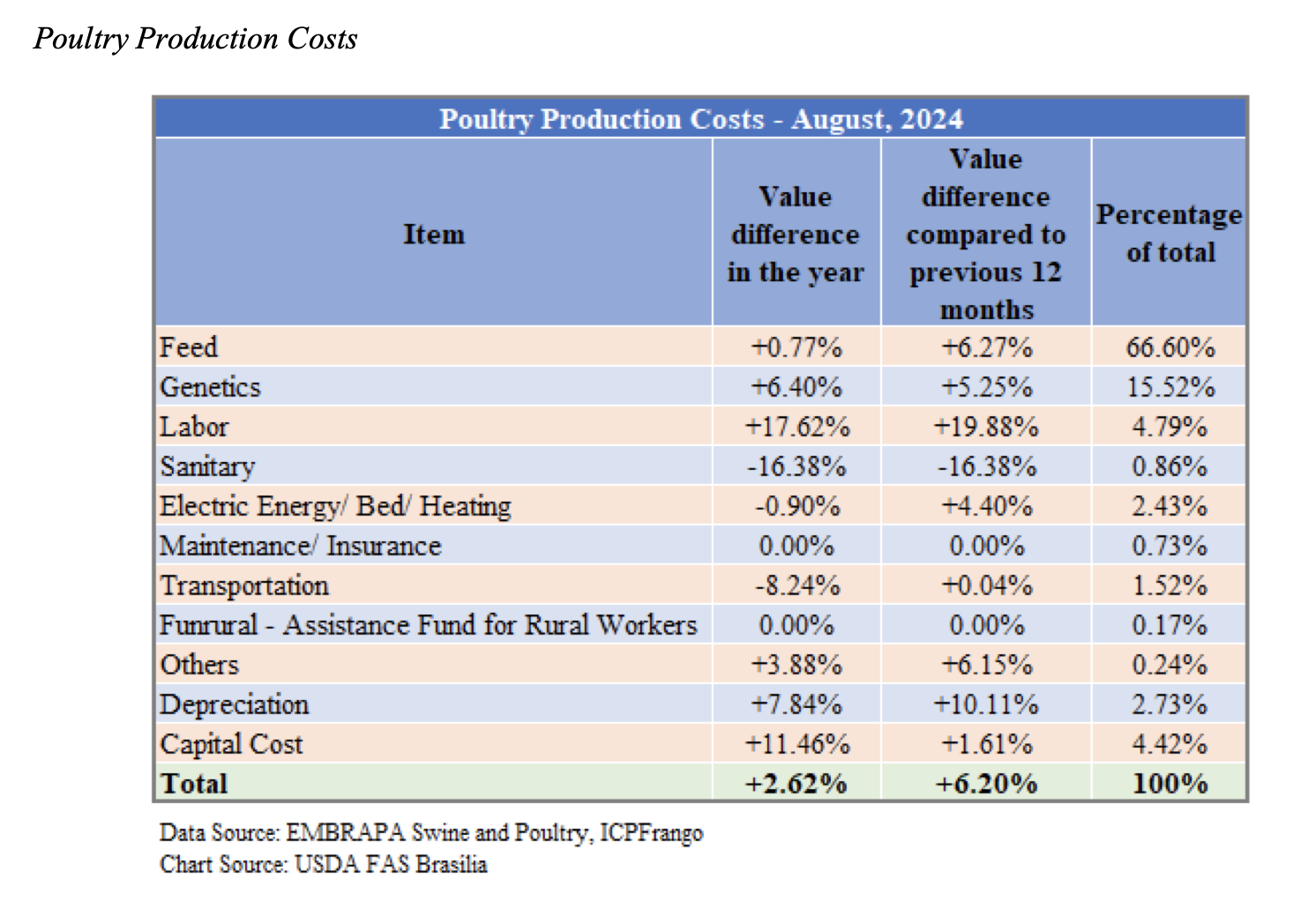

EMBRAPA releases poultry production cost breakdown

Highest increases seen in labour costsThe Brazilian Company of Agricultural Research, EMBRAPA, compiles an index for poultry production costs, called ICPFrango. In August 2024, feed costs accounted for over two thirds of total production costs in the state of Paraná, according to a recent US Department of Agriculture (USDA) Global Agricultural Information Network (GAIN) report.

Other expenses such as investments in genetics, cost of labor, electricity, bedding, heating, and transportation also compose production costs. The following table shows that, in August 2024, the largest increase in costs for the sector was for labor.

For the remainder of 2024, the price for electricity will increase. A decision published on September 27th by the Brazilian Electric Energy Agency, the regulating authority in Brazil, increased the price of the kilowatt.

Close to 48% of the Brazilian energy matrix is hydro-electrical and the reservoirs are currently low. The price of energy contracted was not matching energy production costs, and the prices to consumers needed to be adjusted.

As of October 1st, consumers will pay R$7.87 (US$1.44) for 100 kilowatts/hour, whereas in the past the price was R$4.46 (US$0.81), marking over a 75%increase. If this situation persists until 2025, overall cost of production may also increase.

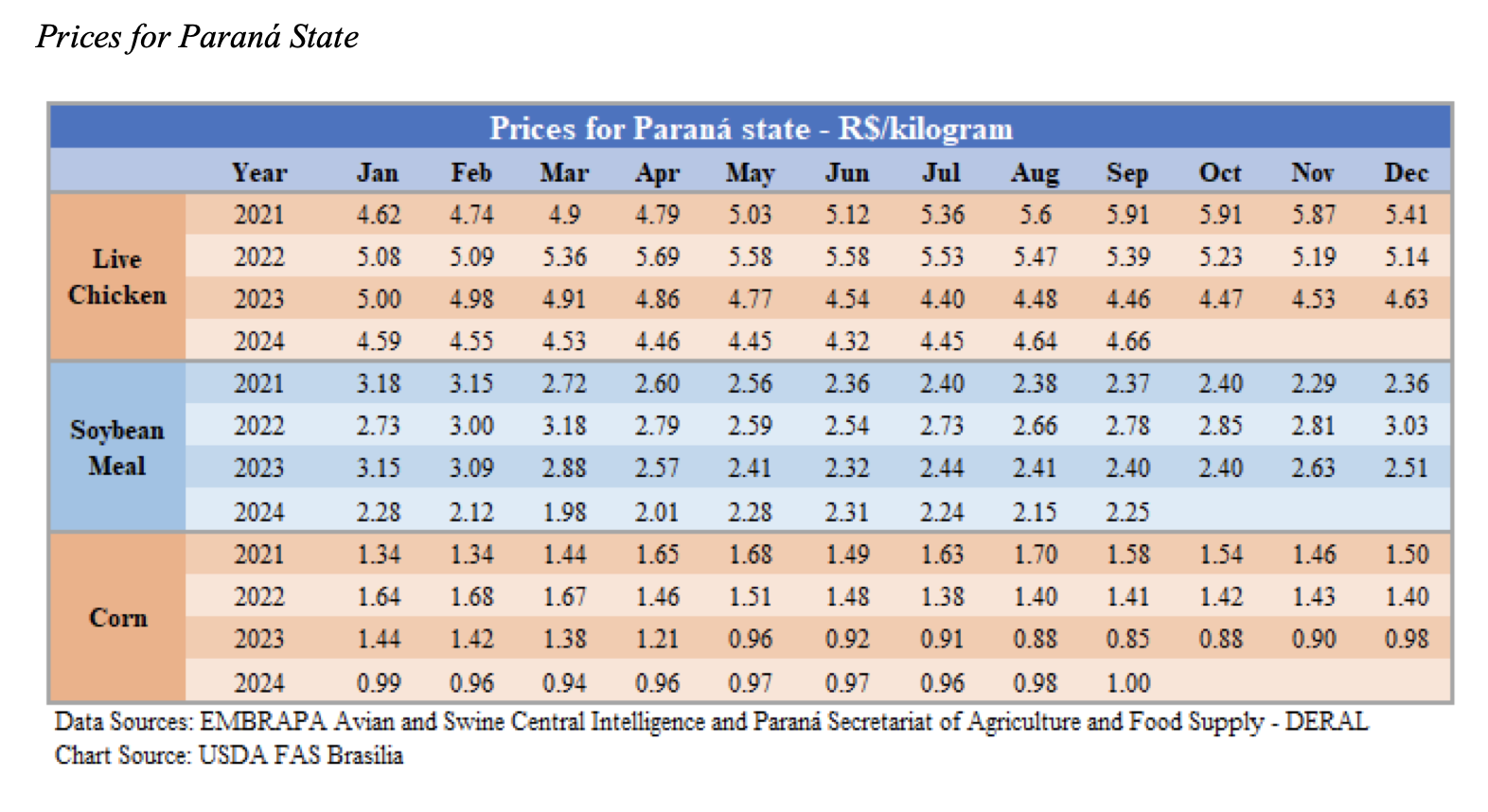

The following table presents the prices of live chickens, soybean meal, and corn for Paraná state from January 2020 to September 2024. As shown in the table, the average prices of live chickens for 2024 have been below those experienced in previous years. The average prices for live chicken, soybean meal, and corn thus far in 2024 have been the lowest compared to the same months in the past three years.

As previously reported in the USDA Semi-Annual Poultry and Products Report, BR2024-0002, Post contacts relayed that the industry was working to adjust production by decreasing placement, in an effort to increase profitability margins for producers – a successful move that can be observed in the prices of chicken in 2024.

Post contacts also note that during the pandemic, the industry at large made substantial investment to increase production. These investments point to idle capacity in production, which can be utilized if profit margins increase for producers.

For 2025, Post forecasts Brazil will have one percent growth in production. As idle capacity is available, producers will continue to balance placement levels, international and domestic demand to production levels. Furthermore, it is important to note that the forecasts in this report consider Brazil`s current sanitary status.