increasing production costs and had a negative impact on producers’ margins.

Poultry meat supply

Commercial poultry slaughter had 1.8% growth compared to 2022 (national data shows slightly higher poultry slaughter at slaughterhouses of 2.3%) while commercial poultry meat production had a small growth of 1.4 percent at 121,000 MT. Non-commercial slaughter still exists although its share is small. In 2023, less than one percent of poultry was slaughtered at farms, producing also about 1% of poultry meat. This meat usually does not enter commercial channels and is used for household consumption at farms and in rural areas.

Unlike in the past when non-commercial production has been gradually shrinking, in 2023 it had a small growth, mainly due to food inflation which encouraged more subsistence farming and home use. With non-commercial production included, the total domestic poultry meat supply was at 122,000 MT, 2.4% more than in 2022.