How poultry economics are evolving in the era of avian influenza - FCC

FCC addresses unique aspects three sub-sectorsThe poultry sector has done a remarkable job in addressing the challenges that have come from outbreaks of avian influenza in recent years, writes Graeme Crosbie of Farm Credit Canada (FCC). Although the virus is still present, the sector can hopefully limit the time and effort required to minimize disease spread and rather focus efforts solely on production to meet evolving demand for chicken, eggs, and turkey. We address the unique aspects of each of these three subsectors below.

Weaker broiler prices driven by lower feed costs

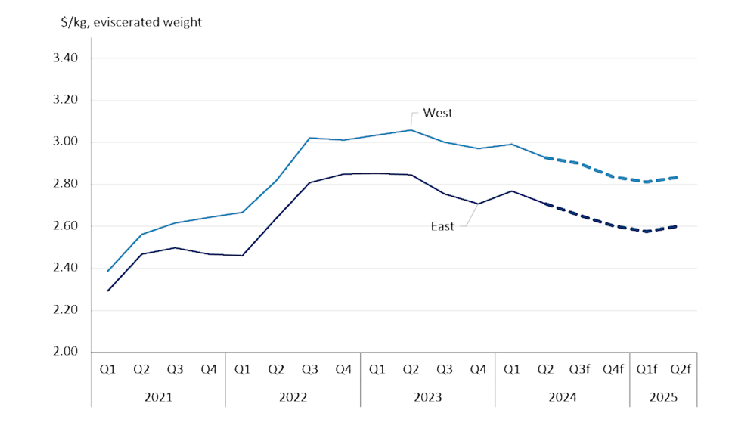

Broiler prices peaked in 2023 and have slowly retreated since. We are forecasting this decline to continue in the second half of 2024 before stabilizing in spring 2025 (Figure 1).

Figure 1: Broiler prices, observed and forecast

Sources: Statistics Canada, FCC Economics

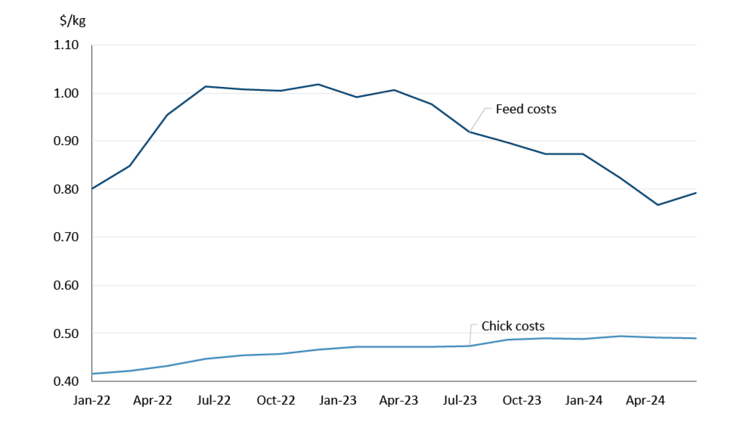

The decline in farm gate prices reflects easing feed costs. In Ontario, the feed cost component of the farm gate minimum live price rose to over $1.00/kg in the summer of 2022 but began falling in the second half of 2023 in line with lower grain and oilseed prices. Feed prices are down -22% relative to their peak in the A-180 quota period (December 2022 - February 2023). Chick costs, however, have been consistently increasing over the last two and a half years, in part a result of the supply shortage caused by the avian flu (Figure 2).

Figure 2: Ontario feed and chick costs by quota period

Source: Chicken Farmers of Ontario

Broiler production growth amid high inventories, imports

Considering the challenges brought about by avian flu, total broiler production in 2023 was surprisingly strong (3.3% growth). For 2024, the USDA is forecasting production growth to slow to 1.7% which, if realized, would be the lowest rate of growth since 2014 (excluding 2020 and the onset of the pandemic).

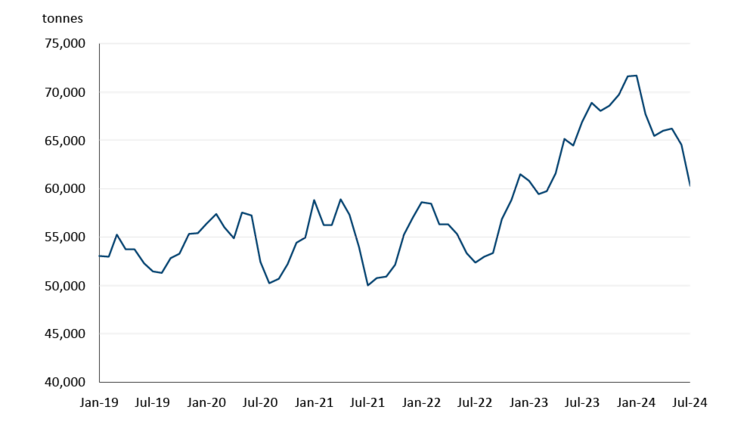

The Chicken Farmers of Ontario 2023 Annual Report noted that “record-high frozen inventories resulted in conservative [quota] allocations for the first four months of 2024.” With lower production at the start of the year, demand was met with chicken inventories which were drawn down -16% from January to July (Figure 3). Stocks of frozen chicken were historically high heading into 2024 and are usually drawn down in the spring and summer months, though notably last summer the opposite occurred and inventory levels surged. A return to more historical levels of frozen stocks bodes well for production in the latter half of the year and into 2025.

Figure 3: Stocks of frozen chicken down -16% since January

Source: Statistics Canada

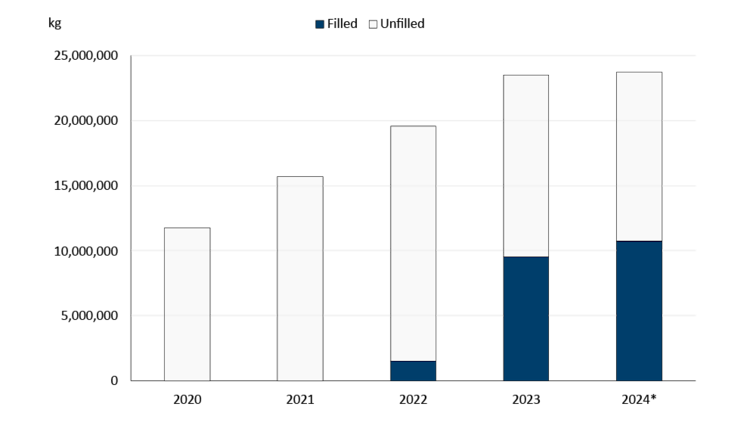

Uncertainty around import volumes matters a great deal. Various trade agreements allow for a certain volume of chicken to be imported tariff-free (i.e., the negotiated limit) though in reality it is not always the case that the imports occur. For example, in 2023 and under Comprehensive and Progressive Trans-Pacific Partnership (CPTPP), only 40% of the negotiated limit was actually imported. However, so far in 2024, imports have amounted to 45% of the negotiated limit with half of the year remaining (Figure 4). The surge in imports under CPTPP is largely the result of imports from Chile who joined the agreement in February 2023. Trade data shows Chile is now the third largest source of imported chicken behind the US and Brazil.

Figure 4: CPTPP imports of chicken and chicken products, 2020 to 2024

*2024 value is year-to-date through to and including June.

Source: Global Affairs Canada

Negotiated limits of chicken imports are now effectively capped. As you can see in Figure 4, the negotiated limit increased by 3.9 million kgs each year since the CPTPP’s implementation but in 2024 the increase was only 0.2 million kgs as the accelerated phase-in period concluded. Negotiated limit increases will be capped at 1% (approximately 0.2 million kgs) for each of the next 12 years. It should be noted that in 2023, chicken imports under CPTPP amounted to approximately 0.7% of total production for the year.

Overall demand for chicken is up so far in 2024 but below potential. Tighter household budgets have limited consumer purchases of chicken relative to preferences. June was the first month since 2022 that chicken price increases were lower than beef and pork prices; should this trend continue, it will be further supportive of demand.

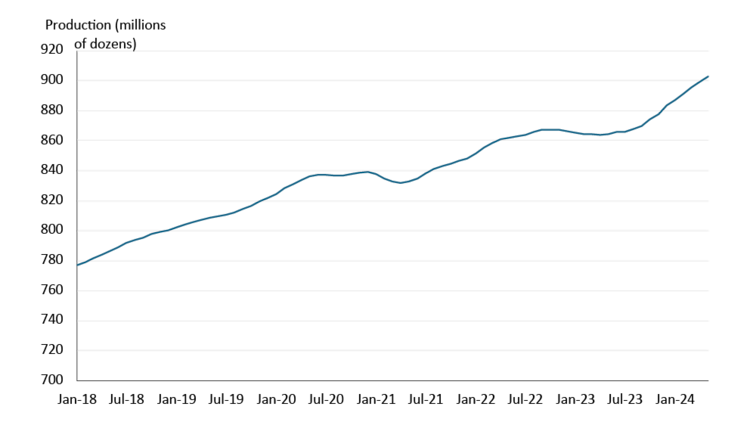

Egg production reaching new record level

The farm gate price of eggs increased in February and is projected to remain stable in the latter half of 2024. Egg production has rebounded from lower production levels in 2023 that corresponded with the avian flu outbreak: between June 2023 and May 2024, 903 million dozen eggs were produced, the biggest 12-month tally on record (Figure 5). Total production costs have edged slightly lower so far in 2024 but still remain historically high.

Figure 5: Egg production back on track, reaching record highs

Sum of previous 12 months production

Source: Statistics Canada, FCC Economics

The U.S. has taken full advantage of additional tariff-free access for eggs and egg products (e.g., shell eggs, egg powder, etc.) since the implementation of the Canada-United States-Mexico Agreement (CUSMA). The negotiated amount of egg and egg products allowed to enter the country has been filled each year; indeed, we are only halfway through 2024 and the negotiated limit of eggs and egg products has already been filled. Put another way, there will be no further tariff-free imports of egg and egg products from the U.S. and Mexico for the remainder of 2024.

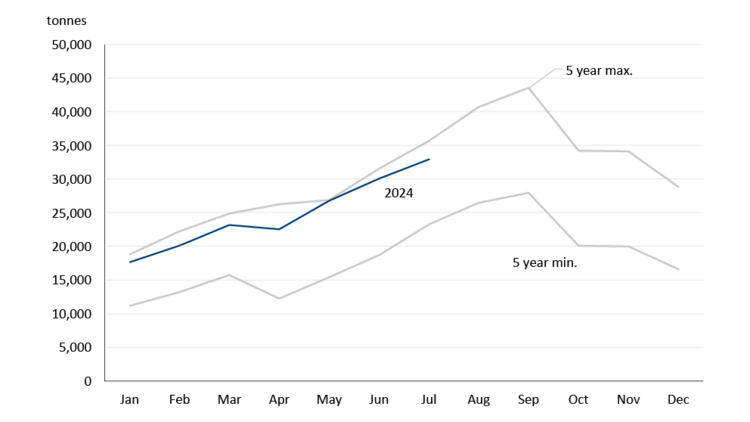

Turkey inventories, production higher – but so is demand

Turkey inventories traditionally peak in September in the lead-up to the North American holiday season before plummeting to seasonal lows in January. So far in 2024, frozen turkey inventories are trending close to the monthly maximum levels seen over the last five years (Figure 6).

Figure 6. Turkey frozen stocks close to recent historical highs

Sources: Statistics Canada, FCC Economics

At first glance this is somewhat surprising, given that turkey production fell every year between 2016 and 2022 (from 183,000 mt to 150,000 mt). Shifts in consumer preferences have led to a weaker demand for turkey products in recent years. However, last year was the first year since 2016 there was an increase in turkey production (a 6.1% increase). Demand played a role here: 2023 was the first time in nearly a decade that per capita consumption of turkey increased.

As is the case with broiler prices, turkey farm gate prices increased between 2021 and early 2023 before falling slightly in the latter half of 2023. Prices declined even more in early 2024 and are forecast to be slightly lower in the second half of 2024 before stabilizing in the first half of 2025.

Bottom line

Lower grain and oilseed prices have been a welcome relief to livestock producers, including those in the poultry sector. Broiler production growth may be lower this year but producer margins on a per unit basis remain healthy: as of quota period A-187, the margin component of the farm gate price was updated to reflect increased labour, capital, and operating expenses. Egg production is at record highs, while turkey production may be turning the corner after a stretch of lower demand and production. Lower food inflation should support demand for poultry products, and the long-term fundamentals for the sector are sound.

Used with permission from FCC