Brazil feed production forecast to rise slightly for 2024

Brazil has a competitive advantage in terms of available feedThe National Union for Animal Feed Industry forecasts a 2.4% increase in feed production in Brazil for 2024. For broilers the expected growth in feed demand is 1.8%, and for layers it is 6.5%, according to a recent US Department of Agriculture (USDA) Global Agricultural Information Network (GAIN) report.

For both broilers and layers the top macro ingredient used for feed is corn, followed by soybean meal. The feed industry is highly dependent on the animal protein sector – especially poultry and swine production. It is important to note that sources point to idle capacity in the feed industry, meaning they could ramp production up if needed.

As a major producer of both corn and soybean meal, Brazil has a competitive advantage when producing animals for subsequent slaughter, decreasing the cost of feed. For crop season 2024/2025, USDA forecasts increased crops from the previous harvest.

Corn

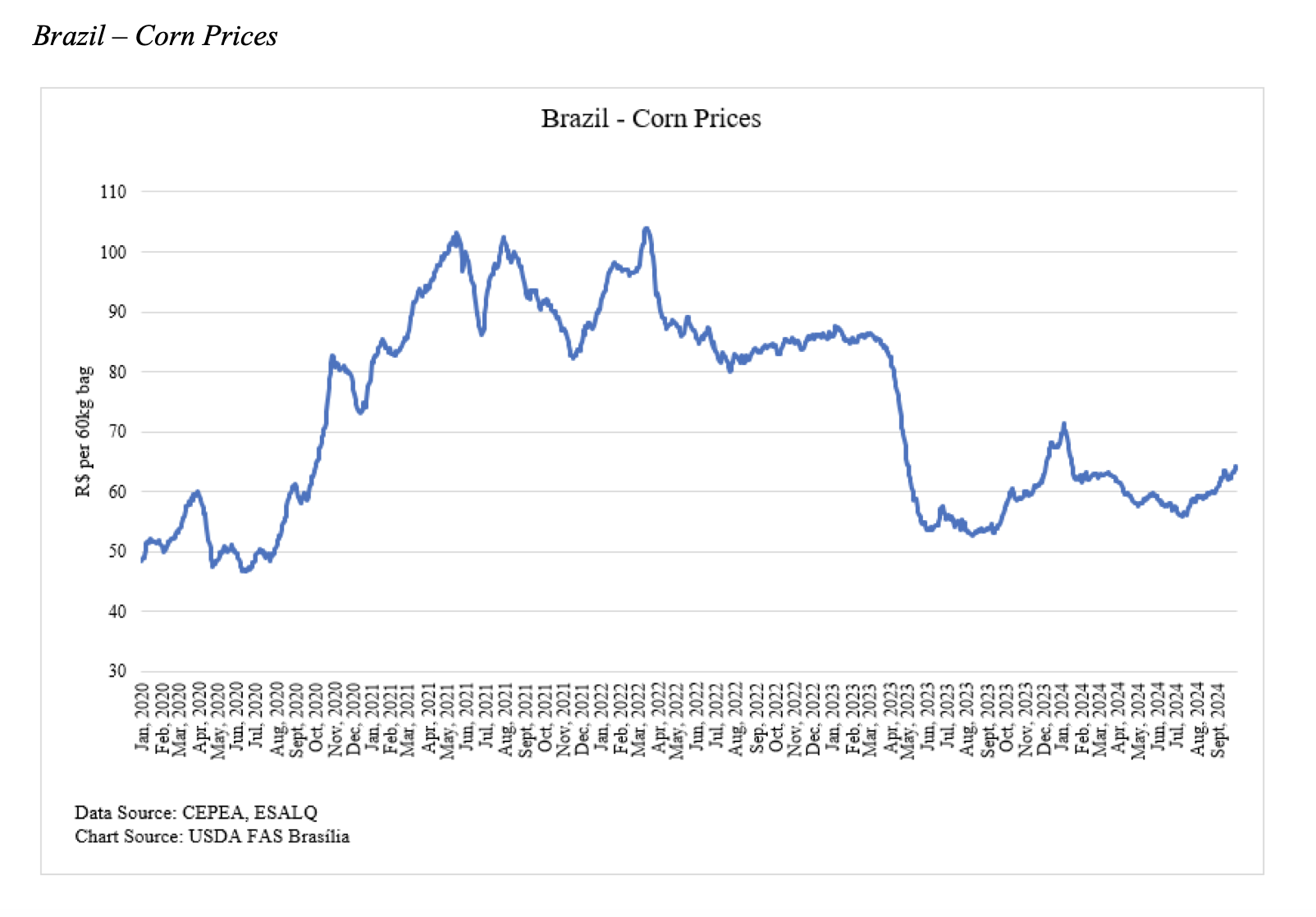

The USDA World Agricultural Supply and Demand Estimates (WASDE) forecasts corn production for MY 2024/25, as of September 12th, at 127 MMT. The forecast is based on improved weather conditions, with an end to the El Niño phenomenon which severely impacted corn productivity in the 2023/24 crop cycle. Brazil is expected to remain the third-largest corn producer in the world, behind the United States and China. Corn prices remain low when compared to historical levels, as seen on the following graph.

Soybean meal

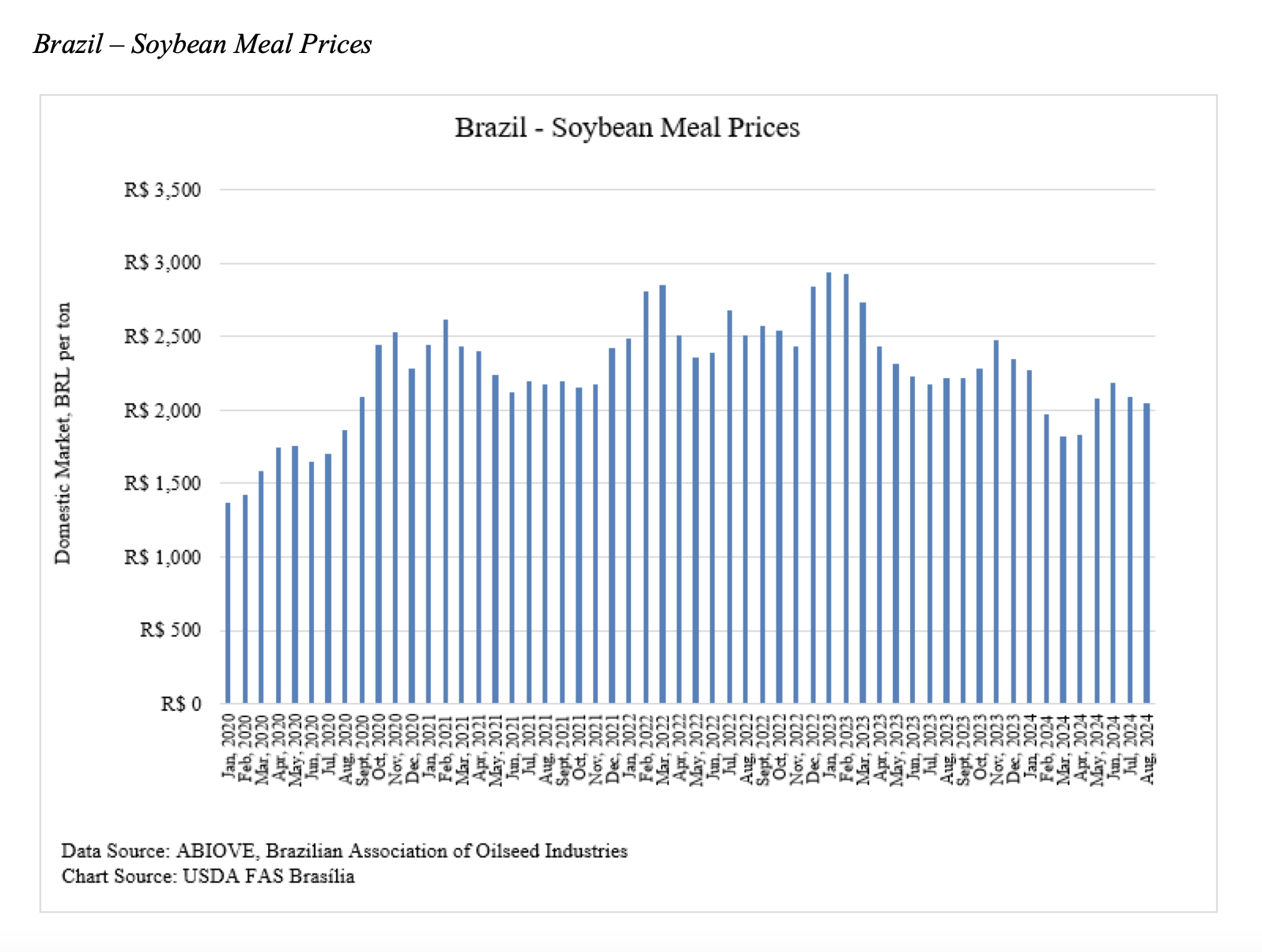

As of September 12th, the WASDE currently forecasts MY 2024/25 soybean production at 169 MMT, up 10% from the MY2023/24 crop of 153 MMT. Brazil remains the world’s largest soybean producer.

Impact of feed costs on production

In the first eight months of 2024, chicken meat producers saw relatively stable feed prices, growing only 0.77% in the year. The price of corn and soybeans started to recover but remained below historical levels. For 2025, Post forecasts that the large corn and soybean crops will continue to positively impact the poultry industry, lowering feed costs and making it easier for producers to balance other production costs, as seen in the following subsection.