Slower growth, ongoing price volatility drive global poultry trade - Rabobank

Brazil emerges as main poultry exporterAccording to RaboResearch’s recently-published World Poultry Map, poultry trade flows have changed significantly since 2018 due to slower market growth, more trade restrictions, higher volatility, and the emergence of new players.

Brazil has emerged as the main exporter, capturing 90% of global trade growth, with Thailand, China, Ukraine, and Russia also increasing their market presence. In the coming years, the market is expected to continue its slow growth trajectory, accompanied by persistent price volatility.

Disruptions slowed poultry industry growth and led to trade volatility

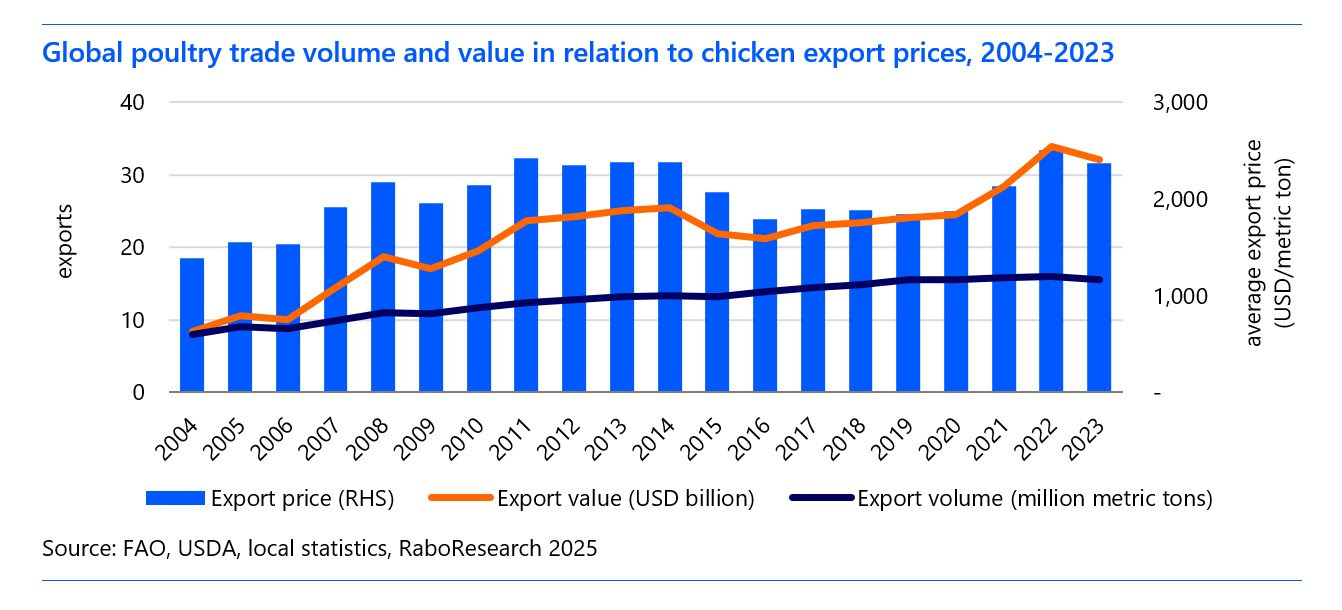

Between 2018 and 2023, global poultry meat trade grew by a modest 8%, or 1 million metric tons. This slow growth is attributed to several disruptions, including the Covid-19 pandemic, avian influenza, and African swine fever, which affected demand and trade. Global economic slowdown, high feed costs, and geopolitical tensions, such as the Ukraine war and trade frictions between Western countries and China, have further contributed to a volatile trade environment. Emerging markets' focus on food security and limited new export market openings have also slowed growth.

Brazil: The leading exporter in a challenging market

In a market with limited increases in import volume, Brazil stands out as the clear winner, capturing nearly 90% of global poultry trade growth. According to Nan-Dirk Mulder, Senior Analyst – Animal Protein for RaboResearch, Brazil’s success is due to cost-competitive advantages and its strategic diversification of export markets. While countries like China, Mexico, the UK, and the Philippines have increased imports, others, such as Saudi Arabia and South Africa, have reduced them due to the implementation of food security strategies. Meanwhile, Thailand, China, Ukraine, and Russia have expanded their exports, while the US and the EU have seen reductions.

Significant differences in export value by country

The global poultry trade, valued at USD 32 billion (USD 48 billion including intra-EU trade), is dominated by Brazil, the US, the EU, Thailand, and China. Brazil leads with a 30% share of global trade by value, followed by the US and the EU at 16% each. Brexit has boosted the EU's market share by transforming the EU-UK trade stream into a global flow. Thailand ranks fourth with a 13% share, while China, Turkey, Ukraine, and Russia complete the list of top exporters.

Rising global trade value driven by higher prices

"Since 2020, the value of global poultry trade has increased by 20% to 25%, primarily due to higher prices, while trade volume growth has remained around 6%,” said Mulder. “The average poultry export price has risen from USD 1,400/metric ton in 2004 to USD 2,400/metric ton today.”

Factors such as export price inflation, higher production costs, a shift toward processed poultry, volatile shipping costs, and Brexit have influenced price levels. Thailand leads in export value, followed by China and Chile, due to their market access. The EU is next, benefiting from Brexit. Brazil, despite being the largest exporter, ranks in the middle for export value, with the US and Argentina at the lower end.

Outlook of slow growth with potential for market shifts

"We expect global poultry to grow slowly, at a rate of 1% to 2% annually over the next five years," explained Mulder. "This slow pace is driven by food security strategies in key growth markets like Asia, Africa, and the Middle East, which may challenge major exporters."

Geopolitical tensions, economic volatility, and diseases like avian influenza will continue to impact trade. Brazil is expected to further increase its market share, while Thai and Chinese exports will grow above the market average. Russia and Ukraine may also expand their market presence, while Argentina could reemerge as a major exporter if economic conditions stabilize. Emerging players like Paraguay, Vietnam, Colombia, and South Africa may gradually gain traction in global trade.

Brazil: The leading exporter in a challenging market

In a market with limited increases in import volume, Brazil stands out as the clear winner, capturing nearly 90% of global poultry trade growth. According to Nan-Dirk Mulder, Senior Analyst – Animal Protein for RaboResearch, Brazil’s success is due to cost-competitive advantages and its strategic diversification of export markets. While countries like China, Mexico, the UK, and the Philippines have increased imports, others, such as Saudi Arabia and South Africa, have reduced them due to the implementation of food security strategies. Meanwhile, Thailand, China, Ukraine, and Russia have expanded their exports, while the US and the EU have seen reductions.

Significant differences in export value by country

The global poultry trade, valued at USD 32 billion (USD 48 billion including intra-EU trade), is dominated by Brazil, the US, the EU, Thailand, and China. Brazil leads with a 30% share of global trade by value, followed by the US and the EU at 16% each. Brexit has boosted the EU's market share by transforming the EU-UK trade stream into a global flow. Thailand ranks fourth with a 13% share, while China, Turkey, Ukraine, and Russia complete the list of top exporters.

Rising global trade value driven by higher prices

"Since 2020, the value of global poultry trade has increased by 20% to 25%, primarily due to higher prices, while trade volume growth has remained around 6%," said Mulder. "The average poultry export price has risen from USD 1,400/metric ton in 2004 to USD 2,400/metric ton today."

Factors such as export price inflation, higher production costs, a shift toward processed poultry, volatile shipping costs, and Brexit have influenced price levels. Thailand leads in export value, followed by China and Chile, due to their market access. The EU is next, benefiting from Brexit. Brazil, despite being the largest exporter, ranks in the middle for export value, with the US and Argentina at the lower end.

Outlook of slow growth with potential for market shifts

"We expect global poultry to grow slowly, at a rate of 1% to 2% annually over the next five years," explained Mulder. "This slow pace is driven by food security strategies in key growth markets like Asia, Africa, and the Middle East, which may challenge major exporters."

Geopolitical tensions, economic volatility, and diseases like avian influenza will continue to impact trade. Brazil is expected to further increase its market share, while Thai and Chinese exports will grow above the market average. Russia and Ukraine may also expand their market presence, while Argentina could reemerge as a major exporter if economic conditions stabilize. Emerging players like Paraguay, Vietnam, Colombia, and South Africa may gradually gain traction in global trade.